Pre-tax (Traditional) or post-tax (Roth) contributions: Which is better?

The more control you have over your emotions, the more control you have over your money.

& when it comes to money - there’s no shortage of emotions surrounding it.

One strong emotional belief I’ve been coming across is the idea that either Roth or Traditional contributions are better than the other (commonly it’s people who believe strongly in Roth contributions).

Roth meaning, you pay taxes today, then when you pull out qualified distributions later, they’re tax free.

Traditional meaning, you get a pre-tax deduction today for your contribution, then when you pull out qualified distributions later, they’re taxable as ordinary income.

The main difference being, when do you want to pay taxes, now or later?

For many who believe Roth contributions are better than a Traditional contributions, they’ll likely say:

“It’s tax free growth forever” or “Tax rates always go up”

For many who believe Traditional contributions is better than a Roth contributions, they’ll likely say:

“I want to defer as much tax as possible”

While each defending argument has a silver lining of truth, they’re missing one key fact:

Whether Roth or Traditional contributions make sense is based on your current versus future marginal tax rate.

Qualified Roth distributions are misunderstood because the frequent belief to justify their perceived superiority is that the compounded growth in combination with not paying tax later makes them better.

But you do pay something:

Opportunity cost.

If you paid tax at 32% but then took the money out of your Roth IRA at 24%, you could have paid tax at 24% if you originally contributed pre-tax.

The result?

You paid more in taxes than you should have.

Consider this played out in action.

Starting with $20,000, you have two options, either contribute Traditional or Roth.

If you contribute Traditional, you get a deduction for your contribution to that account. That deduction reduces the amount of tax you pay in the year you make the contribution.

If you’re married and have $220,000 of taxable income, your marginal tax rate is 24% (or the tax rate you would pay on the next $1 of income you earn) this would then reduce your taxable income to $200,000.

In this case, your $20,000 contribution isn’t taxed so you keep the full $20,000 that grows over time.

On the Roth side, you pay tax today, so that $20,000 contribution really is $15,200 after a 24% tax bill.

Growth assumptions are the same at 7% over 30 years with no additional contributions being made.

Your traditional total = $152,245.10

Your Roth total = $115,706.28

When you pull money out of your Traditional account, you pay ordinary income tax on the total value.

When you pull money out of your Roth account, you don’t pay ordinary income tax on the total value.

After a 24% tax bill on your Traditional account, you’re left with $115,706.28.

The same as the Roth account.

In this case was one account better than the other?

No.

Why?

Because the tax rate you paid was the same.

Traditional contributions can be better than Roth contributions.

Roth contributions can be better than Traditional contributions.

What rate you end up paying in taxes matters the most.

“But Roth contributions have no required minimum distributions”

Correct.

And if you’ve paid all your tax up front and pay no tax later, you’ve just guaranteed yourself a missed opportunity to pay tax at lower marginal rates in the future.

If you’ve paid taxes today where your marginal rate was 32%+ then you have the ability to pull money out at 10%, 12%, 22%, or 24% in the future, you overpaid in taxes.

Plus you can always make Roth conversions later, you cannot make a Traditional conversion, once you pay the tax, there is no going back.

“But the tax free growth compounds over time to beat the Traditional contributions”

Not exactly.

Taxes are paid in percentages, not fixed dollar amounts.

After taxes, Roth contributions will grow to the same value as a pre-tax, traditional contribution will grow that is taxed later.

“But taxes rate always go up”

Maybe - who knows.

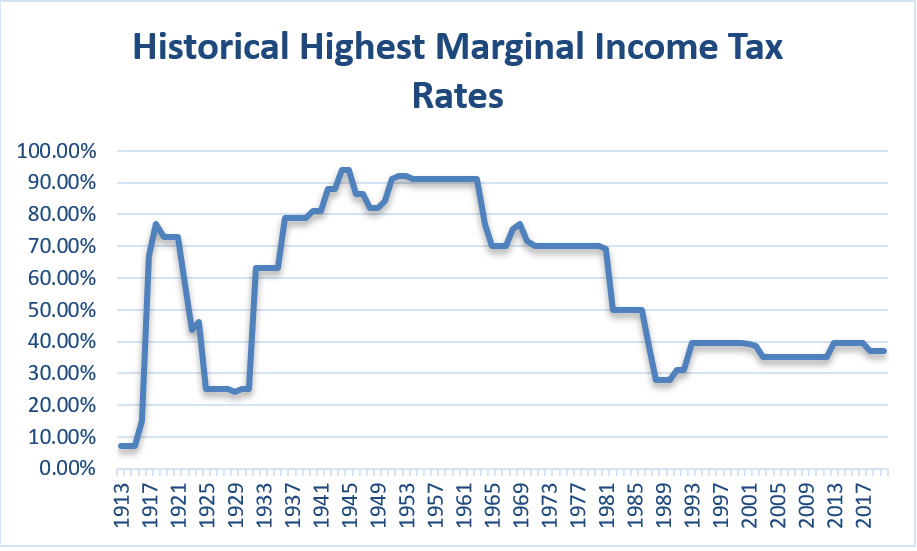

For context, here’s the historical highest marginal tax rates (which tells a different story).

I’m not saying taxes will never increase but how and when that will occur is unknown.

Trump's Tax Cuts and Jobs Act (TCJA) is set to sunset in 2026 where tax rates will go back to 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Where today rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

While rates are projected to increase, who's to say they will stay this way forever (or if there isn’t additional tax legislation impacting this before it reverts)?

I agree this would add further justification to make Roth contributions but that is ONLY the case if your future tax rate will be higher than it is today.

Just like future tax rates are uncertain, so is your future income need (which would determine what tax rate you pay).

So if you don’t know what your future income needs will be or what future tax rates will be, what do you do?

I would argue you use reason, then act in accordance with that reason to make progress that is directionally correct towards the outcome you think is most accurate at this time.

Just like a skydiver who jumps out of a plane to land at the correct location.

At first, they jump off in the general vicinity from their landing zone.

As they get closer to the ground, what was once blurry is now clear, you have a better sense of direction as you get closer.

This makes the action you take more precise as you have more clarity on your destination.

The same applies to making Traditional or Roth contributions.

You may not know exactly what your future taxable income will be or what future tax rates will be.

But you do know:

What you’re saving today (& will continue to save in the future). Your income and expenses. How long until you would like to retire. How you’re allocated today which we could reasonably generate a future return assumption from.

These fundamental assumptions will give you an idea of what the future may hold.

As you model out into the future, you can begin to understand what makes the most sense.

Given the uncertainty of what the future may hold, you may have preference over which option you believe makes the most sense for you.

& that’s OK.

But just be mindful of what presumptions your preference is rooted in.