Navigating the Maze of Medicare

Medicare, the cornerstone of healthcare for millions of retired Americans, can be a maze of options and decisions that many find daunting to navigate.

You may be asking yourself:

When do I need to enroll in Medicare?

What does Medicare not cover?

What are the different parts of Medicare?

Do I need a supplemental plan?

What are late enrollment penalties?

We’ll cover all this & more as we dive into the key components that shape your Medicare coverage and decisions.

Medicare is a National U.S. health insurance program for those people 65 and older (you could also have medicare if you have certain disabilities or end-stage kidney failure) & is broken into the following parts:

Part A

Benefits: Assists with the cost of inpatient care, skilled nursing stays, hospice care, and home health care.

For skilled nursing care, Medicare part A covers the first 20 days fully, then days 21-100 there is a daily coinsurance amount that applies

For hospital care, Medicare part A covers up to 90 days of inpatient hospital care per benefit period (with an additional 60 “lifetime reserve days” available)

For hospice care, Medicare part A covers care as long as your doctor certifies you’re terminally ill and has a life expectancy of 6 months or less.

For home health care, Medicare part A covers part-time skilled care, physical therapy, and occupational therapy - but has limits of services received within a 60-day window.

Cost: Free (or paid considering 2.9% of your pre-tax compensation (& an additional 0.90% if your income is over $250,000 for married filers and $200,000 for single filers) is used to fund this. Assuming you have worked for 10 years or 40 quarters, this is free to you).

Part B

Benefits: Assists with outpatient medical coverage outside of your inpatient hospital care. This could be doctor services, preventive services, laboratory tests, ambulance services, mental health services.

Cost: Premium is based on your modified adjusted gross income & increases based on your compensation, see 2024 part B premium thresholds below:

There are planning opportunities that strategize around reducing these surcharges but that’s a topic for a different time.

Part C

Benefits: This coverage is supplemental and offered into two options Medicare advantage and Medigap discussed below:

Medicare Advantage (Part C): offered by private insurance companies and is an alternative to traditional Medicare Part A and B. Typically plans have a restricted networked only to the local service area (except in emergencies).

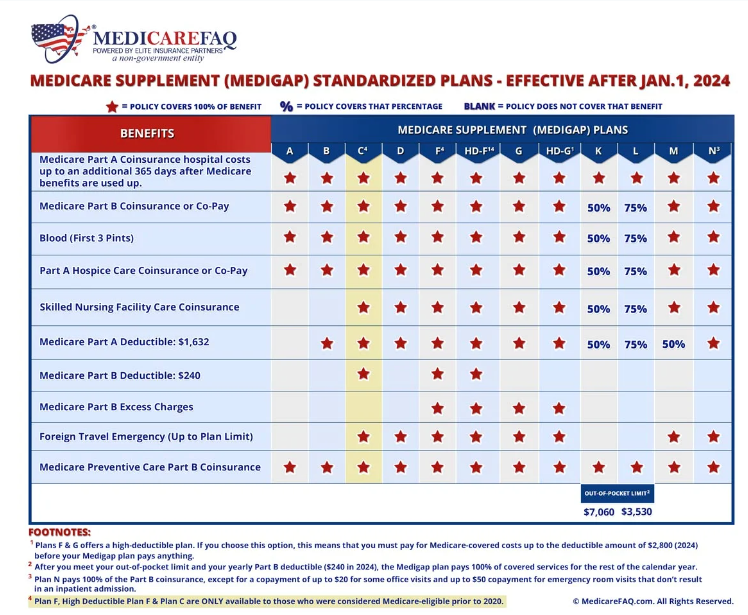

Medigap Plan C: designed to cover a portion of the remaining balance of bills not covered from parts A and B (deductibles, copays, and coinsurance). Plan types and coverages are noted below:

Both medicare advantage part C and Medigap plans have out of pocket maximums - which is valuable as without, you will not have an out of pocket max, which would get costly if you have a catastrophic event.

Cost: depends on the plan you choose, your state, zip code, age, gender, and tobacco use. Typically Medicare advantage part C will be cheaper than a Medigap plan.

Part D

Benefits: designed to help cover the costs of prescription drug coverage and was added in 2006 from President Bush’s “Medicare Modernization Act”. These plans must have 2 drugs in each category per the Centers for Medicare & Medicaid Services standards.

Cost: average cost is around $59/mo & the drugs covered will range based on the plan.

Your time to enroll in Medicare is 3 months before and after your 65th birthday.

This is extremely important to complete this as late enrollment penalties can eat into the costs of coverage throughout your life.

For Medicare Part A, the late enrollment penalty increases your monthly premium by 10% for twice the number of years you were eligible for Part A but did not enroll.

Ex: If you were eligible for Part A for 2 years but didn’t enroll, you’d pay a 40% higher premium for Part A for as long as you have it.

For Medicare Part B, the late enrollment penalty increases your Part B premium by 10% for each 12-month period you could have had Part B but didn’t sign up.

Ex: if you delayed enrolling for Part B for 2 years after your initial enrollment period, your Part B premium would be 20% higher than the standard premium for as long as you have Part B.

The good news is that those that are covered by an employer’s health insurance plan - either directly or through a spouse, may delay Part A & B without facing a late enrollment penalty.

For those who have an employer health insurance plan upon the initial enrollment period at 65, they will have a second chance during a Special Enrollment Period (SEP) which ends 8 months after the individual loses group health coverage or stops working (whichever comes first).

Medicare advantage special enrolment period is typically 2 months after the qualifying event.

Once you enroll in Medicare Part B, this also starts the 6-month window for obtaining Medigap insurance without any underwriting restrictions.

In the case of Medicare Part D, a similar special enrollment period applies but the duration is only 2 months.

Notably, it’s not enough for an employer provided healthcare plan to have prescription drug coverage. They must have “creditable” coverage as defined as having actuarial benefits equal or exceeding the coverage of Medicare Part D itself.

As many employees will not know this, the employer is required to send out a notice of creditable coverage to employees.

If you do not have creditable coverage, you will have to enroll during the initial enrollment period (or within the a 2-month special enrollment period after your creditable prescription drug plan falls off) or the penalty for late enrollment in a Part D plan will be 1% premium surcharge over the national base premium for Medicare Part D for each month the individual delays enrolling in Part D without having creditable coverage beyond a 63-day grace period.

Ex: For those who delay 12 months, the enrollment penalty would be 12%/year for as long as the individual remains enrolled in Medicare Part D.

Medicare does not cover everything.

Some Part A and B exclusions are noted below:

Long-term care

Routine dental/vision/hearing care

Cosmetic surgery

Acupuncture

Foot care

Prescription drugs

Healthcare services outside the U.S.

When evaluating your Part D plan, it’s important to note that some drugs are covered on some Part D plans but not on others (& this changes each year) so be careful about which plan you choose so you’re not surprised.

One question many may be wondering is whether choosing Medicare Part A, B, and D with a Medigap policy would be better/worse than a Medicare Advantage Part C plan with Medicare Part D.

In practice, it depends, and much of this comes down to the price and benefits trade off.

Medicare Advantage plans are typically cheaper but will not be as comprehensive in coverage and often have a more narrow network of providers.

Medicare Part A, B and a Medigap policy will be more expensive but will typically be more comprehensive with a more broad network of coverage.

Beyond the decision to pick a plan when enrolling in Medicare, it’s important that this decision be reviewed annually as coverage needs may vary.

When choosing a Medigap or Medicare Advantage Part C plan it’s important to look under the hood to get an idea of what you’re buying. You want a plan that fits the coverages that you are most likely to need, at the best cost.

While most medical providers accept Medicare, some don’t. It’s important you ask your existing providers if they accept Medicare and if not, who they recommend.

For those looking to shop around for Medicare Part D plans: Explore your Medicare coverage options

For those looking to shop around for Medigap plans: Find a Medigap policy that works for you (medicare.gov)

As with the decision to choose any health insurance plan, knowing:

Your current medical conditions

How often you use the doctor

Potential issues that you may have a presupposition for based on family medical history

Can all be great decision points to decide which plan makes the most sense for you.