Stock Market Volatility: Why Short-Term Drops Are the Price of Long-Term Wealth

Market drops like this week's 13% dip can rattle investors, but understanding why volatility is the cost of long-term wealth is key to building a resilient portfolio and staying the course when others can't.

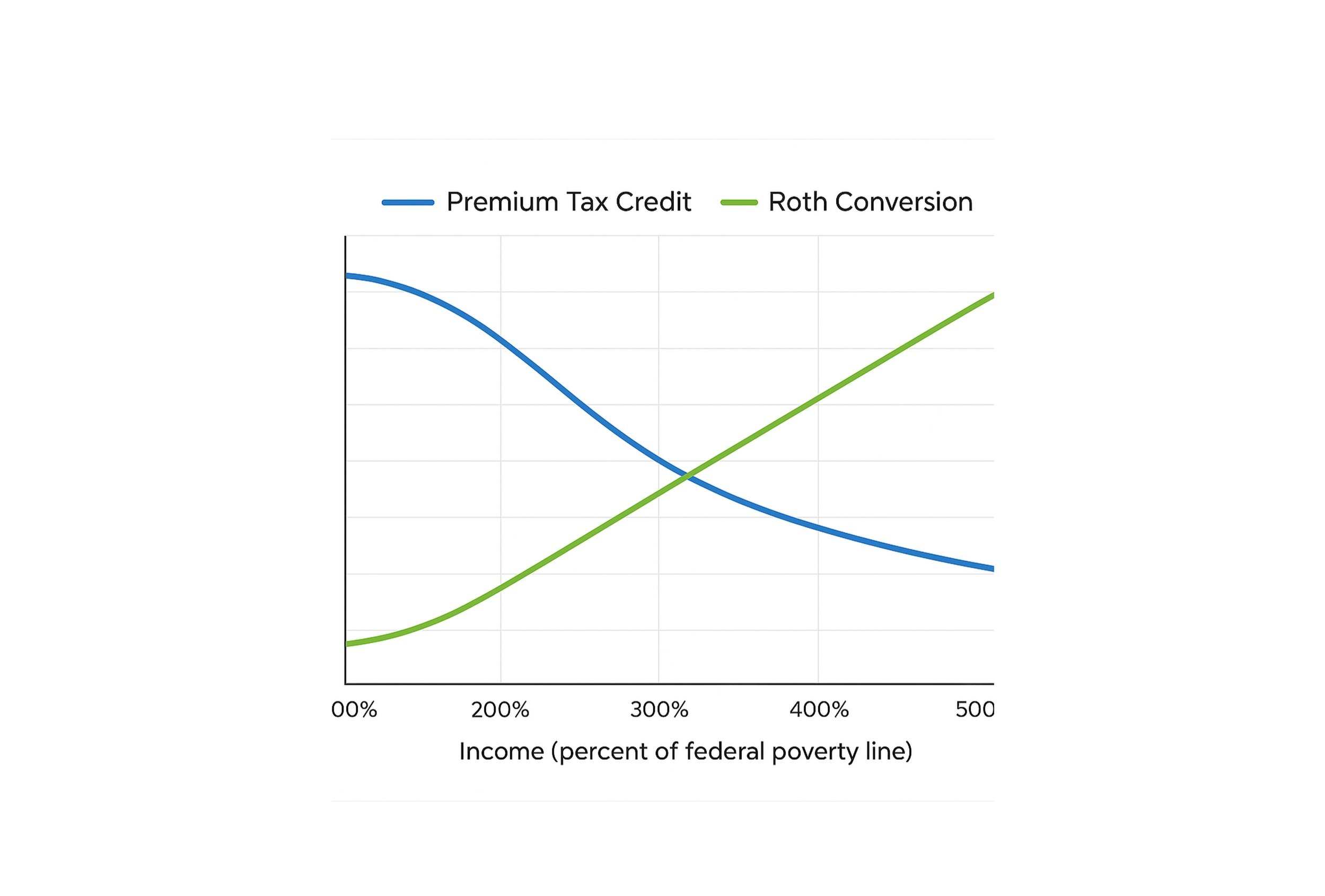

Early Retirement Health Insurance Strategy: Cash Withdrawals vs. Roth Conversions for PTC Optimization

Should you minimize income to maximize the Premium Tax Credit or leverage Roth conversions for long-term tax savings? Here's how early retirees can strategically balance both to reduce healthcare costs and lifetime taxes.

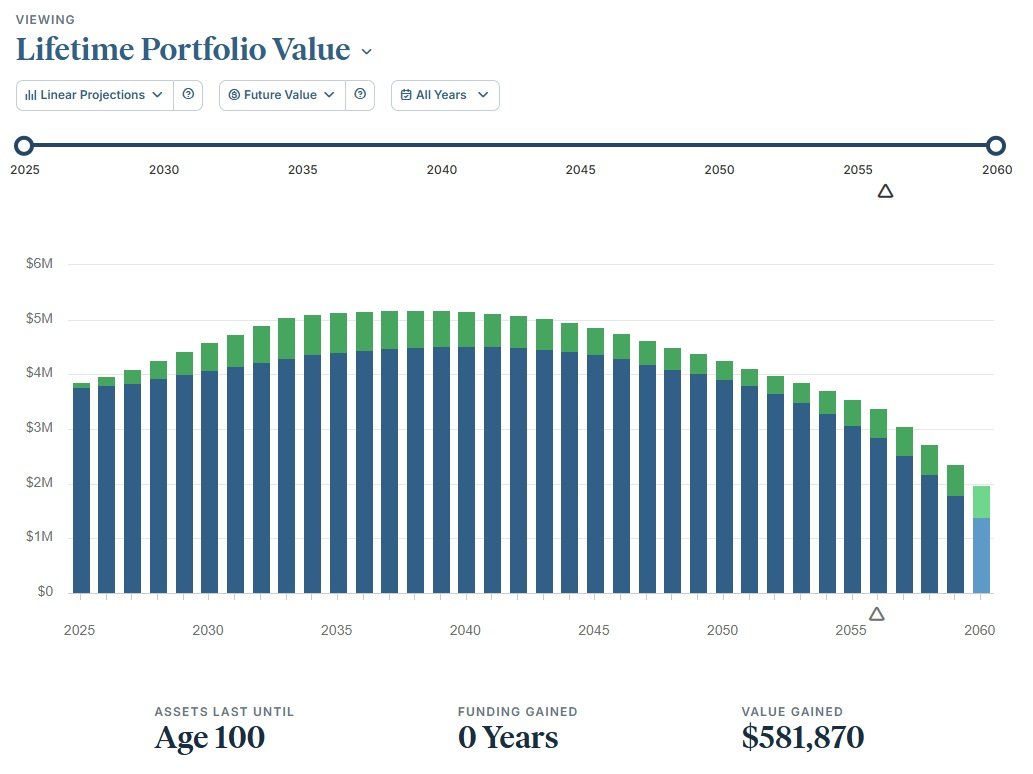

Retirement Income Planning: Why Smart Withdrawal Strategies Matter More Than Savings

Retirement success isn’t just about how much you’ve saved—it’s about how strategically you withdraw, and new research suggests that dynamic withdrawal strategies could significantly extend your portfolio’s longevity and increase your lifetime spending.

The Truth About the Size Premium: Why It Still Exists If You Control for Quality

The small-cap premium isn’t dead—it thrives when you control for quality, as research shows that high-profitability small-cap value stocks significantly outperform their low-quality counterparts, offering a compelling case for strategic factor-based investing.

The One Business Risk You’re Ignoring: Why Every Owner Needs a Buy-Sell Agreement (Before It’s Too Late)

Most business owners take time for vacation, but few spend time securing their business with a buy/sell agreement—here’s why delaying this critical step could cost you everything.

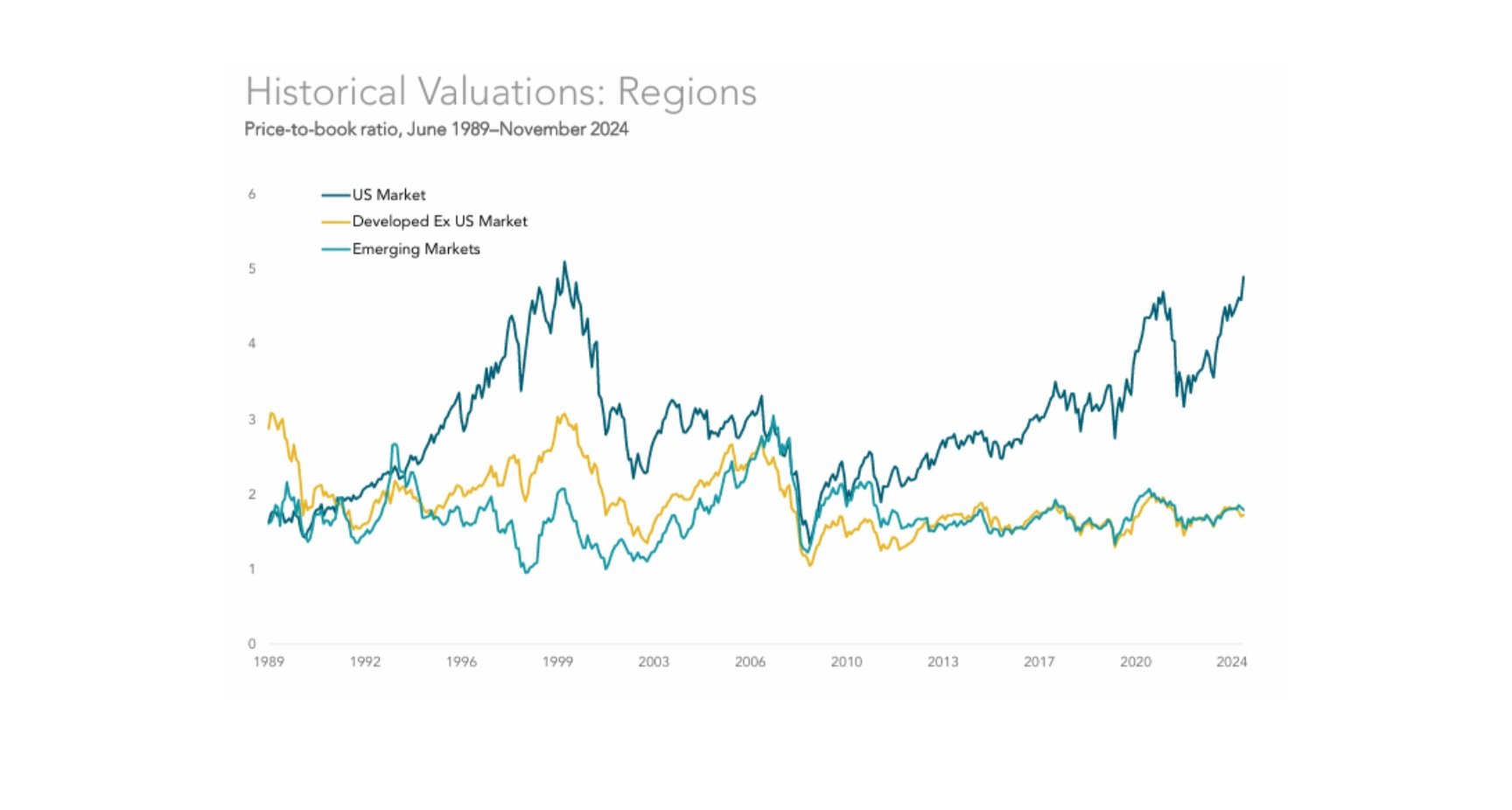

The Illusion of S&P 500 Outperformance: Why Smart Investors Think Bigger

Relying on the S&P 500 as your sole benchmark for investment success is like judging a restaurant only by its dessert—this article uncovers why true long-term investing requires diversification, discipline, and a global perspective beyond today’s market winners.

How I Helped a Business Owner Save Over $60,000 on Health Insurance Costs Without Cutting Employee Benefits

Discover how I helped a small business owner save over $60,000 annually on health insurance by leveraging the healthcare marketplace and premium tax credits—without sacrificing employee benefits.

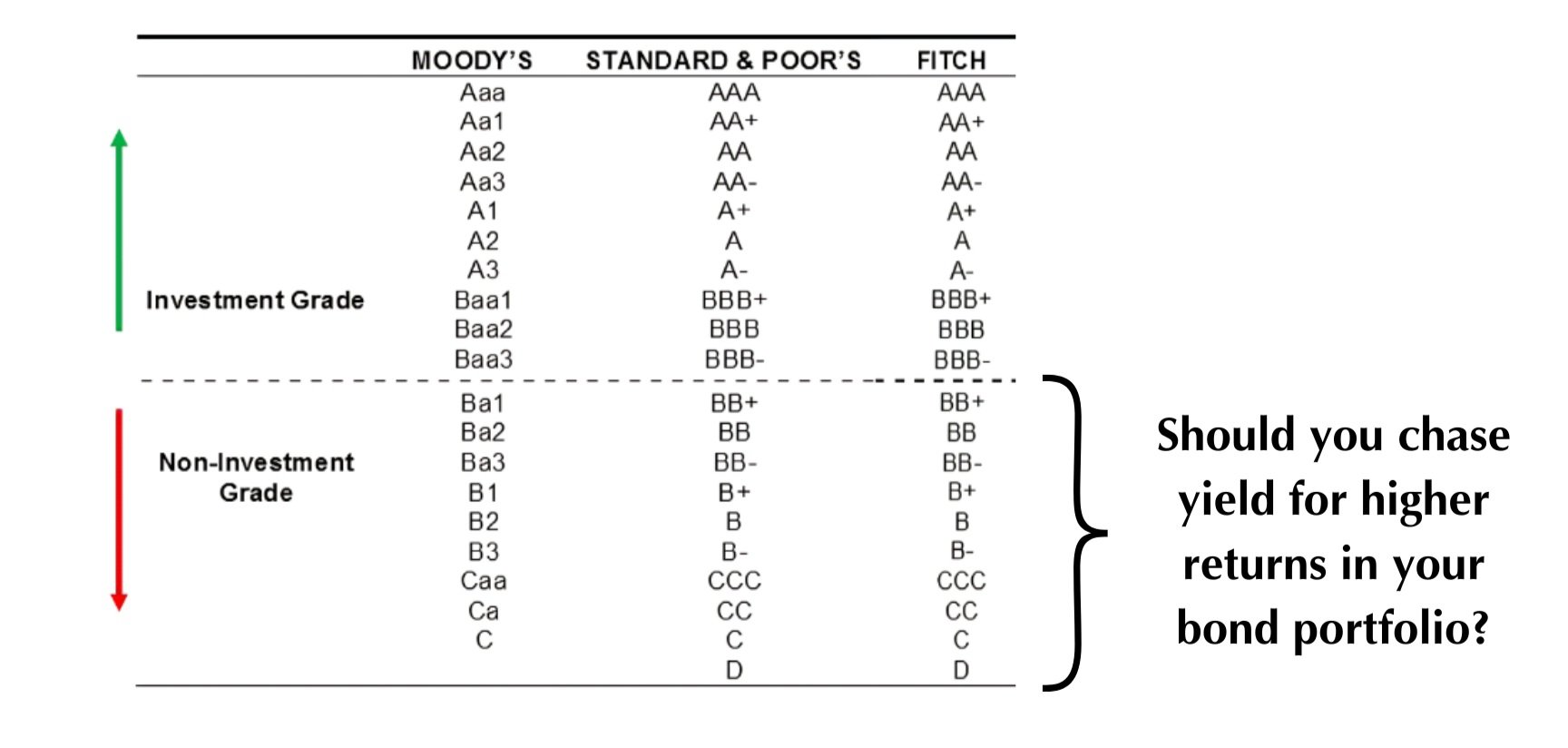

Are High-Yield Bonds Worth the Risk? Exploring the Trade-Offs in Your Investment Portfolio

Are high-yield bonds worth the equity-like risk, or are there smarter ways to boost your portfolio's returns without sacrificing stability?

10 Lessons from 2024: Reflections on a Year of Financial Insights and Growth

A summary of my favorite writing from 2024.

Should You Invest Your Social Security Taxes Instead? A Deep Dive into the Numbers and Real-Life Impacts

Are you better off investing your social security taxed earnings (the surprising truths behind the system's benefits and limitations).

How a Simple Insurance Review Helped a Client Save Big ($1M Lifetime Value?)

Insurance needs change over time—what works today may not be the best fit tomorrow. Evaluating your policies within the context of your financial plan ensures adequate coverage and maximum savings.

How We Create Personalized Cash Plans for Our Financial Planning Clients

An effective cash management plan balances financial best practices, personal comfort with cash, and active cash oversight to maximize returns, ensuring emergency funds are maintained at optimal levels and excess cash is efficiently invested for higher returns.

Accountable Plans for S-Corp Owners: Maximize Tax Savings and Compliance

S-Corp owners can avoid taxable reimbursements by using an accountable plan, allowing federal and FICA tax-exempt reimbursements for business-related expenses. With Trump's 2017 tax law changes, personal expense deductions are limited, making accountable plans essential for tax efficiency and compliance on mixed-use expenses like home office and cell phone costs.

What to Do After a Loved One Dies: A Step-by-Step Guide

When a loved one passes, the emotional toll can be overwhelming, and managing the financial details only adds to the complexity. By taking proactive steps now—such as preparing key documents and having essential conversations—you can reduce the burden later and ensure your loved ones are taken care of with clarity and confidence.

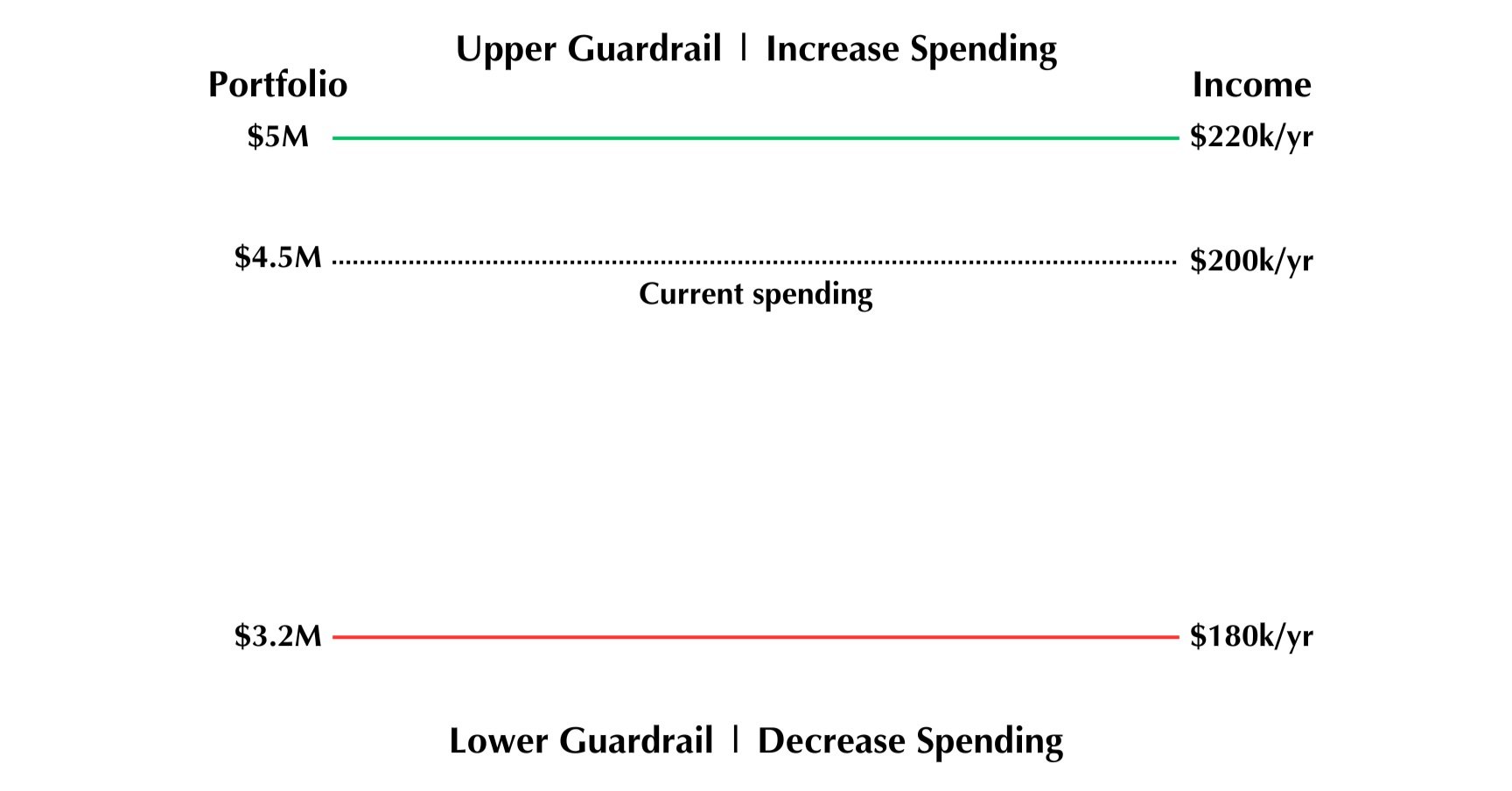

Reframing Retirement Success: How to Improve Spending Conversations

Maximize retirement spending by adopting a flexible, proactive approach to asset depletion, rather than relying solely on the traditional 4% rule. By adjusting withdrawals based on market performance and regularly reviewing your financial plan, you can increase lifetime spending while maintaining financial security throughout retirement.

Unlock the Flexibility of ICHRAs: A Cost-Effective Health Benefit Solution for Your Employees

There’s a smarter, more flexible way to offer health benefits—one that lets your employees keep the coverage they love while still providing them with valuable support, without pushing them into a one-size-fits-all group health plan.

Are Markets Prices Wrong?

If market prices are right, they reflect all available known information. If market prices are wrong, then you should be able to exploit this to make millions.

New Required Minimum Distribution (RMD) Rules | What You Need To Know

The SECURE Act has dramatically changed the rules for Required Minimum Distributions (RMDs), making it essential for beneficiaries to stay informed on the new guidelines to effectively manage inherited retirement accounts and avoid costly errors.

Minimizing College Costs

College is the equivalent cost of a mortgage - here’s ways to take $50k off the sticker price.

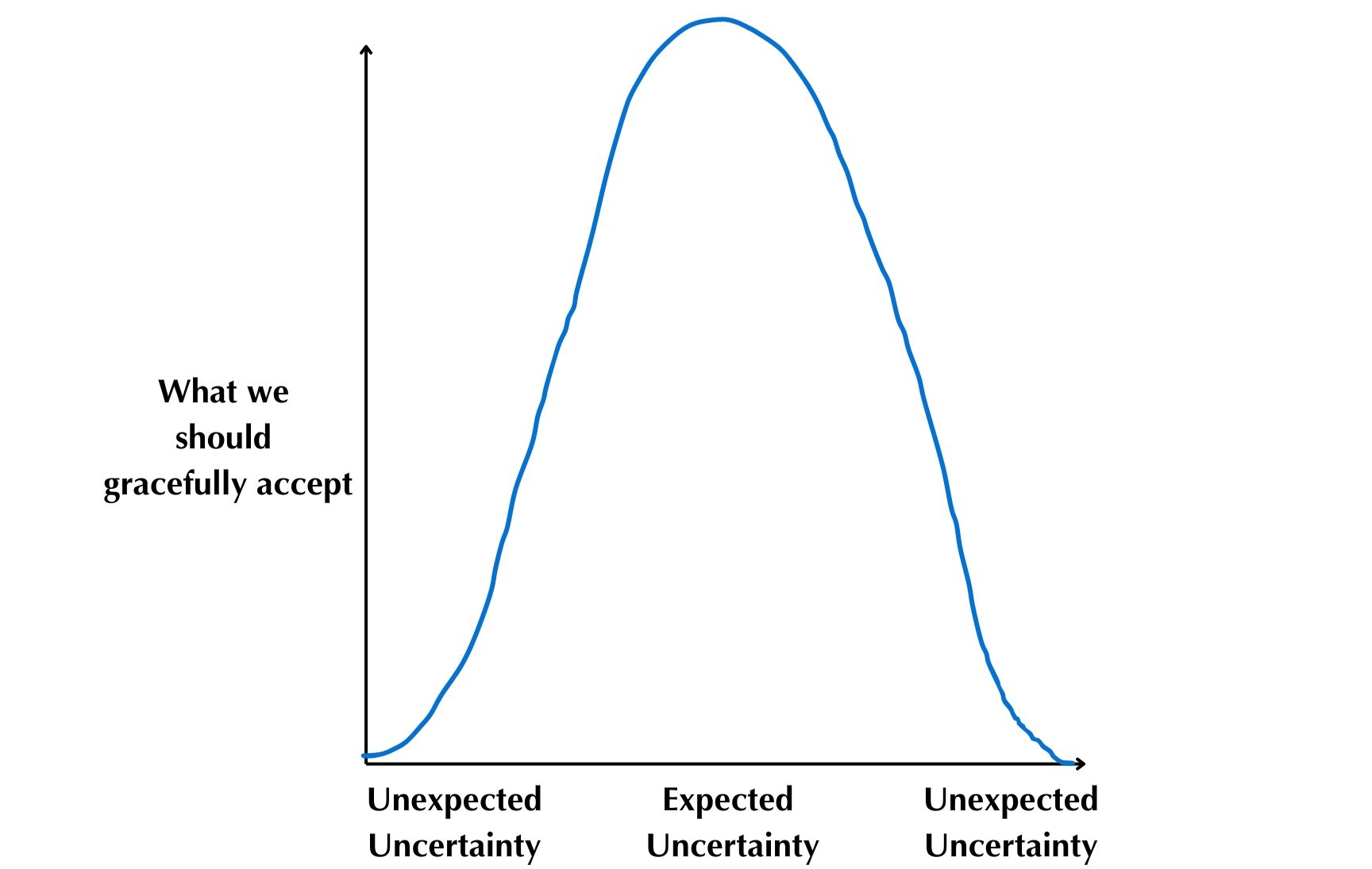

The Value of Uncertainty

Whether we are voluntarily or involuntarily subjecting ourselves to uncertainty, we might as well value it, because life without uncertainty is like a static, unchallenging existence absent of growth and discovery.