Should You Invest Your Social Security Taxes Instead? A Deep Dive into the Numbers and Real-Life Impacts

You and your employer each pay 6.2% into the social security program (12.4%) in total.

That money is taken, invested on your behalf, then given back to you later in the form of your social security monthly income benefit.

Which begs the question:

Would you be better off investing that money yourself rather than relying on the government to tax you now and provide the benefit later?

Granted - this question is rhetorical, because no matter the outcome, it’s not like you can opt-out of social security… although, that wouldn’t be a bad idea provided it doesn’t work in your favor.

First, let’s unpack how social security benefits are calculated:

As mentioned above, 12.4% of your salary is taken to fund your future social security benefit up until the social security wage base which adjusts annually for inflation; in 2024, this is $168,600.

Meaning - you and your employer will each pay 6.2% up until the social security wage base cap, then you're exempt from social security taxes on income above this amount.

Your taxed social security wages are adjusted for inflation up until you turn age 60. After age 60, your earnings are taken at face value.

In order to qualify for social security, you’ll need 40 credits.

In 2024, one credit is awarded for each $1,730 in earnings & up to 4 max can be earned each year.

Which means many will qualify after one decade in the workforce.

Note: There’s special rules if you’re disabled or if you have net annual earnings of less than $400.

You can take your social security benefit between ages 62 and 70.

You’re entitled to 100% of your social security benefits at your full retirement age.

Depending on when you were born, your full retirement age fluctuates:

If you take social security prior to your full retirement age, the benefit you receive is reduced.

You can take social security between 62 and your full retirement age, depending on your birth year, your benefits are reduced between 25%-30% from your full retirement age benefit.

Similarly, if you delay your social security past your full retirement age, you receive an 8% increase in your benefit from waiting to claim.

These increases are called delayed retirement credits - which you can earn up until age 70.

The amount of social security that you receive at full retirement age is based on your Primary Insurance Amount (PIA).

Your PIA is calculated as follows:

Add your highest 35 years of indexed social security earnings

Averaged them over 420 months (35 years) this is your adjustment indexed monthly earnings (AIME)

Multiple AIME by 3 bend points to get your PIA.

Bend points are:

90% up to $1,115

32% of your AIME over $1,115 until $6,721

15% over $6,721

Consider this played out in a real life example, consider the following earnings history:

Running the math out for Social Security benefits for this individual (via the benefit of a statement):

Full retirement age = $2,976/mo

Age 70 full retirement age = $3,940/mo

How would this have fared provided you were able to invest this on your own?

Using the social security taxable earnings above, I multiplied all earnings by 12.4% to get the social security earnings taxed each year.

Starting at year zero, all the way up until 2020 which is 48 years of earning history, I assigned growth rates between 5% - 8% on those taxed dollars until the end of the 48 year period.

Ending values are as follows:

Ending value at the end of the 48 year period:

At 5% = $841,683

At 6% = $1,030,372

At 7% = $1,276,123

At 8% = $1,598,432

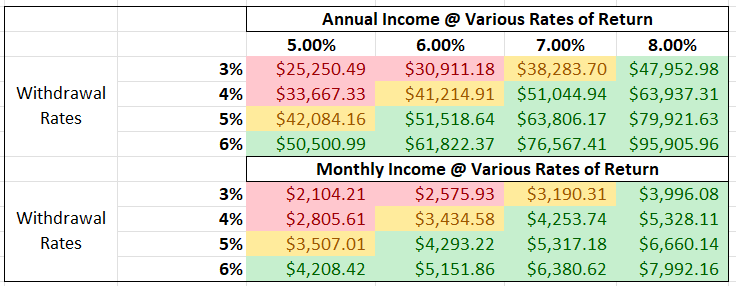

Considering average withdrawal rates over time could range from 3% - 6%, we see monthly income of the following:

Highlighted in red is income where the rates of return and withdrawal rates are less than the full retirement age income benefit.

Highlighted in yellow is the income where the rates of return and withdrawal rates are less than the age 70 income benefits.

So what inferences can be drawn from the data?

I think a realistic long-term rate of return is slightly over 6% and long-term withdrawal rate is slightly over 4% - which points us on the edge of a decision like this making sense for us to take over the investing.

When you receive your social security income, it is then taxed at either 0%, 50%, or 85% (which for many, will be 85%). So if we were able to save these dollars on our own, would we have a new account that would allow for the same level of taxation? Increased qualified account contributions? Or would we be stuck with a taxable brokerage account?

I’d have to run the numbers on whether the reduced return from the tax drag on the rate of return from the brokerage with capital gain tax treatment would be better/worse than paying tax on social security earnings - my gut says the brokerage would be better because only the gain would be subject to capital gains tax - which at its absolute most is 20% - which is better than 85%.

One non-illustrated datapoint that’s extremely important is the fact that if you pass away - all your social security earnings go away and are redistributed amongst others. So there is no inheritance or way to transfer unused social security taxed earnings.

Granted - yes, if you have minor children or a spouse, under certain circumstances they could be eligible to claim social security benefits for a specified period of time. But even then, it probably should have some tie back to how much you’ve been able to save over time. For some they get more than they put into the system and some less than they put into the system.

There is no way to access your social security taxed earnings in the event of need - unlike some sort of retirement account or non-qualified investment. This illiquidity, technically, should be warranting a higher return for social security income beneficiaries - which doesn’t appear to be the case.

So that being said, would you be better off investing on your own?

When you factor in the illiquidity, lack of ability to inherit the unused saved tax dollars, average rate of return and withdrawal rate - I’d venture to say yes.

But with a caveat…

On one hand, I have a lot of confidence that you could do better investing on your own.

In other words - if you gave me an option of either having the social benefit being paid out later, or me being able to invest - I would easily take the option of investing on my own.

I say this because I’d be comfortable taking the necessary market risk and have the willingness to both save those dollars and let them grow for as long as needed until I can start that income stream.

On the other hand, I think for the majority of the population, they’d probably spend all of their social security earnings that are supposed to be saved, and we’d end up with a very upset population.

In this way, social security acts as a safety net for those who need it most or wouldn’t/couldn’t be disciplined/fortunate enough to save this over time.

So, while Social Security serves as a critical safety net for many, exploring ways to improve its efficiency and flexibility could better empower individuals to secure their financial futures—because everyone deserves the opportunity to make the most of what they’ve earned.