Are Markets Prices Wrong?

If market prices are right, they reflect all available known information.

If market prices are wrong, then you should be able to exploit this to make millions.

So, if you think you can outperform the market, why aren’t you rich yet?

Let’s unpack this.

Financial theory rests on asset pricing.

How do investors decide how much to pay for a stock?

A rational investor will pay a price for a stock that is the equivalent to the present value of a company's expected future cash flows.

All else equal, investors will pay more for a stock with higher expected earnings or pay less for more riskier future earnings.

Whether investors agree or disagree with the current stock price brings us back to a core concept in finance known as market efficiency.

Market efficiency was created from Eugene Fama’s 1970 research, “Efficient Capital Markets: A Review of Theory and Empirical Work”.

His work later won him a Nobel Prize in Economics.

Eugene describes market efficiency as:

“An efficient market is one in which prices fully reflect all available information”

The problem some have with this idea is it’s a theoretical model that’s based on empirical research that’s extrapolated to future market conditions.

It's a model that reflects reality, but it's not reality itself.

A model in action could be that I expect my car to start each morning as I turn the key.

Sometimes, when I turn my key, & the car doesn’t start – I’m surprised.

This doesn’t mean the model no longer works & needs to be changed.

The map is not the territory.

This idea of market efficiency has been pivotal in modern investing.

It implies that if price changes result from new information and are thus unpredictable without that information, trying to forecast them—like traditional active managers or stock pickers do—should not be expected to improve your investment outcomes.

This also explains why passive investing in an efficient market makes sense.

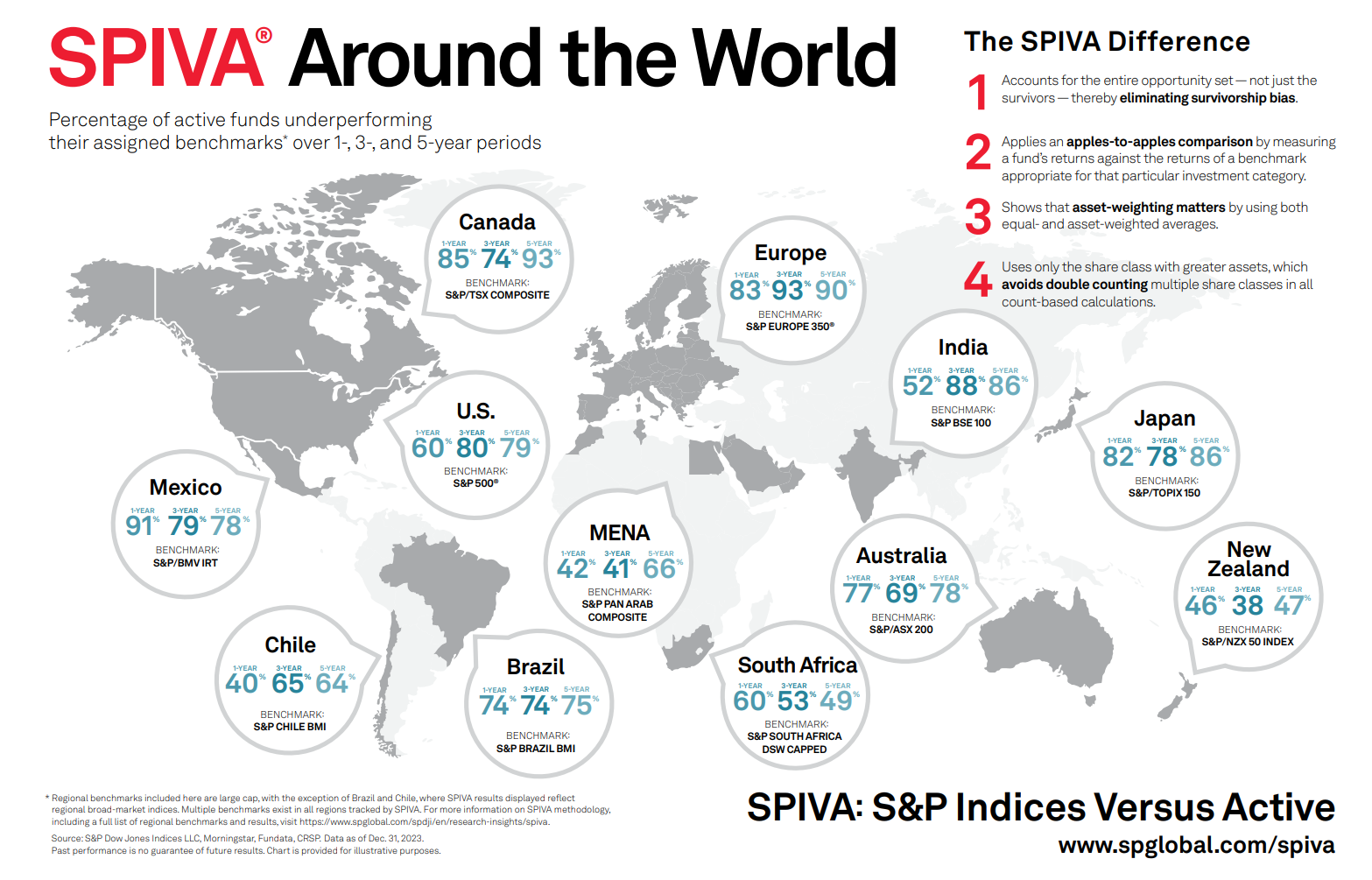

Examining the larger studies on active managers and their ability to outperform the benchmark reveals a lack of success.

This is from SPIVA Research.

Again, if markets are inefficient why aren’t you rich?

If you can’t beat the market, just be the market.

The efficient market hypothesis was derived from empirical research that allows us to gain insight into how markets work to aid in better decision making in the present.

This removes the need to rely on anecdotes or stories with little empirical evidence to inform a theoretical framework.

Anecdotes create bias - Warren Buffett being successful picking stocks is an anecdote.

Why was he successful?

This question, empirically, is the wrong question to ask.

If I had to focus my efforts on achieving a specific outcome, I would choose the path with the highest likelihood of success (typically the outcome with the most empirical backing).

This is like asking your Doctor why your Grandmother lived to be age 98 smoking a pack of cigarettes a day.

Science can’t answer everything.

But this doesn’t make it a good idea to start smoking a pack of cigarettes a day or start picking stocks.

In the words of Eugene Fama:

“Modern medicine doesn’t ask old people for their health secrets. It does double blind clinical trials. To this we owe our ability to cure and prevent many diseases. Modern empirical finance doesn’t ask Warren Buffet to share his pearls of investment wisdom as the media does. We study a survivor bias-free sample of funds sorted from some X-antivisbile characteristic to separate skill from luck and we correct for exposures to systematic risk. To this we owe our wisdom, and maybe as a society a lot of wealth as well.”