Should you invest in dividend stocks?

Want to make more money in the stock market?

Stop solely focusing on holding dividend stocks.

Holding dividend stocks is a misguided investment strategy. Income generating stocks should not be treated as a factor in determining which stock you should own.

There’s a growing emergence of dividend loving investors. People who buy stocks solely for their income producing characteristics.

But there’s one misunderstood flaw in this idea:

Investors should be indifferent between a $1 dividend (which causes the stock price to drop by $1) vs. receiving $1 by selling some shares.

This comes from Economic Nobel Prize winner Merton Miller and Franco Modigliani in their Journal of Business paper Dividend Policy, Growth, and the Valuation of Shares.

Let me explain.

If you have two companies that are identical, same earnings and same business.

Company 1 is trading at $100/share and uses their $10 in earnings to issue a dividend. This reduces the stock price to $90.

Company 2 is trading at $100/share and uses their $10 earnings to invest back into the business (company price is unaffected).

If you need $10 in income, you have two options:

Option 1: Company 1 pays you a dividend for $10.

Option 2: You sell a 1/10 of your position in Company 2 to generate $10 in income. Reducing your position to $90 in remaining shares.

In both examples, whether you receive a dividend or sell some shares the outcome is the same.

So, if you’re indifferent between owning a stock that pays a dividend versus a stock that does not pay a dividend, why do investors still own dividend paying stocks?

Psychologically, owning dividend paying stocks offers a few benefits.

Dividend stocks naturally apply constraints. If you’re only spending the income generated from your investments, then you never touch the principle.

But there’s a few issues with this rule of thumb.

Dividends are not guaranteed - they’re discretionary.

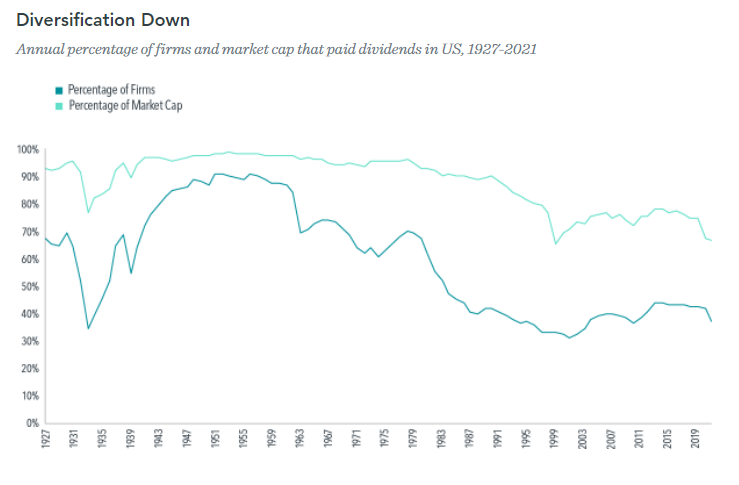

In 1927, 68% of companies paid a dividend.

Today, that percentage is closer to 38%.

When do you rely on income the most? In uncertainty.

During the 2020 COVID market, 22% of companies cut or eliminated their dividends during the pandemic.

Does an equity strategy focusing on stocks with above-average dividend yield offer an appealing risk/reward tradeoff? Have dividend-paying stocks outperformed non-dividend payers in the U.S.?

Here’s what Nobel Prize winner Eugene Fama has to say:

“Ranking stocks on dividend yield is just another way to separate value stocks from growth stocks using the ratio of a fundamental to price. We prefer to use other fundamentals, like book value or cashflow, in the numerator of the price ratio, for a simple reason: roughly 80% of all listed U.S. stocks and almost all small firms do not pay dividends.

Dividends were more common in the past, and like sorts of stocks on book-to-market equity or cashflow to price, sorts on dividend yield do identify a value premium (higher average returns for higher dividend yields) in international markets as well as the U.S. (Fama and French 1993, 1998). Sorts on book-to-market equity or cashflow to price seem to do a better job identifying value premiums, possibly because dividends are subject to more managerial discretion than other fundamentals.”

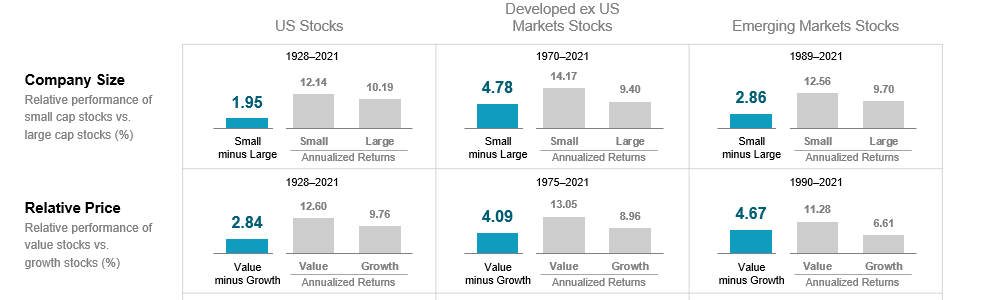

By tilting towards a portfolio that has a bias for companies that issue dividends you suffer three consequences:

Reduced total diversification

Reduced small cap exposure

Reduced value premium

While dividends are an important component of a stock's total return. Dividends, or the growth of dividends, is not a signal of being a good stock to own.

Sell-off method > Dividends

But don’t take it from me, take it from Warren Buffett in his 2012 Shareholder Letter (page 20-21) who sheds some light on this approach:

If your goal is to receive the highest rates of return possible, a sell-off approach is superior.

Investing is not about what you earn, it’s about what you keep.

So what about taxes?

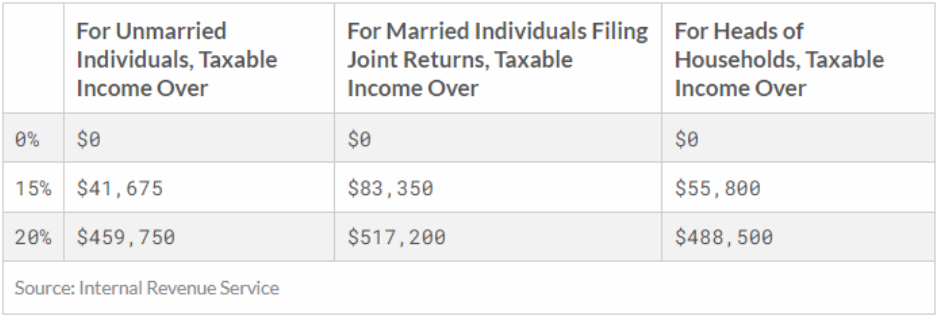

Dividends can be taxed at ordinary or qualified rates.

Ordinary dividend = your marginal income tax rate

Qualified dividend = your capital gain tax rate

The rules for qualified dividends are as follows:

The dividend is paid by a U.S. corporation (located in the U.S.) or a foreign corporation listed on a major U.S. stock exchange.

AND

You have owned the stock paying the dividend for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date (day the stock starts trading post dividend paid)

Qualified dividends are taxed at capital gains tax rates:

When you own dividend stock(s) you’re taxed each time a dividend is paid whether you need the income or not (yes, you’re still taxed if the dividend is reinvested).

When you use a sell-off method, you only incur a tax consequence when you sell.

If you own a globally diversified portfolio of stocks, will there be dividends paid?

Yes.

Do you own a globally diversified portfolio of stocks for its dividends?

No.

While I don’t have a vendetta against dividend stocks (I think dividends are great), I do think it’s an error to have a bias for dividend paying stocks.

But truth be told:

The best investment strategy is the one that you can stick to.

If owning dividend stocks means you can stay in the market - awesome.

Then own dividend paying stocks.

But I wouldn’t hold your breath thinking these stocks will outperform the broader market over time.