Is the S&P 500 Actively Managed?

The world’s most followed benchmark isn’t as passive as you think.

The S&P 500 which tracks the 500 largest companies in the United States, is widely thought of as the concrete scorekeeper for the U.S. markets.

Mutual funds or Exchange Traded Funds (ETFs) that track the S&P 500 (or any other benchmark) are considered an index fund.

Tracking a benchmark = passive investing

Trying to outperform a benchmark = active investing

The world of finance seems to debate active or passive management at nauseum.

But we seem to forget one thing…

There is no such thing as active or passive investing, just agreed upon rules.

In essence, everything is active investing.

You’re just choosing your rules (or your definition of active).

All benchmarks have their own set of rules they abide by.

There are many benchmarks but few that matter.

The major players in the game are Morgan Stanley Capital International (MSCI), Financial Times Stock Exchange (FTSE) Russell, Center for Research in Security Prices (CRSP), and Standard & Poors (S&P).

Each benchmark has their own rules and methodology for determining which companies enter the benchmark.

Looking at the S&P 500 we see the following criteria:

Each company’s weighting in the index is relative to its size within the index.

Ex: If Microsoft makes up 6% of the index, it has a 6% weighting in the index.

Each company must have 4 consecutive quarters of positive earnings

Newly listed companies will need to trade for a year before being considered in the index.

Free float adjusted liquidity ratio > .10

This is the ratio of the annual value of shares traded versus the market cap. Meaning, if a company has a market capitalization (i.e., outstanding shares multiplied by current share price) of 700 billion then annual trading volume must be 7 billion in total value of shares traded.

Finally, there is an active committee that meets once a month to discuss potential revisions and makes a vote on which companies should be entered or removed from the index.

In the S&P 500’s 50th anniversary press release they noted that only 86 of the original 500 companies since the index’s inception in 1957 remain in the index today.

When the S&P 500 was originally constructed it tracked the performance mainly industrial, railroad, and utility stocks.

AT&T used to be the largest company in the S&P 500.

Today, that is no longer the case:

As the world’s buying preferences change, so do the companies that make up the S&P 500.

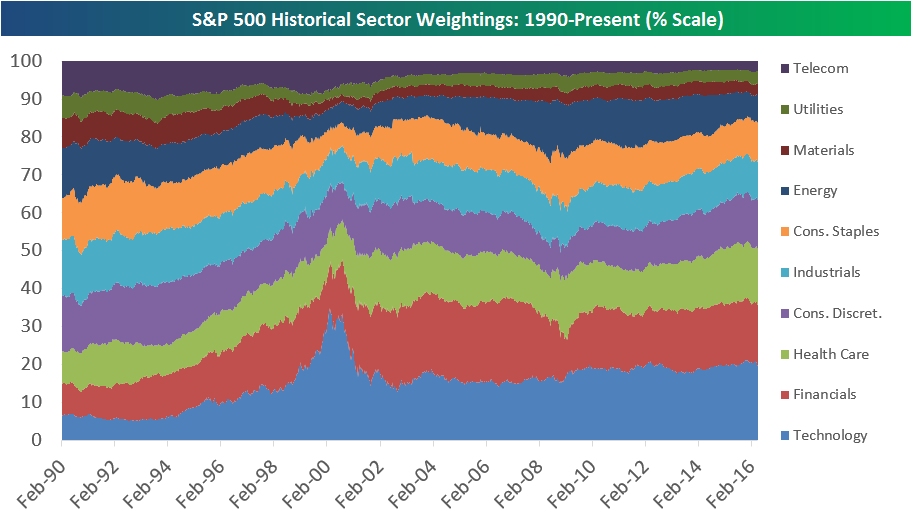

Not only do the companies within the S&P 500 change over time but also the sectors comprise those companies change.

In the 90s, telecom made up a large portion of the S&P 500’s weighting; today the weighting has fallen.

In the 90s, technology made up a small portion of the S&P 500 weighting; today the weighting has increased.

This is a built-in feature of market capitalization.

Company’s that perform well increase in price and earn a larger holding within the index.

Company’s that perform poorly decrease in price and earn a smaller holding within the index.

There’s wisdom in crowds.

Not only are there changes regarding the companies and sector weightings but the average company lifespan on the S&P 500 index is on a negative decline.

“At the current churn rate, about half of the S&P 500 companies will be replaced over the next ten years”

Passive investing isn’t passive at all.

The index is adding and retracting companies that don’t meet their criteria anymore.

Staying passive does not mean that you’re doing nothing when the market falls and you’re less of an investor.

As investors we worry about our return on investment.

We want to know how money we will make from our investment.

But there’s a more important metric that isn’t talked about enough:

Return on hassle.

This looks at your return per unit of effort put into a task.

Active investing requires hundreds of hours pouring yourself into company annual reports and running various valuation models to determine if there’s mispricing in a security.

This effort (time and time again) has proven to underperform a benchmark (& charge higher fees).

This is low return on hassle work and is to be avoided at all costs for the sake of both your time and money.

Passive investing reduces the psychological and emotional connection to how your investments are performing and allows for more mental bandwidth to be allocated on things that actually matter in life.

How can you use rules to add to your life?