Ultimate Quick Start Guide to Social Security

After paying into the social security administration your whole life - you may wonder, how your benefit is calculated, when to start social security, and how much of your social security is taxable.

Social Security is derived from your 15.3% Federal Insurance Contributions Act (FICA) tax. You and your employer split this bill, you will pay 7.65% and they pay 7.65%.

6.2% of this is for social security and is withheld up to $147,000 in 2022 wages (then not taxed further after reaching this threshold).

1.45% is Medicare tax withheld on 100% of your wages (there is even an additional 0.9% additional Medicare tax that kicks in at $200,000 for single filers and $250,000 for married joint tax filers).

Considering taxation if you’re married making $260,000 in 2022:

$147,000 taxed at 6.2%

$260,000 taxed at 1.45%

$10,000 taxed at 0.9% (additional medicare tax noted above)

Your social security statement will show your earnings history. If you’re beginning to question what your benefit amount will be, it would be wise to create your account and see this information at www.ssa.gov/myaccount.

Social security earnings are fully taxed up to the social security contribution and benefit base then each year is adjusted based on the National Average Wage Index.

Your taxed social security wages are adjusted for inflation up until you turn age 60. After age 60, your earnings are taken at face value.

This money (along with income taxes and interest) is held in the Social Security Trust Fund which is used to pay for your social security benefits down the road.

In order to qualify for social security, you’ll need 40 credits.

In 2022, one credit is awarded for each $1,510 in earnings & up to 4 max can be earned each year.

Which means many will qualify after one decade in the workforce.

Note: There’s special rules if you’re disabled or if you have net annual earnings of less than $400.

You can take your social security benefit between ages 62 and 70.

You’re entitled to 100% of your social security benefits at your full retirement age.

Depending on when you were born, your full retirement age fluctuates:

If you take social security prior to your full retirement age, the benefit you receive is reduced.

Looking at the chart above, you can see that if you take social security between 62 and your full retirement age, depending on your birth year, your benefits are reduced between 25%-30% from your full retirement age benefit.

Similarly, if you delay your social security past your full retirement age, you receive an 8% increase in your benefit from waiting to claim.

These increases are called delayed retirement credits - which you can earn up until age 70.

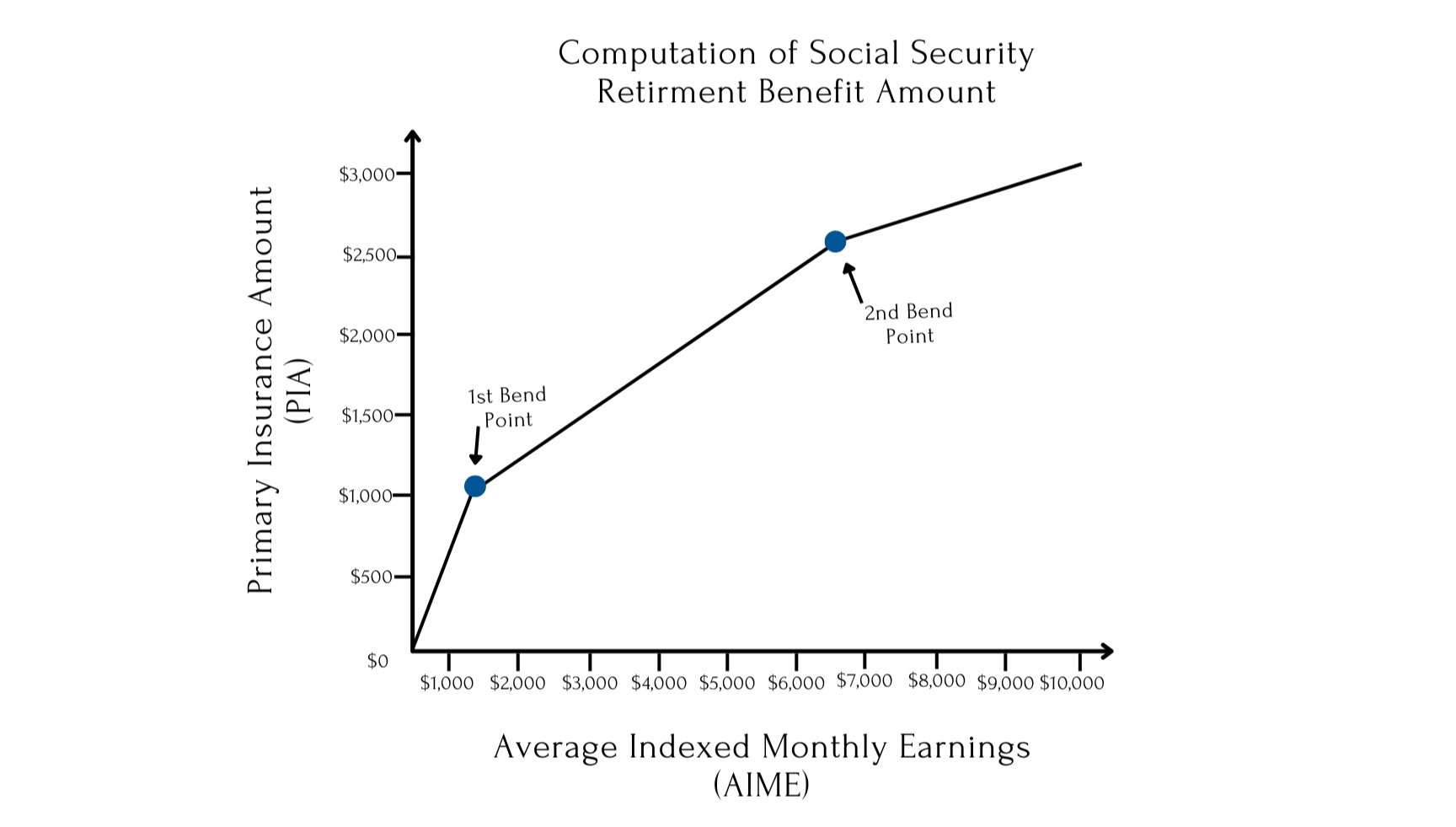

The amount of social security that you receive at full retirement age is based on your Primary Insurance Amount (PIA).

Your PIA is calculated as follows:

Add your highest 35 years of indexed social security earnings

Averaged them over 420 months (35 years) this is your adjustment indexed monthly earnings (AIME)

Multiple AIME by 3 bend points to get your PIA.

2023 bend points are:

90% up to $1,115

32% of your AIME over $1,115 until $,6721

15% over $6,721

If you’re someone who doesn’t have 35 years of earning history, you will have 0 for all years you don’t have income.

Having $0 drags down your average indexed monthly earnings (& reduces your benefit).

One planning consideration is to work part time for the number of years you have $0 in income, this will increase your social security benefit.

When you start social security is based on a variety of factors.

Lifespan

Inflation

Growth rates

Legacy goals

Tax minimization

How long you work (earnings testing)

The longer you live, the more it will make sense to delay. Someone who lives until age 100 who starts taking at age 70 will surely receive more juice out of their social security benefit opposed to someone who starts taking at age 62 or their full retirement age.

If you’re single, a breakeven analysis may work best.

If you believe you’ll live longer than early 80s the probability, you’ll receive more from social security benefits is high.

If you’re married, you need to carefully consider the survivorship benefit.

As a married couple, if one spouse passes after full retirement age, the surviving spouse receives the higher of their benefit or 100% of their spouse's full retirement age benefit.

One more important thing to note: your spouse can claim 50% of your social security benefit if it is higher than their FRA benefit - this is great for couples with large discrepancies in income.

In a scenario like this, if one spouse has a higher earning history, it would make the most sense for him/her to delay to maximize this survivorship benefit for their spouse.

The decision to delay social security isn’t just about the increased benefit by delaying but also about the money that must be spent from the portfolio in the meantime to sustain desired levels of spending.

Using your portfolio to delay taking social security increases the withdrawals made, increasing the total taxes paid.

There are no perfect solutions, just tradeoffs.

If you earn before your full retirement age your benefit is reduced $1 for every $2 earned above $19,560/yr. This is increased to $1 for every $3 in your year you reach full retirement age. After full retirement age, you can make $1,000,000 a year and your benefit wouldn’t be reduced.

If the earnings test is going to impact you, it wouldn’t make sense to take before your full retirement age.

Further, the government taxes the money to give you your benefit, then taxes you when you receive the benefit that you already paid tax on (messed up… I know).

At the federal level, up to 85% of your social security benefit is taxable each year.

This is based on what’s called provisional income.

Your provisional income is your adjusted gross income (line 11 of your 1040), nontaxable income (line 2a of your 1040), and ½ of your social security benefit.

In 2022, here’s how that taxation is broken down:

And as for whether social security will be around?

My answer is yes.

Do I think it’ll be the full amount provided today?

Likely not.

Why?

The 2021 Annual Report of the Board of Trustees from the Social Security Administration has mentioned that the program is struggling resulting from higher withdrawals, unfavorable market conditions, and less funding through taxation.

I’d imagine the way this would be solved is one, or a combination of, a few ways:

Decreased benefits

Higher taxes

Delayed time until we can claim

Given ~40% of Americans rely solely on social security, the lash back from reducing (let alone eliminating) would be considerable.

While this article couldn’t be completely exhaustive of all strategies/nuances and may have left you with more questions than answers, chances are, you likely have a good jumping point to dive into the rabbit hole that is social security.

Happy hunting!