What Do Rising Interest Rates Mean for the Economic Machine?

Spending, borrowing, credit, rising/lower interest rates are a part of the economic machine. Knowing how this machine works is the difference between disciplined action over emotional reaction.

“Charlie and I have seen - we’re not remotely perfect at this - but we’ve seen patterns. Patterns get very important in evaluating humans and businesses. And the pattern recognition isn’t 100 percent and none of the patterns exactly repeat themselves, but there are certain things in business and securities we’ve seen over and over.”

One pattern in financial markets is rising interest rates.

Interest rates being at historic lows makes borrowing money cheap.

Borrowing cost is determined largely by interest rates.

Total borrowing costs = principal + interest.

Low interest rates = cheap borrowing.

High interest rates = expensive borrowing.

When borrowing is cheap, it incentivizes growth because it increases spending which drives the economy.

When you borrow, you borrow on credit (or a promise to pay in the future). Borrowing brings forward your future spending to the present. In doing so, you’re increasing spending today to decrease spending in the future.

Credit creates cycles.

When the U.S. Economy expands through easy access to credit, the prices of goods and services rise.

This is also known as inflation.

Inflation is concerning because it erodes the purchasing power of $1.

Some inflation is good, as it promotes growth in the economy.

The Federal Reserve (the bank of banks) doesn’t want too much inflation because it causes problems (lower growth, instability, higher uncertainty, lower real wages, and decreasing international competitiveness) so they increase interest rates.

Rising rates disincentivize borrowing for three reasons.

Borrowing becomes more expensive: which makes you and I not want to make out loans to spend today.

Higher interest rates = more savings: This incentivizes us putting money in the bank to earn interest.

Higher cost on existing debt: Adjustable-rate loans, credit cards, and student loans see higher interest expenses associated with their debt.

Higher borrowing costs, high savings rates, and higher cost of existing debts slows down the economy through reduced spending.

When people spend less, prices fall.

This falls in line with supply and demand:

High demand + low supply = price increase (inflationary)

Low demand + high supply = prices fall (deflationary)

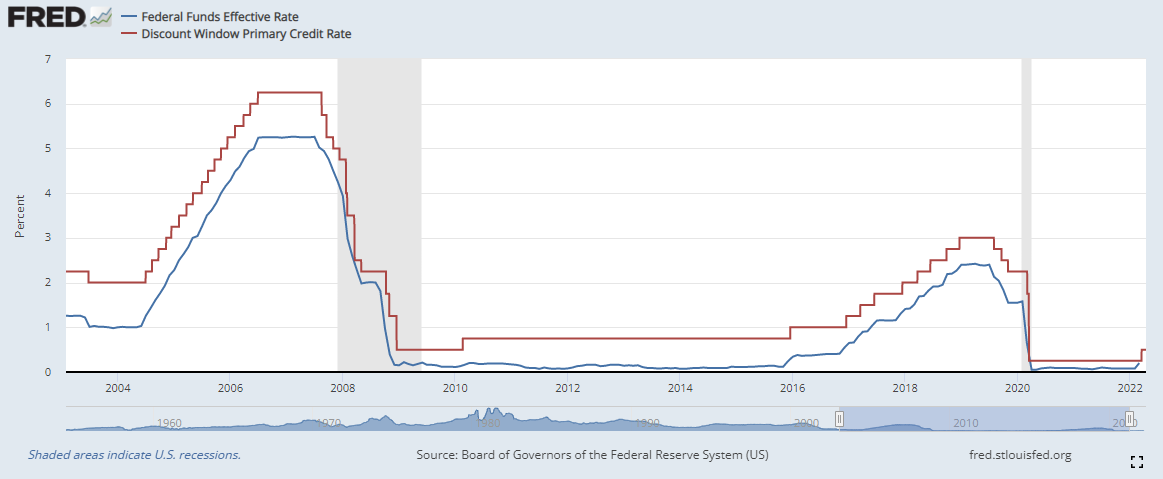

Economic growth falling leads to a recession, in which case, the federal reserve lowers interest rates to stimulate the economy again.

This is the balancing act required of the Federal Reserve.

The Federal Reserve strives to maintain inflation around 2% per year. Currently, inflation (measured by the consumer price index) is 8.7% as of March of 2022.

On March 16, 2022, for the first time in 4 years, the Federal Reserve increased interest rates.

You may think this is as simple as raising rates and inflation goes away.

It’s not.

Rising rates too quickly will cause a sharp contraction in spending, asset prices falling, and results in a recession.

Rising rates is like building a home. You must first lay down the foundation, complete rough framing, then the plumbing, and insulation first before you start adding in the kitchen stove, TVs, and refrigerator. This process takes time. Raising rates are no different.

To understand the implications of rising rates, it’s helpful to know how the Federal Reserve Bank actually raises rates to understand what this may mean for us.

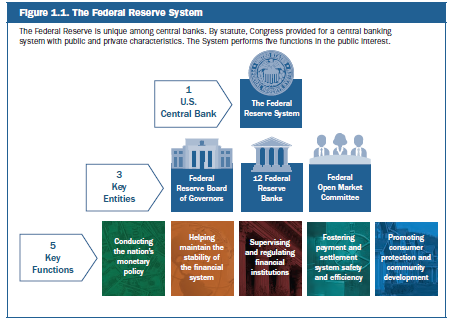

The Federal Reserve’s serves 5 key functions:

Conducting the nation's monetary policy (maintain maximum employment & stable prices)

Helping maintain the stability of the financial system

Supervising and regulating financial institutions

Fostering payments and settlement system safety and efficiency

Promoting consumer protection and community development

A breakdown of the Federal Reserve system is below:

The Federal Reserve was created by the Federal Reserve Act signed into law by President Woodrow Wilson in 1913 as a result of the Panic of 1907 (50% stock market crash combined with a run on the banks) which convinced Americans of the need for a Central Bank.

The Federal Reserve is headed by seven Board of Governors who guide all aspects of the operation of the Federal Reserve System (& its 5 key functions).

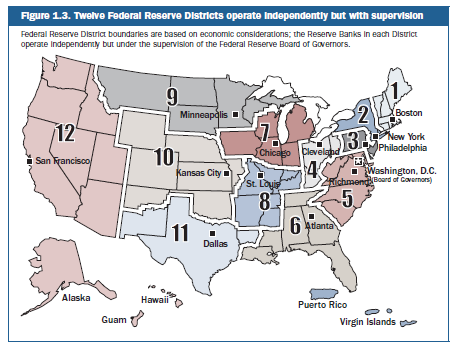

The 12 Federal Reserve Banks operate independently of each other so they can consider economic considerations of their district. While they operate independently, they are still under the supervision of the Federal Reserve Board of Governors.

The Federal Open Market Committee (FOMC) sets the national monetary policy & consists of 12 voting members, 7 Board of Governors; the president of the Federal Reserve Bank of New York; and 4 of the remaining 11 Reserve Bank presidents who serve one-year terms on a rotating basis.

Monetary policy from the Federal Reserve comes in a variety of forms:

Open Market Operations

Discount Window & Discount Rate

Reserve Requirements

Interest of Reserve Balances

Overnight Reverse Repurchase Agreement Facility

Term Deposit Facility

Central Bank Liquidity Swaps

Foreign and International Monetary Authorities (FIMA) Reop Facility

Standing Overnight Repurchase Agreement Facility

While these are all tools used by the Federal Reserve, their primary tool is increasing the Federal Funds Rate which is achieved through Open Market Operations where the Federal Reserve enters the bond market to buy and sell securities to target a specific Federal Funds Rate.

There are two types of Open Market Operations:

Expansionary Open Market Operations: Used to stimulate the economy. Federal Reserve purchases short-term securities = increasing money supply and lowering federal funds rates.

Contractionary Open Market Operations: Used to slow the economy. Federal Reserve sells short-term securities = decreasing money supply and increasing federal funds rate.

This is important because all other interest rates are built off the Federal Funds Rate.

As short-term securities are purchased from banks or sold from the Federal Reserve through Open Market Operations, the money supply is impacted.

More money (expansionary) = more lending = more economic growth

Less money (contractionary) = less lending = less economic growth

As banks do business, they can lend out more money than they have in deposits. This creates a shortage of cash. Banks are required to keep a certain number of deposits “in reserve” set by the Federal Reserve. If they lent more money out than they have in deposits, then they must borrow money overnight.

Banks lend from other banks at the Federal Funds Rate.

The fuel for Open Market Operations to increase interest rates starts with overnight lending.

If the Federal Funds Rate increases, banks must increase rates charged to consumers to remain profitable.

This creates a rippling effect through the economy and can take months before this rate increase has a meaningful impact on consumer behavior and prices.

When bank reserves dry up from an overheating economy, banks can borrow from the Federal Reserve at the Discount Rate as a last resort option.

As the Federal Reserve signals to raise rates, this starts a chain of events in the background.

This raises the question:

What does rising rates mean for you?

Economic Slowdown

Prices begin to stabilize, and inflation begins to fall and normalize.

Higher borrowing costs

Car loans, credit cards, student loans, 401k loans, corporate debt all get more expensive as rates increase.

Reduced stock prices

Stocks = the present value of a company's expected future cash flows. As interest rates rise, that discount factor increases, reducing stock valuations (rising rates → borrowing is more expensive → growth becomes more expensive (& consumers spend less) → company profitability falls → stock prices decrease)

Higher bond yields

In the short term, existing bonds are discounted in price (bond prices fall, otherwise, no one would buy them).

In the long term, bond holders receive higher rates of return because yields are higher (Bond paying 5% > bond paying 3%).

Saving account rates increase

Incentivizing consumers to save over borrow

House prices will stabilize

From less demand due to higher interest rates

Rising rates means additional volatility as buyers and sellers transact in the market. But we have survived this before. This isn’t abnormal - this is how the economic machine works. This is a part of the cycle.

Investing is a long-term game.

Stay disciplined & stay committed to your plan.