Student Loans Set to Resume (here's what you need to know)

We averted the debt ceiling crisis but there’s another crisis on the horizon that many may be overlooking:

Student loans resuming.

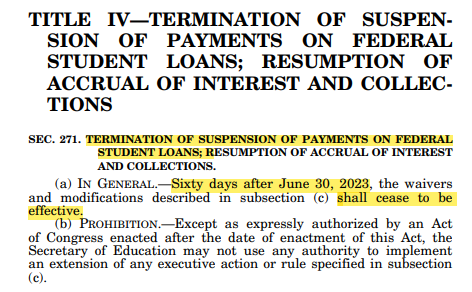

This was stated in recent new legislation (Fiscal Responsibility Act of 2023) which suspended the debt ceiling through January 1, 2025 but provided a deadline for resuming student loans.

Take it from the bill itself:

This means beginning August 30th, 2023, student loans are set to resume again after 8 student loan payment extensions since March of 2020 (the bill further includes language insinuating Biden’s ability to extend payment will be close to 0%).

This is a big deal & may come as a shock to many borrowers.

Here’s everything you need to know to be prepared.

First thing I would recommend is that your personal information is correct with your student loan servicer.

As many have moved, gotten married, changed phone numbers, etc. You’ll want to make sure your information is up to date so you receive important communication & bills.

With student loans resuming on August 30th, you should receive a notice or billing statement around 3 weeks before you restart payments.

This will outline your repayment plan and loan repayment amount.

If you were on auto-repay before the pause started, you’re going to want to login to your studentaid.gov website or contact your loan servicer to resume this.

If you are on an income driven repayment plan, you’re going to want to recertify your income by logging into your studentaid.gov portal. If your income decreased, your repayment will be lower (& vice versa).

Note: if your family size grew, this will help reduce the payment amount.

Getting an idea of what your repayment amount will be will help you budget this into your current plan.

If you are a new borrower and you don’t do anything (i.e.: picking a repayment plan), you are automatically placed into the standard repayment plan.

This plan offers the shortest repayment period, but the highest repayment amount (something to watch out for as this may or may not be what you’re looking for).

If you’re looking to explore your loan repayment options, there's a few things you can do.

I would first visit the student aid website that has a loan simulator where you can compare different standard and income driven repayment plans that you’re eligible for.

The next option is to hire someone to help you with the loans to make sure you get it right the first time (if that’s you, send me an email to see if I can help).

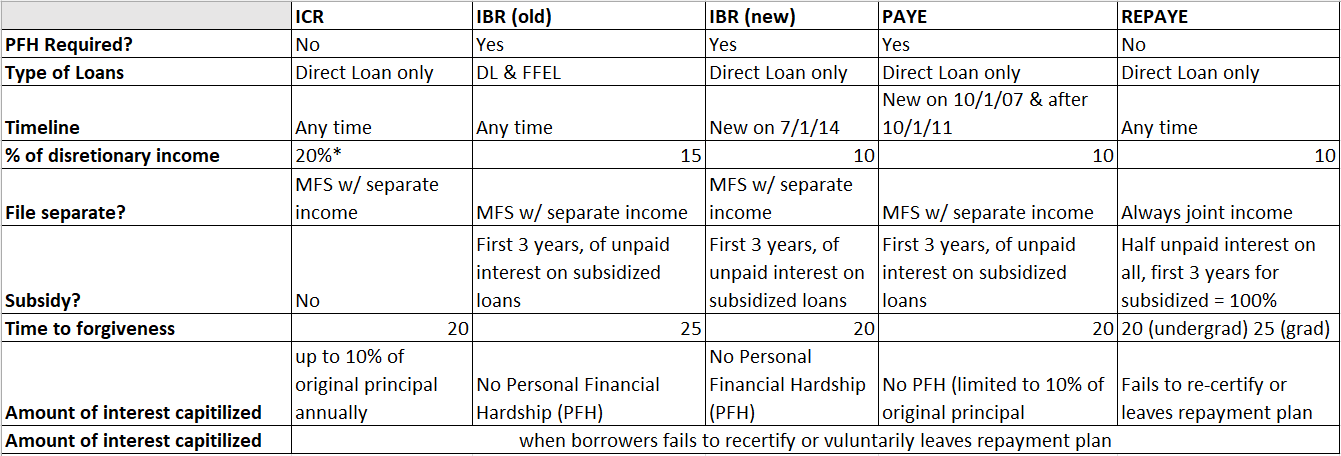

When looking to understand the different income driven repayment plans, I created a tool to help myself and those who I work with understand the loans at a high level:

How the income driven repayment plans are calculated is as follows:

Start with your Adjusted Gross Income

Subtract your AGI from the current year federal poverty amount based on your household size multiplied by your 150% (or 100% if on the income contingent repayment).

That amount is what is considered your discretionary income.

Take your discretionary income then multiply it by the percentage noted above based on the plan you choose.

Divide that by 12 and you have your monthly repayment amount.

There are some special considerations to allow for your monthly payment to be reduced further with the potential of filing taxes separately, contributions pre-tax to your retirement accounts, using capital losses, etc.

Note: while filing taxes separately may have the greatest impact on reducing your repayment amount, this requires some additional work/coordination and may cost you slightly more in taxes (which should be understood in the calculation of whether this makes sense).

But what if your repayment plan amount is more than you can afford?

I would consider exploring your repayment options (noted above). Then explore if you can reduce your AGI enough to make an IDR repayment plan fit into your budget.

Also, I would take a hard look at income and expenses. Not having a student loan payment for 3 years likely meant that this line item wasn’t considered as part of your budget.

If this is you, that’s OK, and I would just accept that there may have to be some sacrifices made to build this into your budget.

As a worst scenario option, you could request a general forbearance claiming financial difficulties but this will have to be approved by your loan servicer (& given loan payments have been on pause for 3 years, I’m uncertain of your odds of a successful outcome).

If you do not pay your loans within 90 days when they resume, your loans become delinquent & are reported to a credit bureau. If you do not pay your loans within 270 days, your loans go into default.

If your loans default, there’s quite a few consequences which include:

Having the entire balance of your loan and interest due immediately

You lose deferment or forbearance eligibility

Your credit score is tarnished

Your wages may be garnished

You may be taken to court

Full list HERE.

Safe to say, we want to avoid this at all costs.

I hate to say this, but I’ve had conversations with borrowers who ask about declaring bankruptcy & borrowers wondering if they can start clean.

Unless an undue hardship is proven, generally the answer is no.

Undue hardship is tested through a three-pronged Brunner test which is:

Debtor must show he cannot maintain a minimal standard of living for themselves or dependence if they are forced to repay their student loans.

Additional circumstances exist that are likely to persist (earnings will not increase, expenses cannot be reduced).

Debtor has made good faith efforts to repay the loans.

This is a tough path to go down & I’d hope borrowers are able to utilize a more favorable income driven repayment plan to get on the right footing.

If you were in default before March 2020, there’s a one-time opportunity to begin again through the U.S. Department of Education’s Fresh Start program.

On the bright side, the U.S Department of Education proposed regulations transforming the Revised Pay As You Earn (REPAYE) income-driven repayment plan (this may have sweeping impacts on your IDR plan borrowers).

The short & sweet of the changes to REPAYE are as follows:

Poverty line deduction of 225% verses 150%

Ability to file taxes separately (before payment was ALWAYS based on joint income even if you filed separate)

Lower the share of discretionary income that REPAYE formula would mandate be put towards monthly payments → undergrad loans would be 5% of discretionary income and graduate loans would be 10% of discretionary income (if you have both grad & undergrad, there would be a weighted average percentage of discretionary income calculated)

Provide shorter repayment period for those with low original loan balances ($12,000 or less)

You could switch income driven repayment plans without interest capitalization (note, this was mentioned only for when switching between IDR plans NOT when a borrower leaves IDR or fails to recertify)

If I could speculate…

I have low confidence that the $10,000 of student loans ($20k of PELL Grant) are going to pass into law.

There’s a number of lawsuits deeming this unconstitutional & I think the Biden administration settles with introducing this new IDR plan as a compromise to voters.

All this said, there’s a lot of potential change on the horizon for student loan plans and what this could mean for borrowers.

But it’s safe to say, repayments are getting ready to begin again so making sure you’re organized and prepared will save you time, money, and ensure peace of mind.