How To Be a Tax Savvy Investor

Many investors focus on increasing total returns but in pursuit leave excess returns on the table due to poor tax management.

Tax-efficiency doesn’t matter in qualified accounts (IRAs, 401ks, 403bs, etc.) because you don’t pay tax on the interest, dividends, or capital gains as the assets grow.

In taxable accounts - you do pay tax on interest, dividends and capital gains as the account grows.

Consider two taxable investors in the same tax bracket:

Investor 1: Total return = 9% & after-tax return = 6.84%

Investor 2: Total return = 8% & after-tax return = 7.12%

Which investor would you rather be?

Investor 2.

Why?

They had a higher return after taxes.

What you earn after taxes matters more than your total return.

This isn’t to say that you shouldn’t want a higher return - that’s perfectly reasonable.

Rather:

Taking risks at the expense of higher taxes - isn’t worth it.

There’s six big buckets of tax-saving opportunities though investing in taxable accounts:

Tax loss & gain harvesting

Realizing capital gains at a 0% rate

Municipal bonds

ETF vs Mutual fund structure

Asset location

Lending against the value of your portfolio

As a taxable investor, it’s your job to understand how these tax-savings opportunities can be used to your advantage to increase your after-tax returns - which is precisely what we’ll dive into today:

Tax loss & gain harvesting

Tax loss harvesting in the process of selling securities that are trading at a loss.

For example, say that you have $1M investing in a brokerage account, over the course of the year, your stocks have fallen 30% due to market volatility.

For your positions, this amounts to a $200k unrealized loss in your portfolio.

As a tax savvy investor, you can sell those positions inside your portfolio to capture that loss.

But there’s one thing you need to be mindful of:

Wash sale rules.

Wash sale rules state that you cannot repurchase a security that you sold for a loss 30-days before and after the sale date.

So what do you do?

You repurchase a different, but similar security to avoid the wash sale rules (& having to sit on the sidelines in the markets).

For example:

Vanguard S&P 500 ETF (VOO) → Schwab US Large Cap ETF (SCHX)

Vanguard Small Cap ETF (VB) → DFA US Small Cap ETF (DFSTX)

Vanguard Developed Markets ETF (VEA) → DFA International Core Equity Market ETF (DFAI)

You maintain similar market exposure, get to stay invested, & capture your loss.

Win-win.

At the end of the year, you’ll be issued a 1099 which will show a $200k realized loss, but if markets have recovered, you could see a positive return while reporting a loss on your tax return.

This $200k loss can be used to offset other capital gains and if more losses exist than gains, you can use $3,000 (if filing taxes married filing joint or single) or $1,500 (if married filing taxes separate) to offset ordinary income.

At a 32% marginal tax rate, this $3,000 in losses generates $960 in tax savings.

Unused losses get to be carried forward indefinitely to future tax years.

Realizing losses in your portfolio is great but it also reduces your cost basis. Meaning when you sell in the future, your capital gain tax bill will be higher because you have a lower cost basis.

So if you want to further increase your after-tax returns from tax-loss harvesting:

SAVE your tax savings resulting from the tax-losses being harvested.

Tax-gain harvesting is the ugly stepchild of tax-loss harvesting because no one likes to talk about realizing gains.

But when it comes to tax planning - you win the game by paying the lowest amount of taxes throughout your life.

So this means that in lower income years, accelerating your taxes paid can actually be a great idea.

If you’re historically in the highest top two marginal tax brackets, you pay 20% on your capital gains.

If this is something that’s a common theme for you, it may be worth your while to harvest some gains when your income falls below the 35% margin bracket.

This way, you can realize capital gains at 15% instead of 20%.

On $100,000 of gain, this could be $5,000 of tax savings.

There’s also the idea of:

Realizing capital gains at a 0% rate.

If your income falls within the 10-12% marginal federal tax brackets, your capital gains rate is 0%.

This means you could realize gains inside your brokerage and pay 0% on the taxes associated with the capital gains.

Capital gains stack on top of your ordinary income, so if you made $50k in ordinary income, in 2024, you could realize another $43,300 in capital gains as the limit for married filing joint tax filers is $94,300.

This could be $6,495 in tax savings.

For unmarried tax filers, the 2024 12% income cap is $47,150 so if your income is below this, the difference between your income and this threshold is your opportunity to realize capital gains at a 0% rate.

Next up:

Municipal bonds.

Municipal bonds are bonds issued by a government entity, commonly state or local municipality or non-profit and offer a unique tax advantage of tax-exempt interest at the federal level.

For investors purchasing a municipal bond from their state of residence, the interest is also exempt from state taxes.

Note - some states still tax in-state purchased bonds (good news = Delaware is NOT one of those states).

This is the opposite of Treasury bonds which are tax-exempt at the state level.

The tax benefits of muni-bonds are not evenly distributed - whether a muni makes sense for you depends on your rate of return after taxes.

Consider a Muni-bond that pays 4% and a taxable corporate bond pays 5.5%, which bond is right for you?

The answer lies in your marginal federal tax rate.

At a 35% marginal tax rate, the Muni-bond tax equivalent yield: 4% / (1 - .35) = 6.15%

But at a 22% marginal tax rate, the muni-bonds tax equivalent yield: 4% / (1 - .22) = 5.12%

At a 35% marginal federal tax rate the muni makes more sense.

At a 22% marginal federal tax rate the taxable bond makes more sense.

This is also important that as your income changes, tax brackets change, and muni yields change - you could fall in and of favor for the use of municipal bonds.

Be sure to take this into consideration as you purchase muni’s & as your muni’s mature.

Up next:

ETF vs Mutual fund structure.

The main consideration for using ETFs over mutual funds in a taxable brokerage account is the fact that:

ETF fund structure allows for them to distribute little (if any) capital gain distributions.

Capital gain distributions represent a fund's net gains, that are distributed to shareholders of the fund.

This is a common attribute of mutual funds.

Where at the end of the year, just like if you bought and sold securities throughout the year, you would report the gain, the same is true for mutual funds.

But ETFs rely on a creation/redemption mechanism that allows for the continuous creation or destruction of ETF shares which reduces, or in many cases, completely eliminating capital gain distributions.

To understand why we wouldn’t want capital gain distributions, consider the following –

In 2021 mutual funds distributed over $822 billion in capital gains to shareholders.

Using J.P. Morgan U.S. Large Cap Core Plus Fund (JLCAX), this fund’s 2022 estimated capital gain distribution is 23.02% of the fund's net asset value (NAV) with $4.15/share in long-term capital gain to be distributed to shareholders on 12/14.

This means if you hold $100,000 in this fund, or 5,186.72 shares, you would receive a 1099 tax form at year end to report a gain of $21,524.88 in long term capital gains, even though you never sold your shares!

If you owned this fund in your taxable brokerage account, owning this fund (on top off it’s grossly overpriced expense ratio of 1.70% with a 5.75% front-load sales charge and 0.25% 12b-1 fee), you would pay an additional $3,228.73 in capital gains tax.

That’s ugly.

This is where ETFs come in to offer relief through their creation/redemption mechanism.

You can read more about ETF creations and redemption processes HERE.

Next:

Asset location.

By simply placing more efficient assets in taxable accounts and less efficient assets in tax-deferred accounts you receive higher after-tax rates of return.

Paying attention to investment tax efficiency is one tool to get ahead.

Most Tax Efficient:

Stock Index Funds (S&P 500, MSCI EAFE, Russell 2000, etc.)

Municipal Bonds

I/EE savings Bonds

Tax Efficient:

Cash

Government bonds

Least Tax Efficient:

High-Yield bonds

Real Estate Investment Trusts (REITs)

High turnover mutual funds (actively managed funds)

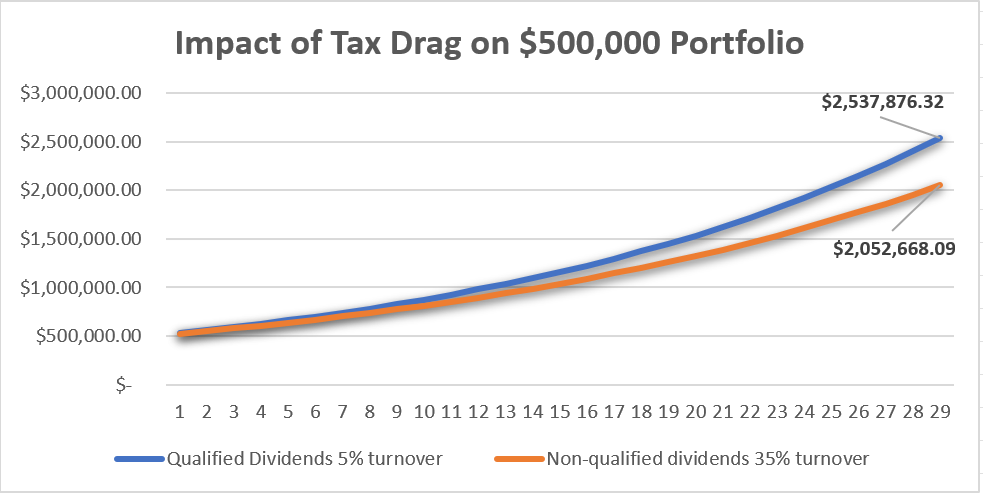

The income (interest and dividends) or capital gains (from the sale of securities) impacts your after-tax rate of return.

This is called tax drag.

See below:

Lastly:

Lending against the value of your portfolio.

Banks will offer you a loan on the value of your taxable securities.

Say, you have a $1M brokerage account, banks typically start at a rate of 50% lending and will adjust that lending percentage based on the asset allocation.

More bonds and cash = higher lending rate

More stocks = lower lending rate

Having the ability to lend against the value of your portfolio allows you to avoid having to pay capital gains yet maintain the ability to use those dollars (as if you had sold).

The interest rate charged on the SBLOC is variable and depending on the SOFR rate (secured overnight financing rate) plus a percentage (that varies based on the size of your assets). In 2024, for a $1M portfolio, this would be around 7.07% - with a current WSJ prime rate of 8.5% - this isn’t too shabby.

Why would this rate be so favorable?

Because your taxable assets are invested in highly liquid publicly traded securities that can be sold in a day to cover your loan - very little hassle for the bank.

Plus - as your assets act as the collateral for the loan, there’s no underwriting hoops to jump through like traditional loans.

If you need the loan, you can have it in your bank account in 24 hours.

The use case of an SBLOC could be a down payment on an investment property (or home), car purchase, tax payments, etc.

If you’re looking to lend for any project, it’s best to have options available to you - this is just another tool in the toolbox.

As we combine all our tax savvy brokerage strategies discussed today:

Tax loss & gain harvesting to pay tax in lower income years.

Strategically realizing capital gains at a 0% rate when income permits

Using municipal bonds if it makes sense for you on an after-tax basis

Using ETFs over mutual funds in your brokerage account

Being mindful about which assets are placed in your taxable vs tax deferred accounts to minimize tax drag.

Using your SBLOC as a tool to borrow against the value of your portfolio if this permits the lowest lending rate available.

You easily can add thousands of dollars back in your pocket annually from using these strategies.