The cost (& power) of leverage

Leverage allows you to earn 200-300% in excess returns through investing.

Is this finally the cheat code we’ve been waiting for?

Just as physical leverage allows you to lift an object with less effort, financial leverage allows you to increase return with less capital.

Leverage comes in the form of options, borrowing on margin, futures contracts, and leveraged investment products.

Leverage in practice looks like this:

You have $5,000 to invest and you borrow $5,000 from the bank to invest.

Your $10,000 total investment earns 20% so you have $12,000 in total.

After you pay back your $5,000 loan to the bank you have $7,000.

Ignoring the bank's interest expense, this is $1,000 more you would have if you just invested $5,000 without borrowed money.

Leveraged return = 40%

Non-leveraged return = 20%

Sounds great, right?

Using leverage converts short-term volatility into long-term risk.

Risk multiplied = leverage

The popular adage goes something like this:

“I’m a long-term investor. Volatility doesn’t matter to my portfolio.”

Seems reasonable.

It’s easy to look at the reward and act. It’s hard to look at the consequences and question.

Why would you not want to use leverage to increase your total return as a long-term investor?

While leverage offers the potential for increased total return, it comes with two costs:

Reduced long-term compounded growth rate on your portfolio; this is called volatility decay.

Risk of losing 100% of your investment; this is called tail-risk

Consider volatility decay in action:

Say you have $100 that earns 15% for two consecutive years or an investment that earns 29% then 1%.

Total return in both examples is 30%.

Example 1:

Year 1: $100 *1.15 = $115

Year 2: $115 * 1.15 = $132.25

Example 2:

Year 1: $100 * 1.29 = $129

Year 2: $129 * 1.01 = $130.29

The difference of $1.96 is the price you pay for increased volatility.

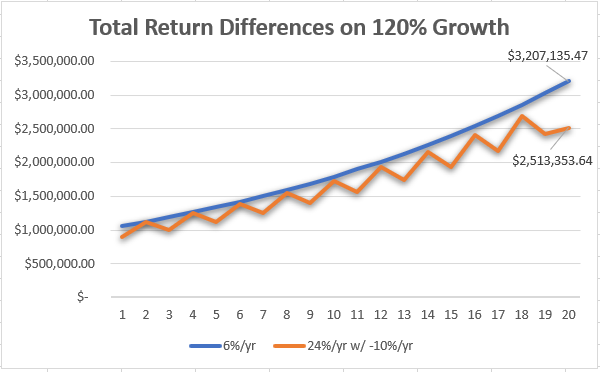

$1.96 today doesn’t seem like much but if we extend both our time horizon to 20 years and our initial starting value to $1,000,000, the impact is magnified.

Volatility decay costs you $693,781.83.

A smoother ride offers higher long-term compounded rates of return.

While volatility is the price you pay for higher returns; unnecessary volatility erodes returns.

Conceptually, this is harder to imagine as 120% is 120% no matter how you look at it.

Not quite.

How you receive those returns matters.

If you had 100 oranges, then ate 10, then gained 10, you still have 100 oranges.

This is an absolute.

But percentages are relative - not absolute.

If you have $1,000 and you earn -10% followed by +10% you end up with $990.

You would need a 11.11% return to get back up to your original $1,000.

If you use a 2x leveraged investment and you earn -20% followed by a +20% you end up with $960.

You would need a 25% return to get back to your original $1,000.

Or -3.89% in excess loss.

You risk greater loss than you do financial gain.

Leveraged funds exhibit a negative return bias.

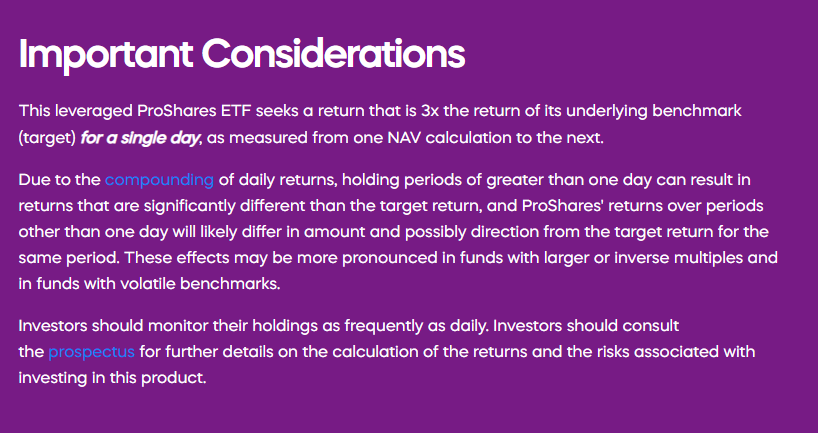

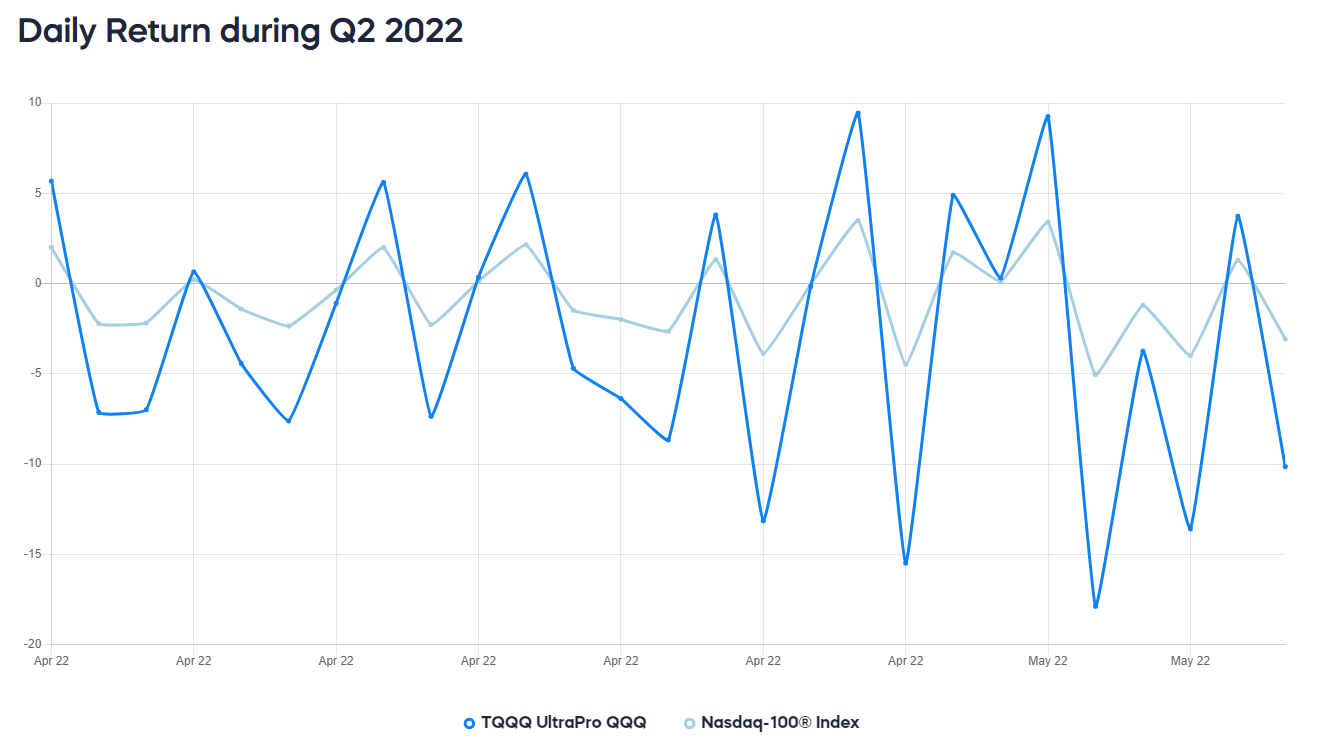

Take TQQQ, a leveraged ETF that looks to provide 3x the return of the NASDAQ 100 for a single day.

The fund resets its leverage each day.

This is important because real wealth comes from compounding.

With leverage being reset daily, a leveraged investor may not expect the full amplification of returns through compounding.

Leverage funds exhibit tail risk.

Or

Total loss of investment capital.

If you own a 3x leveraged ETF and the market falls -33%, you lose 100% of your investment

If you own a 2x leveraged ETF and the market falls -50%, you lose 100% of your investment.

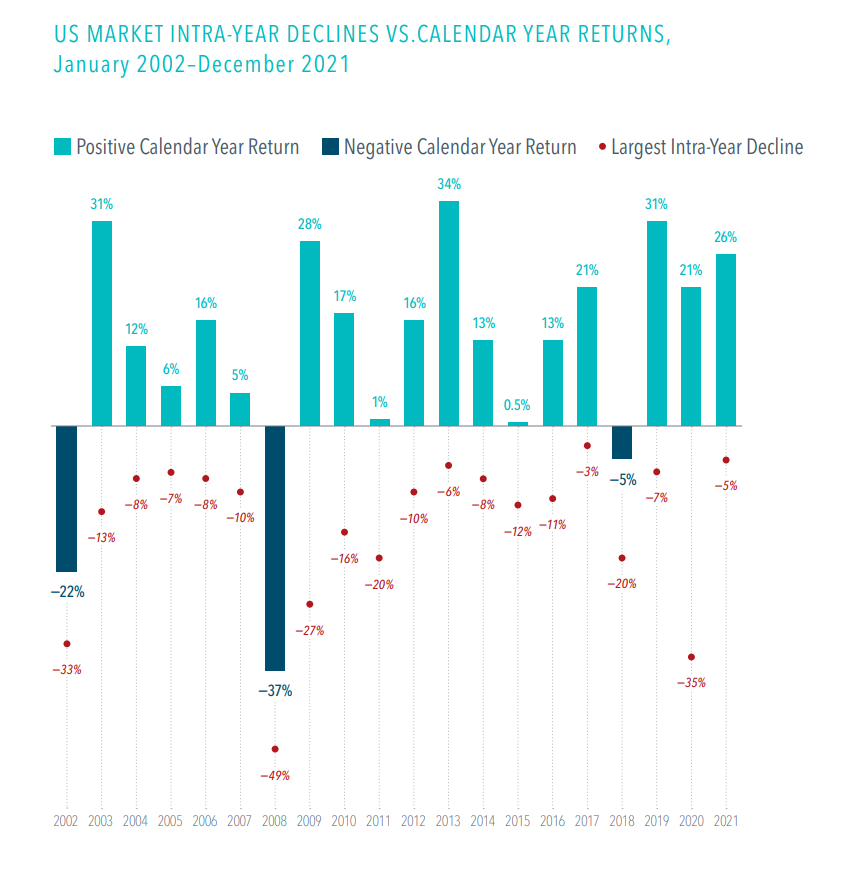

Looking at intra-year volatility over the last 20 years we see the following:

Owning a 2x leveraged fund you would lose 100% of your investment once.

Owning a 3x leveraged fund you would lose 100% of your investment three times.

The last risk to consider is higher investment costs.

TQQQ, as mentioned above, has an expense ratio of 0.95% compared to Invesco’s QQQ with an expense ratio of .20% or 79% cheaper.

We highly underestimate the impact of psychology on the financial decisions we make.

Risk takes on a whole new meaning when you’ve spent 20+ years saving your money.

The risk of a 30% pullback that results in a $60,000 loss on a $200,000 portfolio versus a $600,000 loss on a $2,000,000 portfolio while are fundamentally the same, feels different.

While leverage offers the potential for increased return, it increases risk.

Would you rather have 100% certainty of $4,000,000 in retirement or 50% chance of $8,000,000 (with 50% chance of $2,000,000).

Invest with a margin of safety.