The Problem with Public Service Loan Forgiveness (& the solution)

Student loan debt is a problem. But not for the reason you might think.

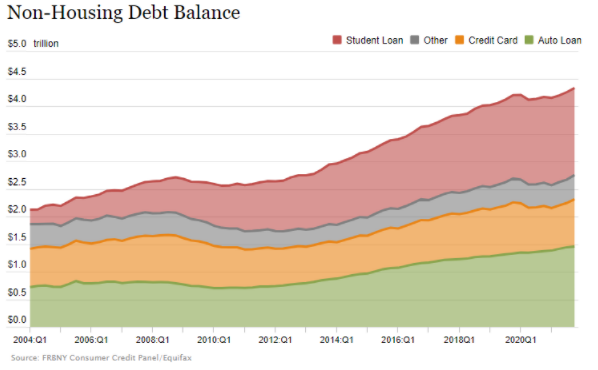

In 2022, student loan debt is the fastest growing consumer debt surmounting to over $1.75 trillion. Many are delaying getting married, buying a home, or saving for retirement due to the mounting student loan debt.

The number of Americans over age 60 with student loan debt has doubled in the last decade.

Tuition is outpacing the median income and many borrowers believe forgiveness will save them. While this is an option for many - few receive this benefit.

In fact, 98% of applications for forgiveness through Public Service Loan Forgiveness (PSLF) were denied.

The problem isn’t the student loan debt, rather, it’s the lack of proper education regarding the repayment of the debt.

The government does a great job of lending students (with no credit history) tens of thousands of dollars in student loan debt.

Where they fall short is in the education regarding the repayment of these obligations.

When I was in college, I was a peer-to-peer counselor for the University of Delaware educating borrowers on their repayment options. This role revealed how unprepared borrowers were.

As you consider getting ahead of the curve on your debt, Public Service Loan Forgiveness (PSLF) is a popular option to consider.

To qualify, you need to be on the right plan, with the right kind of payments, and the right kind of job:

PSLF applies only to federal direct loans (private loans are separate)

Make 120 qualifying payments (on time)

Be on an income driven repayment plan

Work in public sector or qualifying nonprofit

Work 30 hours (considered “full time” - however your employer describes that)

Let’s break this down.

The Right Kind of Loan

When people talk about student loans, they’re usually referring to three different things without realizing it.

There are money undergraduates borrow from the federal government (Direct loans). Money from private institutions like Sallie Mae, a bank, or a credit union (private loans). Finally, money parents borrow (PLUS loans).

Over 90% of student debt is through the government and less than 10% is private.

To be eligible for direct loans, borrowers file the free application for financial student aid (FAFSA) then their expected family contribution (EFC) is calculated which the government then uses to determine who receives subsidized versus unsubsidized loans.

Subsidized = government pays the interest payments while you are enrolled in school.

Unsubsidized = You’re responsible for the interest payments while you are enrolled in school.

As you’d imagine the government uses your EFC to determine which loans you receive.

Lower ability to pay for school = greater aid offered (in the form of grants or subsidized loans) & vice versa.

For federal loans many undergraduate borrowers who started school after 2010, you likely have a mix of direct subsidized & unsubsidized loans.

For graduate or parent borrowers, you likely have PLUS loans.

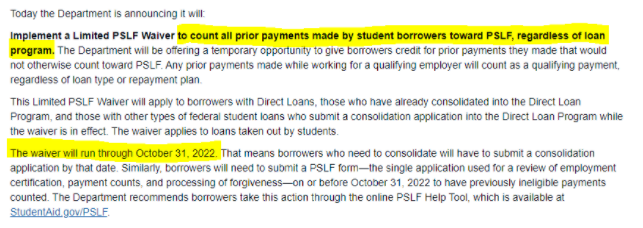

Graduated prior to 2010? You may have Perkins loans, Federal Family Education Loans (FFEL). These loans previously were not eligible for PSLF because they’re not considered Direct loans (you’d have to consolidate them to be eligible).

Note: In October of 2021 there was PSLF overhaul which offers a limited period where borrowers with these loans may reconsolidate to direct loans to qualify that debt for PSLF & have their payments on these plans count towards PSLF (even though they weren’t on the right repayment plan or had the right loans):

Read the full press release from the U.S. Department of Education - HERE.

To determine if you have direct loans visit Home | Federal Student Aid loan in using your Federal Student Aid ID (FSA ID). When you log into, on the summary page, it should list your Federal loans. The type of loan named should be Direct.

The Right Kind of Job

Common jobs for those who are eligible to qualify for PSLF are public health (nurse, doctors, and professionals engaged in Health care practitioner occupations & health care support), public education, social work, law enforcement, Military, government, & 501(c)(3) tax exempt organizations.

But here’s the catch –

You & your employer should confirm your employment qualifies though getting the Employment Certification for Public Service Loan Forgiveness form approved. While technically, this isn’t a requirement, there is too much on the line to leave your forgiveness up to uncertainty.

The Right Kind of Repayment Plan

An income driven repayment (IDR) plan is what qualifies you for PSLF.

There’s 5 types of income driven repayment plans. They are as follows:

Pay As you Earn (PAYE)

To qualify you must prove a Financial Hardship, meaning your repayment amount via PAYE is less than the standard 10-year repayment option.

“New” borrowers on 10/1/07 & must have borrowed after 10/1/11

Repayment based on 10% of your discretionary income.

Max repayment length before debt is forgiven = 20 years

Revised Pay As you Earn (REPAYE)

No need for proof of Financial Hardship

May have loans from any time

Repayment based on 10% of your discretionary income.

Max repayment length before debt is forgiven = 20-25 years

Old Income-Based Repayment (IBR)

Loans taken out before 7/14/14

To qualify you must prove a Financial Hardship, meaning your repayment amount via IBR is less than the standard 10-year repayment option.

Repayment based on 15% of discretionary income

Max repayment length before debt is forgiven = 25 years

New Income-Based Repayment (IBR)

New borrower on or after 7/1/14

To qualify you must prove a Financial Hardship, meaning your repayment amount via IBR is less than the standard 10-year repayment option.

Max repayment length before debt is forgiven = 25 years

Income Contingent Repayment (ICR)

No need for proof of Financial Hardship

Mainly only used with PLUS loans.

Max repayment length before debt is forgiven = 25 years

Note: For those not eligible for PSLF via job requirement, etc. You are still eligible to have your loans forgiven after 20-25 years via an income driven repayment plan option. Your ending balance forgiven is taxable as ordinary income in the year the debt is forgiven.

PSLF Repayment Example

Income driven repayment plans are unique in that repayment is driven by income, not a traditional amortization schedule (like standard, extended, & graduated debt repayment options).

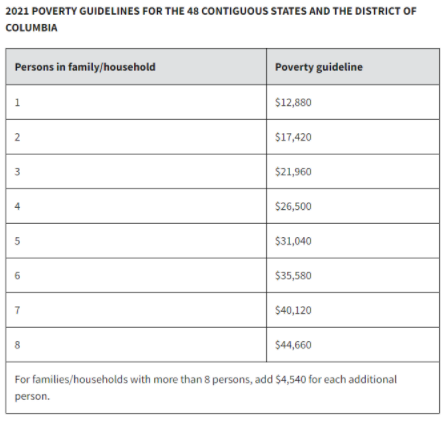

Repayment amounts under income driven repayment plans are tied to “discretionary” income. This is defined as your adjusted gross income (AGI) subtracted by 150% of the federal poverty guidelines for the borrower's size.

Let’s consider an example of a young single teacher making $43,715 of adjusted gross income (line 7 of your 1040). Who has $73,449 in student loan debt.

Discretionary income = $43,715 - ($12,880*1.5) = $24,395

Factors impacting discretionary income include marital status, your income, spouses income, and total debt burden.

Repayment plan options:

Old Income Driven Repayment: $305/mo (($24,395 * .15) / 12)

REPAYE: $203/mo (($24,395 * .10) / 12)

10-year Standard Repayment option: $853/mo

Note: He qualifies for income driven repayment via Financial Hardship because the IBR plan repayment amount is < 10-year repayment plan repayment amount.

In this example, over the course of the 120 qualified payments (10 years) you have the potential for over $114,000 in loan debt forgiven.

One question you may have is how is the amount of debt forgiven GREATER than the amount the borrower originally borrowed?

The answer is negative amortization.

Repayment is a combination of repayment of principal and interest.

Given your income-based repayment plan repayment schedule is based on income (& it’s not fixed like an auto loan or a mortgage) this creates the opportunity for a situation where your monthly payment is so low that it doesn’t pay off any principal at all! It actually doesn’t even cover the amount of interest due!

This results in your payment growing instead of declining – negative amortization.

Don’t be alarmed as this is completely normal when on an income driven repayment plan and in this example not only helps this borrower reduce the monthly repayment amount but also offers the entire balance to be forgiven.

Crazy!

One major advantage of PSLF compared to a long-term IDR plan is the amount of student loan debt that is forgiven is non-taxable whereas LT IDR plan debt forgiveness is taxable as income in the year debt is forgiven.

Nothing about negative amortization is comfortable but having some (or all) of your student loan debt forgiven is a relief.

While we wish colleges didn’t charge astronomically high rates for a college degree - that’s out of our control. What is in our control is how we respond to the debt that we take on.

Don’t settle for standard repayment for your federal loans. Forgiveness could be an option for you.

Are you leaving loan forgiveness on the table?