Are we better off with pensions or 401ks?

Until the 401k was introduced in 1978 from the Revenue Act under Section 401, Subsection K, the pension was viewed as the gold standard and primary savings vehicle for working Americans.

The 401k revolutionized retirement savings. The era of the 401k gold standard had begun.

Many employers sighed with relief as 401ks killed two birds with one stone - allowing employees to save for retirement and removing the pension liability from their balance sheets.

This legislation was thought of as one step forward for employers and two steps back for employees.

Many wondered how could an additional burden and liability be viewed as more beneficial for the employee?

Behind the scenes, pension plans cut a check from their portfolio to send to pension recipients. This is no different from how you would fund your retirement through taking distributions from your investment portfolio.

All else equal - your 401k is a superior investment vehicle.

Pensions should offer more psychological comfort than financial reward.

Pensions have lower average rates of return, fixed contributions, little flexibility, more (company specific) risk, and cannot be passed onto the next generation.

Lower Average Rates of Return

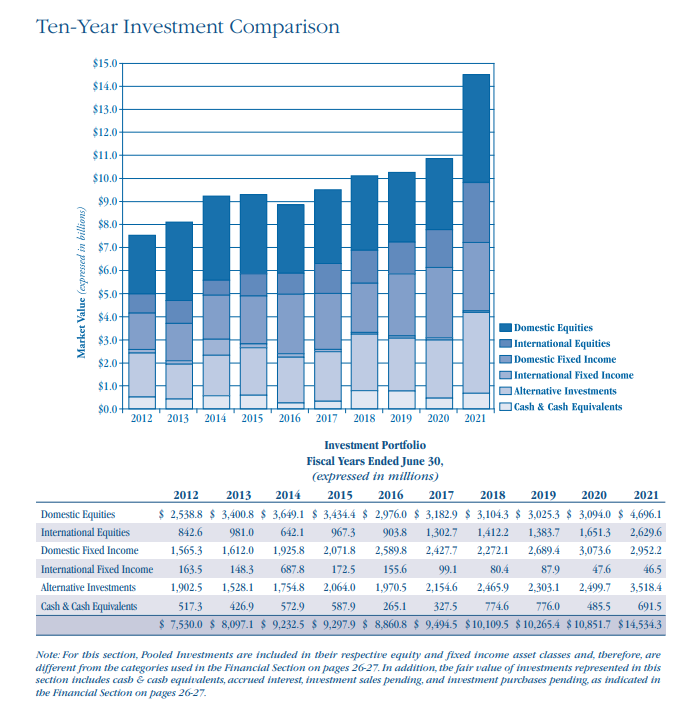

The Delaware Public Employees Retirement System (DPERS) 2021 Financial Report below shows the 10-year investment performance of the plan.

Asset allocation of the plan reveals 43.7% stocks, 28.8% bonds, 23% alternatives (venture capital, hedge funds, private equity, etc.), and 4.5% cash.

The investment objectives established by the board are as follows:

To realize a real return of 3% per year over long periods

To manage portfolio risk so as to limit downside price fluctuations of total system portfolio

To realize as high a rate of total return possible consistent with above.

This makes perfect sense... For a pension fund.

As an individual investor, you’re not bound to the liability of funding thousands of employee’s retirement.

As a 401k participant, you can take additional market risk to yield higher rates of return.

Delaware’s pension plan over a 10-year period has returned 10.4%. Compared to a global stock benchmark (MSCI ACWI) over the same time it has returned 12.56%. A 2.16%/yr excess return.

Don’t let the 23% position in venture capital, hedge funds, and private equity deter you into thinking you’re missing out on returns. Over a decade Warren Buffet won a $1 million bet with hedge funds that an index fund could outperform them.

He won by a margin of 44% in excess return.

These alternative investments are highly illiquid, not transparent, and interim performance is unknown and speculative.

Therefore, DPERS reported investment return may not be accurate as 23% of their portfolio performance is largely unknown.

Performance arguments aside, as an individual investor you can invest more aggressively than pension funds allow.

Fixed Contributions

Pension plans take a portion of your salary and contribute to the pension.

Delaware tax code, Part five, public officers and employees’ chapter 55 code section 5543 defines contributions to Delaware’s pension plan as follows:

Post-2011 employees contribute 5% of total annual compensation in excess of $6,000.

Your employer then contributes 11.96% of your total annual compensation.

Your contributions are then invested per the State pension fund and yield you a monthly annuity payment for the remainder of your life once you’ve met service requirements, vesting periods, and reached age 65.

The Delaware teacher pension calculation is as follows:

(1.85% * average highest 3 years of salary) x (years of service)

For a teacher who caps out making an average of $70,000/yr at 25 years of service this yields $32,375/yr or $2,698/mo.

An approximate lump sum to yield this amount based on the 4% rule is $809,375 (32,375 / .04).

If we take the employee contribution, employer contribution, and an approximate average 3.5% 401k employer match you gross $819,728 over 25 years assuming a 9% rate of return.

The 401k squeaks out a victory.

This margin of victory widens as we extend our time horizon.

A 30-year pension for a teacher who continues to work for 5 more years maxes out at an average salary of $86,502/yr which according to the pension formula yields an annual pension amount of $48,009/yr.

For the diligent 401k saver, they yield a nest egg of $1,350,737 or $54,029/yr in income benefit.

Compounding interest takes off in favor of the disciplined investor over the long-haul.

Little Flexibility

Pensions have little flexibility.

You’re limited to the predetermined retirement benefits calculation based on salary and tenure the state sets for you.

You don’t get to contribute more to increase your pension. Nor do you have a say for how the assets are invested.

Worst of all - you have a 10-year vesting period to be eligible for the pension. Meaning, you must work 10-years to receive this benefit. If you decide to leave early - tough luck.

This eliminates your ability to utilize a one level higher mental model.

This higher-level model asks, is it higher-leverage to optimize a level above the one I’m focused on?

An example is with earning a higher salary, instead of working a year to earn a 10% raise you could switch jobs instantly for a 25% boost in your salary.

Optimize the machine instead of the cog.

As a pension plan recipient, you’re rewarded for your loyalty with a pension.

With the retirement liability on the employee, your flexibility (and value) just increased.

More Company Specific Risk

If your company fails - your pension is at risk.

Remember Enron?

The company's demise not only left thousands jobless but always wiped the company’s $2 billion in pension plans.

Pensions are not a riskless asset. This retirement liability hasn’t always been handled responsibility.

Some private pensions are in dire need of help. Multiemployer pension plans are on a crash course to insolvency by 2025 if federal financial assistance is not provided.

If this happens retirees will get a fraction - 10% of what they were promised.

Changes must be made.

Do you want to subject your retirement responsibility to such change?

While 401ks are a superior retirement savings vehicle - this superiority is contingent.

This contingency is discipline

As Jocko Willink says, “Discipline = freedom”

You need to delay gratification and be consistent.

The combination of these attributes mixed with time yields you more retirement income than pensions.

Yet while many Americans have the opportunity to enter financial independence with more monthly income, they end up with less.

What fun is saving for the future?

It isn’t until we’re 10-15 years down the road that we have the foresight to see why saving is worth the present-day sacrifice. By this time, those with pensions have passed you because their savings were automated.

They don’t have a choice to save - but you do.

Those with 401ks abuse their choice to consume today versus save for tomorrow.

Stay disciplined to stay ahead.