How to Avoid, Defer, and Reduce your Tax Bill

If:

More money = more taxes

&

More tax = More problems

Then:

More money = more problems (Biggie had it right)

But before you actually pay your tax bill, you want to be confident you best utilized the tax code to pay the least amount of taxes allowable by law.

So how can you be confident of this?

If you’re someone who doesn’t work in the tax/accounting or personal finance field, this likely means partnering with a qualified accountant (CPA/EA) and financial planner (CFP/CFA) to strategize and build a plan.

In addition, having a basic understanding of fundamental tax concepts will take you far, as there are many common misconceptions around how you’re taxed.

Let’s explore a few misconceptions:

Tax brackets are marginal & based on taxable income

In 2023, if you’re married and you earn $300,000 of taxable income (note: this is after pre-tax retirement plan contributions, capital losses, the standard or itemized deduction, etc.) then you fill up each tax bracket from 10%, 12%, 22%, and you end up in the 24% tax bracket. 24% = your marginal rate (the rate you would pay on the next dollar of income you earn). Your effective rate is the average tax rate you pay, in this case your effective rate = 17.82%.

Reducing taxes and saving cash are not necessarily the same thing.

You can save $5,000 in taxes by writing a $20,000 check to charity. Most people say that they want to reduce taxes but what they really mean is that they want to save cash. Most tax savings involve moving cash. Sometimes you can do both but not always.

Tax credits and deductions are not the same thing.

Tax credit is a dollar for dollar reduction in the amount of tax you owe.

Ex: your tax liability is $20,000 but the child care tax credit of $4,000 for your two children, you now owe $16,000 in tax

A tax deduction reduces your taxable income.

Ex: your tax liability is $20,000 but you contribute $4,000 pre-tax to your retirement account, you now owe $19,120 in tax. This saves you $880 based on 22% marginal rate (~$160k taxable income)

When you financially measure your life, you’re not going to measure it based on how much tax you saved, rather, how much wealth you’ve built.

But given taxes are our biggest bill each year, let’s give it the attention it deserves.

I like to break down decreasing your tax bill in three categories:

Avoid

Defer

Reduce

With the overarching goal to reduce total lifetime taxes paid.

Decreasing taxes over your lifetime is a different frame than reducing taxes in any one given year.

You could more easily generate a tax year with $0 taxes due but if the next year you get slammed, what good does that do you?

Avoid Taxes

IRC Section 121 - Home Sale Exclusion

IRC section 121 allows a taxpayer to exclude a portion (or all of the capital gain from the sale of their principal residence).

For single filers this is limited to $250,000 of gain.

For married filing joint tax filers this is limited to $500,000 of gain.

To qualify, you must live in your home at least two years during the five year period leading up to the sale.

This rule applies the day the home is sold.

The IRS defines principal residence broadly which could include a boathouse or trailer.

The home that you use the majority of the time will be considered your principal residence.

Realizing capital gains at a 0% rate

In your brokerage account, long-term capital gains up to $44,725 for single tax filers and $89,450 for married joint tax filers of TAXABLE income can be realized at a 0% capital gains tax rate in 2023.

Let’s unpack this.

Brokerage account = a taxable investment account

This account sits between your cash accounts and your retirement accounts.

Meaning, if you want to invest in the stock market but want the flexibility to be able to access prior to age 59.5 without penalty - a brokerage account is for you.

When you sell inside your brokerage account, the gain is taxed to you in the year you make the sale.

That sale is either classified as a short-term or long-term gain.

This determines whether you will pay ordinary income or more favorable capital gains tax rates.

If you held the position for longer than 1 year = long-term capital gains

If you held the position for less than 1 year = short-term capital gains

Short-term sale = ordinary income tax

Long-term sale = capital gains tax

Capital gains tax is more favorable than ordinary income tax because the tax rate is lower.

Don’t fool yourself, taxable income is NOT what salary you’re making.

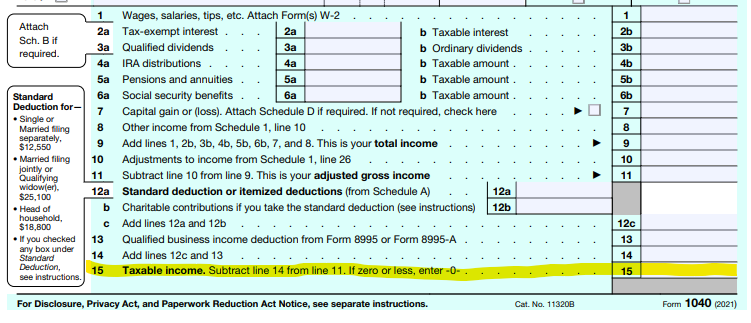

Taxable income is line 15 of your 1040:

This is AFTER:

Capital losses

Standard or itemized deduction

401k & Traditional IRA contributions

Health Savings Account & Flexible Savings Account contributions

Qualified business income (QBI) deduction

Student loan interest deduction, etc.

If you’re married and have $60,000 of TAXABLE income, you can realize another $29,450 of capital gains AND PAY $0 in tax!

It’s important to note when strategizing, your capital gains stack on top of your ordinary income.

Further, the $29,450 is GAINS - not total market value of securities sold.

You could realize $1,000,000 in market value but if your basis (your contribution) was $980,000 then you only pay tax on $20,000.

If you have a brokerage account, there’s a lot of underrated tax planning strategies for the taking (in addition to realizing capital gains at a 0% rate):

Use specific identification to realize gains

Utilizing tax-loss harvesting

Applying asset location to your advantage

Lending against instead of selling within your brokerage account

Investing through exchange traded funds over mutual funds

I wrote about these topics, more on that HERE.

Defer Taxes

Employer Retirement Plans

When you contribute pre-tax to a qualified retirement plan you reduce your taxable income.

Ex: You make $200,000, you contribute $20k to your employer 401k pre-tax, your taxable income is reduced to $180,000.

The account then grows each year without incurring any further tax (no tax on sales for a gain, interest, or dividends earned).

Then upon qualified distribution the account is then taxed as ordinary income.

Qualified distribution is defined as:

Attained age 59.5

Death/permanent disability

Qualified Domestic Relations Order (QDRO – from divorce)

72(t) series of substantially equal payments

Amount of unreimbursed medical expenses exceed 10% of AGI

Separation from service after employee reaches age 55 (50 for public safety)

That’s the main items, full list HERE.

If you do not meet one of these tests, the distribution will have a 10% penalty (in addition to being taxed as income).

You could also make Roth contributions, which are also a great way to reduce your lifetime taxes paid (even though you pay taxes on Roth contributions up front).

Whether an after-tax Roth or pre-tax traditional contribution makes sense for you will depend on your current versus future marginal tax rate (more on that HERE).

If you’re a business owner, there’s also the ability to layer on Profit Sharing or Cash Balance plans to potentially save hundreds of thousands of dollars.

Depreciation

Depreciation allows you to annually deduct a portion of an asset's useful life over time - thereby reducing your tax liability.

This deduction is special because it’s a non-cash expense.

Real estate investors love depreciation because it helps shield their rental income from being taxed - many times, often allowing for a loss that can be used to offset income (unless you’re not a real estate professional, in which case if you actively participated in a passive rental real estate activity, losses are limited to $25,000).

Depreciation is meant to recover the costs of improving and maintaining a property.

You’ll need to replace the roof, AC/heating unit, garage door, leaky faucets, etc. these are the maintenance costs associated with owning an investment property.

In addition to being able to write-off these expenses, your property (physically) is a depreciating asset - it needs to be maintained to its current useful state - this is where deprecation comes in.

Different assets have different useful lives, or, the time period you can depreciate property.

For residential real estate, the useful life is said to be 27.5 which means you can depreciate 3.63% of the property each year.

Note, you cannot depreciate land because land doesn't lose function over time - land is land.

There is another tool you can utilize to accelerate the deprecation you take on a property.

Cost segregation.

Utilizing a cost segregation study allows you to depreciate, primary electrical distribution systems, conduit, floor boxes/power boxes, floor covering, etc. over 5, 7, and 15 years opposed to 27.5 → accelerating the amount of deprecation you can take earlier in the property’s useful life.

This comes in handy if you have an extraordinarily high income year, strategically utilizing a cost segregation analysis can help reduce your tax liability.

Cost segregation aside, if you buy a property for $400,000, of which land costs $115,000 this means we can depreciate the property of $285,000 or $10,363.63 in depreciation for 27.5 years.

The depreciation that you take each year, while it sounds great, is not a freebie - it’s recapture upon sale up to 25%.

Reduce Taxes

Electing S Corporation Status

This is specific for business owners, but is a great tool nonetheless.

There are two HUGE reasons why you may choose to form an S-Corp:

First, your share of S-corp net income will not be subject to self-employment taxes (this is a combination of social security and Medicare - commonly referred to as FICA)

Second, shareholders and officers of an s-corp are not personally liable for corporate debts and liabilities.

Before we dive in, I need to burst some bubbles -

LLC’s do NOT save taxes. LLCs are for asset protection.

When you’re filing as a sole proprietor or partnership, you’re not required to take a salary, making the net income fully subject to self employment tax.

Electing S-corp status allows you to minimize self-employment taxes of 15.3%.

Why is this important?

You WILL pay self-employment taxes on all your net income if you are a sole proprietorship or partnership.

In 2023, 15.3% FICA taxes are made up of:

12.4% in social security tax (up to the social security wage base - $160,200 in 2023)

2.9% in Medicare tax (unlimited wage base)

Further, if you’re a high income earner there is an additional Medicare tax of 0.9% for married tax filers making above $250,000 and single filers making above $125,000.

The benefit of electing S-corp status is the ability to take a reasonable salary through W2 earnings that eliminates the self-employment taxes and additional Medicare tax on your net income.

Let’s play this out…

If you’re an-S-corporation business owner with revenue of $500,000 and net income of $165,000, as a non-s-corp entity, you will pay 15.3% on the $165,000 of net income.

If you elect s-corp status, you minimize this self-employment tax through paying yourself what the IRS deems a “reasonable salary”.

Reasonable salary can be defined as the market rate for someone else to fill your current role if you’re not there. There’s some flexibility with what’s reasonable so I’d encourage you to work with your accountant to figure out what’s deemed reasonable for you.

If we revisit our example as a newly elected S-corp, assuming your reasonable salary is $80,000, this reduces your net income and leaves $85,000 of net income.

Your salary of $80,000 is subject to 15.3% or $12,240.

Your profit of $85,000 is NOT subject to 15.3% saving you $12,194 in FICA taxes.

This is thanks to Revenue Ruling 59-221 as corporate income is not subject to self employment taxes.

This is a great opportunity for those with a profitable business earning around $100,000 in revenue (opinions will defer around when you should convert, my two-cents is around $100k because of the reduction in QBI deduction, payroll costs, and additional 1120S filing fee).

Balancing pre-tax, post-tax, & taxable investments

Your three accounts each offer different tax statuses – taxable, pre-tax, and post-tax.

Details of contribution limits, taxation entering the vehicle, during, and after withdrawal, and accounts available are noted below.

Taxable Brokerage accounts:

Contributions to Account: made with after tax dollars.

During Year: Interest and dividends generated from the stocks and bonds in the account are taxed to you in the year income is generated. (Hence, taxable account)

Ex: $50,000 in stocks & $50,000 in bonds.

Stock dividends either have qualified or nonqualified dividends.

Qualified dividends are taxed at more favorable capital gains rates.

Qualified dividends rules are as follows:

Paid by a U.S. company or qualified foreign company

Held the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date (ex-dividend date is the first date following the declaration of a dividend)

Unqualified dividends are taxed as ordinary income

Bond interest is taxed as ordinary income

Dividend yield = 1.2% and the dividends are qualified.

Bond yield = 1.5%

Total tax due: $270 (24% interest tax rate assumption & 15% capital gains rate)

Contribution limits: None

Upon Withdrawal: Tax due upon sale of securities.

Holding period > 1 year = capital gains rates

Holding period < 1 year = ordinary income rates

Capital gains are split between three rates which vary depending on income:

Ex: You bought $10,000 of Apple stock and you sell it for $20,000 years later. Assuming a 24% marginal tax rate your capital gain is $10,000 taxed at 15% or $1,500.

Option for leverage:

One under-discussed benefit of your brokerage account is the ability to pledge your securities as collateral and borrow against the value of your portfolio. This means you don’t have to sell to realize a gain, your investments can still grow, while you get to enjoy the benefits of accessing the liquidity of your investment account.

Traditional Qualified Accounts:

Contributions to Account: Pre-tax dollars (meaning you receive a tax deduction for your contributions to these accounts)

During Year: No tax due. Interest, dividends, and capital gains tax are deferred until you pull money out of the account.

Contribution limits: Depends on the account. See below for a few examples:

401k/403b/TSP: employee = $22,500 (over age 50 +$7,500). Overall limit is $66k max employee + employer ($73,500 with catch up)

Traditional IRA: $6,000 (over age 50 +1,000)

SIMPLE IRA: employee $15,500 (over age 50 +3,500).

SEP IRA: $66,000 (employer contributions only based on up to 25% of compensation)

Tax Due: Ordinary income upon withdrawal from the account. The account grows tax-deferred, meaning no interest, dividends, and capital gains are taxed each year (unlike your brokerage account). Then your withdrawals are taxed as ordinary income (given you meet withdrawal rules - biggest hurdle is age > 59.5).

Roth Qualified Accounts:

Contributions to Account: Post-tax dollars (meaning tax is paid upfront for your contributions to these accounts).

During Year: Interest, dividends, and capital gains tax are deferred indefinitely as there is no tax due upon qualified withdrawal.

Contribution limits: Depends on the account. See below for a few examples:

Roth 401k/403b/TSP/457: employee: $22,500 (over age 50 +$7,500 & $66k max employee + employer)

Roth IRA: $6,500 (over age 50 +1,000)

Tax Due: Money invested into a Roth account is taxed as ordinary income in the year you make the contribution. The account grows tax-deferred, meaning no interest, dividends, and capital gains are taxed each year (like your brokerage account). Then your withdrawals are tax-free (given you meet withdrawal rules - biggest hurdle is age > 59.5)

Qualified accounts should be considered first because they offer the greatest long-term compounded rates of return because you’re not paying tax on the interest, dividend, or capital gains inside the account.

Your current versus future marginal rate will determine whether you utilize pre-tax or post tax contributions (note: there are Roth IRA income eligibility limits so you have to be mindful of that, also, there’s the ability to make after-tax contributions through backdoor and MEGA backdoor Roth conversions that adds an additional factor to consider).

Your taxable account provides tremendous flexibility if you need to access invested capital prior to age 59.5 (& offers many other benefits as noted above).

A little effort goes a long way. Strategically placing your savings in the right accounts increases your surface area of financial freedom.

While this just scratches the surface of ways to avoid, defer, and reduce your tax bill, this should get your wheels turning for some things to think about as it relates to minimizing your lifetime tax liability.