Why Investors Fail

Investing doesn’t require talent, it requires patience.

Building wealth is a product of persistent savings, not a once in-a-lifetime stock pick.

It’s easy to fantasize about what wealth brings, it’s hard to practice the steps of wealth creation.

Our minds have trouble determining the difference between fantasy and reality.

When you fantasize about success, your brain releases a chemical called dopamine which is closely linked to our sense of motivation.

By only visualizing achievement we’re producing dopamine which tells ourselves that we have already achieved our goal.

This results in false achievement as your subconscious believes you no longer need to work hard because it thinks you have already achieved the goal.

So what happens?

You sell the investment.

You stop investing.

You quit.

Why?

Because your expectation of growth and reality are severed.

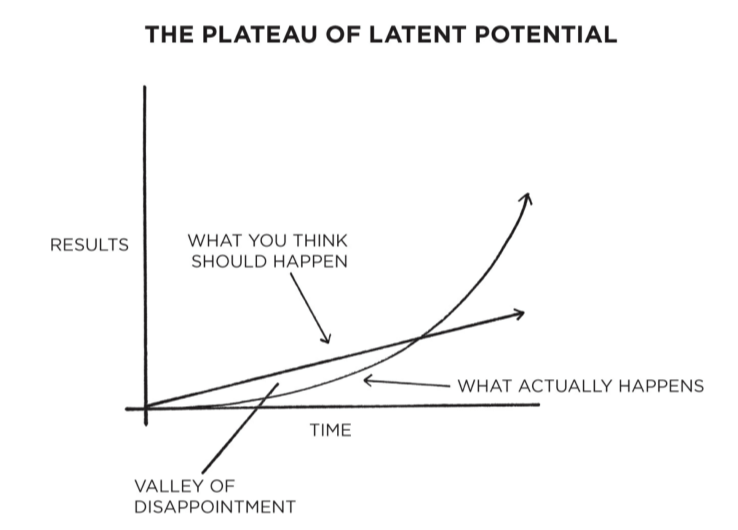

James Clear in his book Atomic Habits clearly outlines this idea with his Plateau of Latent Potential:

If many quit in the valley of disappointment, how do you make it through?

Mental contrasting.

As you positively fantasize about your desired outcome you must sprinkle in some obstacles that will stop you from achieving your goal.

“The impediment to action advances action. What stands in the way becomes the way.”

Let’s be honest, financial freedom is demanding.

It’s hard (& it should be).

You wouldn’t value it if it just came to you effortlessly.

You will constantly be tested to spend more, save less, and invest carelessly.

You must constantly realign and refocus your efforts to act in accordance to your goals.

How can you ever say that you’re a disciplined investor if you’ve never experienced your investments fall by 30%+ and you held to your strategy?

Investing isn’t an armchair philosophy of inaction - it’s a battle tested field for those looking to take risk.

The point isn’t to never fantasize about success or throw yourself into the fire by taking uncalculated risks.

Rather:

To develop unwavering discipline amidst chaos towards your goal.

“Do not be disgusted, discouraged, or dissatisfied if you do not succeed in doing everything according to right principles: but when you have failed, return again, and be content if the greater part of what you do is consistent with man’s nature”

The reason few achieve wealth is because everyone wants to get rich quick - no one wants to get rich slow.

The former is a wise tale, the latter is reality.

The reason speculative asset classes rise “to the moon” is investors are chomping at the bit to attain new levels of financial status overnight.

This is not how wealth works.

Achieving wealth can be boiled down to answer the following questions:

What are you looking to achieve?

Upon achievement, what are you looking to feel?

What obstacles stand in your way of achieving your goal?

How will you face these obstacles when they arise?

Motivation gets you started, but consistency is how you make progress.

The difference is those who can develop endurance versus those who are short-winded.

The path is long, grueling, and tedious but that’s what makes it so fruitful.

Stay the course.