Is My Money Safe?

Silicon Valley Bank collapsed.

Signature Bank collapsed.

First Republic Bank (parent company of Silicon Valley Bank) is under distress.

Swiss Bank Credit Suisse is experiencing turmoil.

Naturally, this has raised widespread concern as depositors and investors are questioning their confidence in banks.

Although, a lot of these concerns stem from an old-fashioned bank run. Where deposits leave the bank faster than banks can provide liquidity to meet these demands.

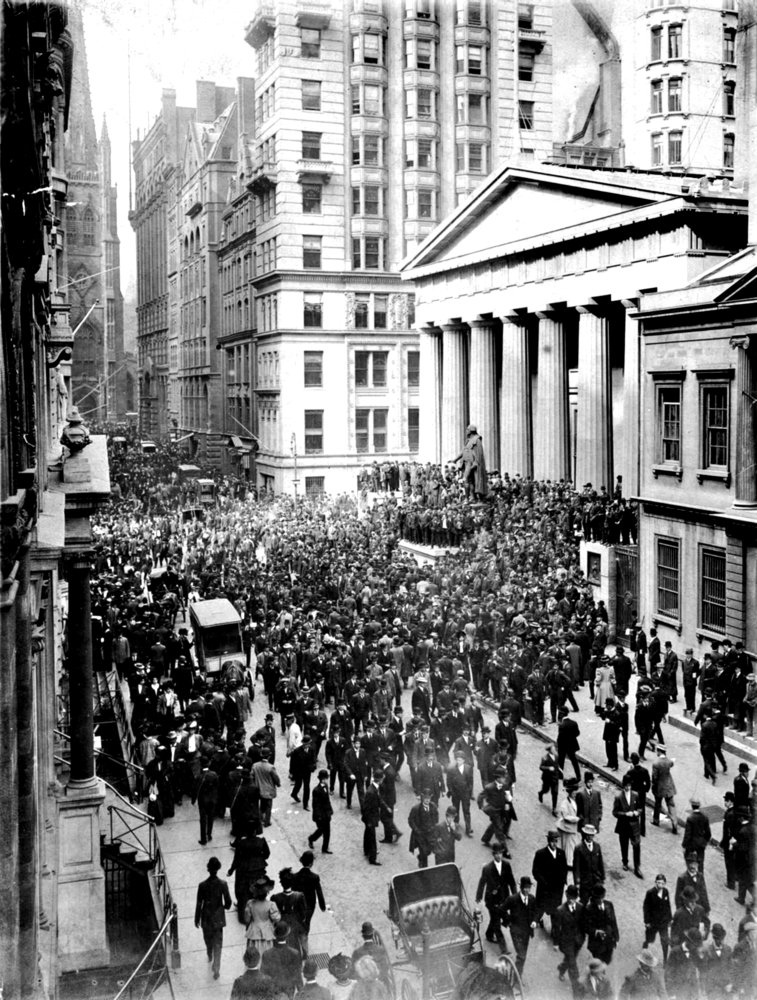

Both wavering bank confidence & bank runs - is not new.

Taking a step back, banks can earn their money in multiple ways but most commonly, it is earned through making a spread on the difference between what they earn from lending money subtracted from what they pay you in interest to keep your money at the bank.

If you earn 3% in your savings account, banks lend this out at 7% and make 4% in profit (simply stated).

But there’s one problem…

Only a fraction of the money in banks is actually tangible.

You see, when you give a bank $50,000 to deposit into your account, banks aren’t actually keeping that $50,000 in your account, they’re lending it out to someone so they can generate the interest to pay you & make a profit.

Banks used to be required to hold 10% in reserve to hedge the risk of individuals needing their money but to stimulate the economy on March 26th, 2020, the Federal Reserve reduced this reserve requirement to 0%.

In the event they lend out more money than they have in deposits, they borrow cash overnight from other banks at the Federal Funds Rate or from the Federal Reserve at the Discount Rate.

Consider this played out in action:

You give the bank $50,000.

The bank then lends your $50,000 to John who buys a car from Mike.

Mike profits $15,000 from this exchange and then deposits the $15,000 into his bank.

The bank then lends Mike’s $15,000 to Sam who buys a new sauna from Erich.

Erich profits $5,000 from this exchange and then deposits the $5,000 into his bank.

And so on down the line…

This is called fractional reserve banking and is how central banks manage the money supply and bolster economic growth.

Banks don’t keep much of your money on hand because they’re busy trying to make a profit from your deposits.

This explains why bank runs can be a death sentence to banks and speaks to the importance of consumer confidence in financial institutions.

There is plenty of risk when investing your money - inflation rate risk, geopolitical risk, interest rate risk, etc.

When you place money into your checking account - you’re not looking to take risks & herein lies the concern:

If you lose trust in the bank, you pull your money out of the bank.

When many individuals lose their trust in a bank and pull out their money this creates a bank run.

This is what happened with Silicon Valley Bank which started this contagion of lack of trust.

The difference with Silicon Valley Bank is they held a number of wealthy venture capitalists' money that was over the $250,000 of Federal Depository Insurance Corp (this is the amount the government guarantees if a bank fails without regulatory support).

In the case of Silicon Valley Bank, the Federal Reserve’s aggressive actions to reduce inflation through increasing interest rates caused sharp declines in the prices of existing bonds which caused large declines in the value of the short term securities held by Silicon Valley Bank.

Taking things one step further, at time of purchase of these short-term securities, they’re forced to decide whether they intend to hold the security until maturity.

If so, the securities are noted as “held-to-maturity”; if not, they’re noted as “available-for-sale”.

Held-to-maturity securities are glued to the banks balance sheets as volatility doesn’t matter as they’re held to maturity. Available-for-sale securities are recorded based on market value.

As rates continued to rise, Silicon Valley Bank booked a $1.8 billion after-tax loss and it was around this time where venture capitalists started pulling their money out of the bank due to liquidity concerns.

As the bank run started, Silicon Valley Bank then couldn’t sell the held-to-maturity securities without triggering the whole portfolio being marked to market causing a loss the bank wouldn’t have the capital to absorb.

So if you hold $10M in a bank, of which, $9.75M is at risk if the bank goes under & you see your bank has a weakening balance sheet, you grow concerned.

As your concern grows and you share the message with your other friends who also hold $10M at the same bank, you all begin to pull your money from the bank - causing a run on the bank.

Things started to spiral from there.

This run on the bank caused the California Department of Financial Protection and Innovation to close the bank who appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.

The FDIC then made a joint statement with the Treasury and Federal Reserve that no money over the $250,000 FDIC limit was going to be at risk.

Restoring the confidence & trust in financial institutions.

The psychology of bank runs is fascinating & multifaceted.

Looking at our modern monetary U.S. history, bank runs aren’t new:

1907 Panic

1984 Continental Illinois National Bank and Trust Company

1991 Bank of United States

2007 Northern Rock

2008 IndyMac Bank & Washington Mutual

Nobel Prize winner Douglas Diamond and Philip Dybvig attempted to uncover why bank runs occur and stated the following:

“A bank run in our model is caused by a shift in expectations, which could depend on almost anything, consistent with the apparently irrational observed behavior of people running on banks.”

Human psychology aside, this makes you wonder whether your money is safe at the bank.

To answer, consider the idea inverted which considers what would happen if your money wasn’t safe at the bank?

In this case, the foundation for which the entire financial system is built upon, would be in question.

Provided faith in the U.S. dollar and economy is of importance to the American people, we have our answer:

It would be of the best interest of the Fed and Treasury department to do everything in their power to maintain trust.

Which is exactly what they did.

If trust fails, everything collapses with it.

With many differing political debates regarding taxes, the wealthy, & inequality, etc. you can be very confident that all interests are aligned to keep trust in the financial system high.

Because it’s not just the wealthy who they’re saving - they’re saving the collective whole.

There are a couple lessons to be gleaned through this whole event to put things into perspective:

Risk is what’s left over after you think you’ve thought of everything.” - Carl Richards

Beware of assets that have a different timeline from when you need the money. An individual bond held to maturity allows you to recoup your investment. An individual bond sold before maturity is subject to potential loss of capital.

Robustly designed portfolios reduce the probability of permanent loss of capital. Silicon Valley Bank was one of 9,000 companies in a globally diversified portfolio making up 0.03% of the world. Looking more closely, regional banks total only 1.15% of the global market (when in doubt, zoom out).

Continuing confidence in the banking system is aligned from all parties. Trust is what keeps the financial system thriving.

Uncertainty is unavoidable. There will always be a reason to panic - just don’t make that reason yours.

Marketing timing is pointless. The negative impact of miscalculating your market timing far outweighs the perceived benefits.

The most interesting part of this whole event was that if the bank run never occurred, the bank would have been fine.

Human behavior and herd mentality never ceases to amaze me.