The Power of Narratives During Market Volatility

Volatile markets do not mean the market is broken or the world is ending.

Sharp price declines are a part of the markets (& should be expected).

But there’s a problem…

Each market correction feels different.

Many times, the narrative is scarier than the pullback itself.

Narratives do not change the facts, but they change our perception of the facts.

Nobel Prize Winner Robert Shiller in his 2017 paper, Narrative Economics explains how humans use both fact and emotion to justify ongoing action (whether true or not).

Narratives cause us to ignore probabilities and draw connections between our situation and what we hear.

Combine powerful narratives with your financial security and you have one hell of an emotional response.

So how do you deal with this?

Accept the power of narratives and choose your response.

Market volatility is inevitable yet feels predictable.

Hindsight bias makes us feel justified for our decision.

Warning signs are everywhere –

Interest rates are rising, inflation at its highest levels in 40 years, Russia-Ukraine war, supply chain issues, lingering pandemic, trade & political risks, the list goes on and on.

This feels like justification for your rationale to sell.

Our attraction to the impossibility of market timing increases when our portfolio falls.

We’ll just sell before the market drops further and buy back in before it recovers.

But that’s not how the market’s work.

Stock prices today reflect an investor’s expectations of a company's profit and risk in the future.

When you buy a stock, you’re buying ownership of expected future earnings of the business.

You pay a price for the rights to those future earnings based on how risky the business is.

When stock prices fall, this means expected future earnings have decreased.

This could be from company specific events such as lost revenue or new management.

Or

This could be from broad market events such as a global pandemic or rising interest rates.

Stock prices are constantly incorporating both unknown and known risk factors into company prices in an attempt to accurately reflect expectations of the company's future profits.

You reduce company specific risk through diversification, so you’re left with market risk.

To lose all your money in a globally diversified portfolio of 9,000+ stocks would mean that no one would expect any business to earn another $1 of profit in the future.

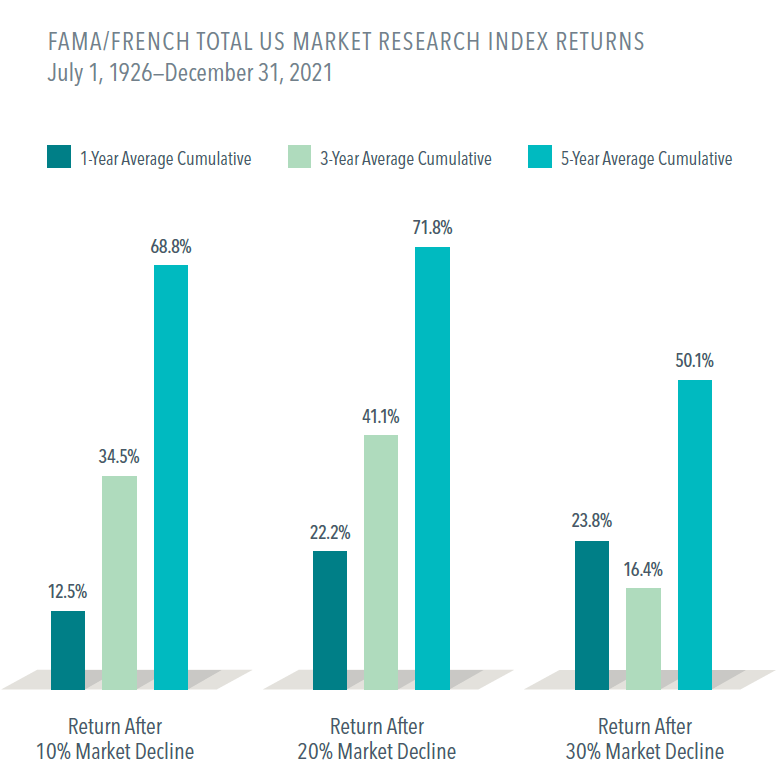

When stock prices decrease expected returns increase:

In the long-term market volatility is a blessing in disguise; we just don’t see that in the short-term.

Everyone wants risk until it doesn’t work in their favor.

But that’s not how risk works.

You don’t get the upside without the downside.

If you want market returns, you must accept risk.

Risk is the uncertainty of your expected return.

You cannot cheat your way to excess returns.

The higher return you desire, the more unknown you must be willing to accept.

The unknown is the variation in outcomes in any one given year.

As you increase your allocation to stocks you increase the variation in expected returns you receive (& level of volatility you must accept).

You decrease the variation in your return through increasing your allocation to bonds.

We’re long-term investors because the short-term results are unaccommodating.

No one has a crystal-ball.

If there were no volatility in investing, it would be hard to argue on why we expect to earn a higher return.

Volatility is the price you pay for higher returns.

In the words of Mike Tyson, “Everyone has a plan until they’re punched in the mouth”

During a market expansion, realizing your gains looks wise in the short-term but is foolish long-term.

Whereas:

During market contractions, holding your investments looks foolish in the short-term but is wise long-term.

It’s not easy to “do nothing” during volatility but it’s the right thing.

Success in equity investing depends on volatility.

Smooth rides are not where you make money. Treasury bills will not make you wealthy.

The future is endlessly unpredictable, but your response doesn’t have to be.

Compounding works best uninterrupted.

Own the market.

Remember your why.

& move on with your life.