The Tax Arbitrage Game

With little effort you can enhance flexibility with your savings to reduce lifetime taxes paid and increase your net worth.

In personal financial planning, this game is called The Tax Arbitrage Game.

The game works a little like this –

The objective of the game is to place your annual savings in the appropriate investments in the right investment accounts that will maximize gains and minimize tax over your lifetime.

But there’s a kicker.

You must optimize your savings between three accounts each offering unique competitive advantages challenged by unknown future income needs, growth expectations, and tax changes.

This makes the game results variable (& so fun!). Giving the person who knows the board the best the greatest odds of victory.

How can you increase your odds of winning? I’m so glad you asked.

There are three key factors to this game. The taxation of each account, investment growth rate assumptions, and projected tax rates.

Let’s dive in!

Investment Account Tax Classification

Your three accounts each offer different tax statuses – taxable, pre-tax, and post-tax.

Details of contribution limits, taxation entering the vehicle, during, and after withdrawal, and accounts available are noted below.

Taxable Brokerage accounts:

Contributions to Account: made with after tax dollars.

During Year: Interest and dividends generated from the stocks and bonds in the account are taxed to you in the year income is generated. (Hence, taxable account)

Ex: $50,000 in stocks & $50,000 in bonds.

Stock dividends either have qualified or nonqualified dividends.

Qualified dividends are taxed at more favorable capital gains rates.

Qualified dividends rules are as follows:

Paid by a U.S. company or qualified foreign company

Held the stock for more than 60 days during the 121-day period that beings 60 days before the ex-dividend date (ex-dividend date is the first date following the declaration of a dividend).

Unqualified dividends are taxed as ordinary income

Bond interest is taxed as ordinary income

Dividend yield = 1.2% and the dividends are qualified.

Bond yield = 1.5%

Total tax due: $270/yr (24% interest tax rate assumption & 15% capital gains rate)

Contribution limits: None.

Upon Withdrawal: Tax due upon sale of securities.

Holding period > 1 year = capital gains rates

Holding period < 1 year = ordinary income rates

Capital gains are split between three rates which vary depending on income:

Income Bracket 0-12% = 0% Capital Gains Rates

Income Bracket 22-35% = 15% Capital Gains Rates

Income Bracket 37% = 20% Capital Gains Rates

Traditional Qualified Accounts:

Contributions to Account: Pre-tax dollars (meaning you receive a tax deduction for your contributions to these accounts).

During Year: No tax due. Interest, dividends, and capital gains tax are deferred until you pull money out of the account.

Contribution limits: Depends on the account. See below for a few examples:

401k/403b/TSP: employee = $20,500 (over age 50 +$6,500). Overall limit is $59k max employee + employer ($65,500 with catch up)

Traditional IRA: $6,000 (over age 50 +1,000)

Employee Stock Option Plan: pre-discounted $25,000 per calendar year

SIMPLE IRA: employee $14,000 (over age 50 +3,000).

SEP IRA: $58,000 (employer contributions only based on up to 25% of compensation)

Tax Due: Ordinary income upon withdrawal from the account. The account grows tax-deferred, meaning no interest, dividends, and capital gains are taxed each year (unlike your brokerage account). Then your withdrawals are taxed as ordinary income (given you meet withdrawal rules - biggest hurdle is age > 59.5).

Roth Qualified Accounts:

Contributions to Account: Post-tax dollars (meaning tax is paid upfront for your contributions to these accounts).

During Year: Interest, dividends, and capital gains tax are deferred indefinitely as there is no tax due upon qualified withdrawal.

Contribution limits: Depends on the account. See below for a few examples:

Roth 401k/403b/TSP/457: employee: $20,500 (over age 50 +$6,500 & $58k max employee + employer)

Roth IRA: $6,000 (over age 50 +1,000)

Tax Due: Money invested into a Roth account is taxed as ordinary income in the year you make the contribution. The account grows tax-deferred, meaning no interest, dividends, and capital gains are taxed each year (unlike your brokerage account). Then your withdrawals are tax-free (given you meet withdrawal rules - biggest hurdle is age > 59.5).

Investment Growth Rates

Tax efficiency is overlooked.

By simply placing more efficient assets in taxable accounts and less efficient assets in tax-deferred accounts you receive higher after-tax rates of return.

Paying attention to investment tax efficiency is one tool to get ahead.

Most Tax Efficient:

Stock Index Funds (S&P 500, MSCI EAFE, Russell 2000, etc.)

Municipal Bonds

I/EE savings Bonds

Tax Efficient:

Cash

Government bonds

Least Tax Efficient:

High-Yield bonds

Real Estate Investment Trusts (REITs)

High turnover mutual funds (actively managed funds)

The income (interest and dividends) or capital gains (from the sale of securities) impacts your after-tax rate of return.

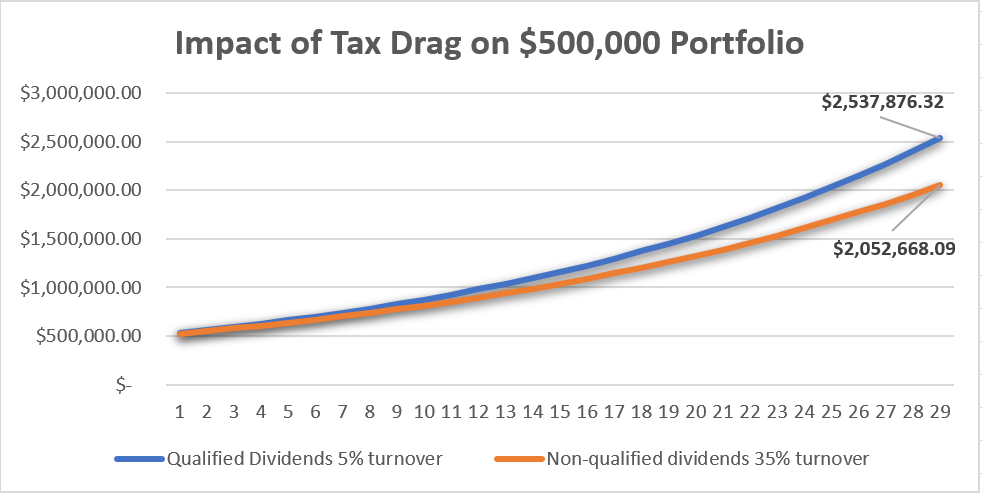

This is called tax drag.

See below:

Over a 30-year period, a tax inefficient brokerage account could cost you nearly $500,000.

Projected Tax Rates

How much and when you pay tax on your savings matters greatly.

While we cannot control what the government does to change marginal tax rates, we can control when we want to pay tax on our savings:

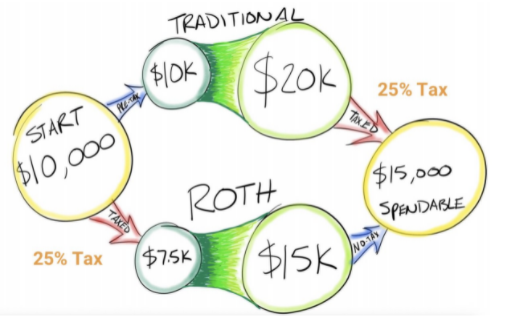

The main way we do this is through making pre-tax (traditional) or post-tax (Roth) contributions.

Timing matters here.

If you pay the same tax rate and the investments grow at the same rate, you’re indifferent between a Roth or Traditional IRA.

For many, income varies through time. With that, so does your tax bracket.

This variation in income can be used as a tax saving opportunity.

The real gain between traditional or Roth is achieving tax arbitrage.

Taking income out at a higher tax rate than what you paid (Roth).

Or —

Taking income out at a lower tax rate than what you deferred (traditional).

If you make Roth contributions at a 12% tax bracket and pull it out later when you’re in the 24% tax bracket you just saved 12% in taxes.

Vice versa:

If you make traditional contributions at 24% and pull it out later when you’re in the 24% bracket, you just saved 12% in taxes.

Always making pre-tax contributions to pay the lowest tax rate possible assures you overpaid in lifetime taxes.

Summarized Factors for Victory

Tax deferred > Taxable but don’t neglect the flexibility of your taxable account

I utilize 80% of my total savings in tax-deferred accounts with the remaining 20% inside my taxable account. Having income flexibility in the future and a more tax-efficient safety net after my emergency fund before I have to tap into my retirement accounts is valuable.

Let your income determine pre-tax or post-tax contributions

Low income relative to future income = Roth (post-tax)

High income relative to future income = Traditional (pre-tax)

Think of your portfolio holistically - not per account.

Place inefficient investments into tax-deferred accounts and efficient investments into your taxable account.

Morningstar researcher David Blanchett in his October 2017 paper The Value of a Gamma-Efficient Portfolio coined the benefits of asset location to be ~0.50%/yr.

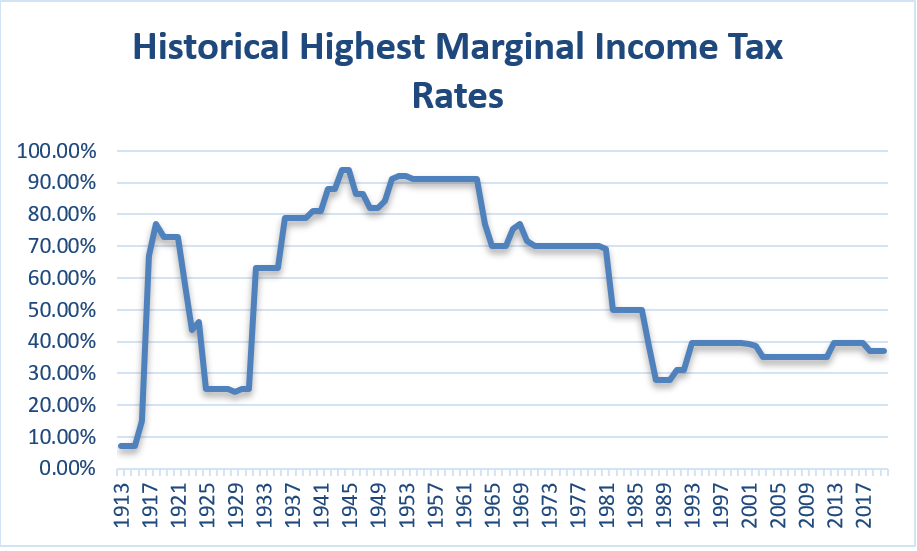

Pay attention to tax legislation

Tax brackets have and will continue to change - knowing how you’re taxed and how that may change over time can help influence your decision on when to accelerate or defer income based on projected future tax changes.

A little effort goes a long way. Strategically placing your savings in the right accounts increases your surface area of financial freedom.

This isn’t about fast growth, rather, the premium of compounded returns through disciplined and consistent savings through time.

Constant improvement is the seed of growth.

Are you paying more tax than you should?