Navigating the Maze of Medicare

Clarifying Medicare options, key decision points, and reviewing ways to reduce insurance costs while maintaining the best coverage.

Putting Estate Planning Strategies To The Test

Provided non-qualified annuities avoid the step up in basis & offer ordinary income rates on distributions which come out as gains first, how does that compare to a non-qualified brokerage account that gets a step up in basis & offers distributions at capital gains rates?

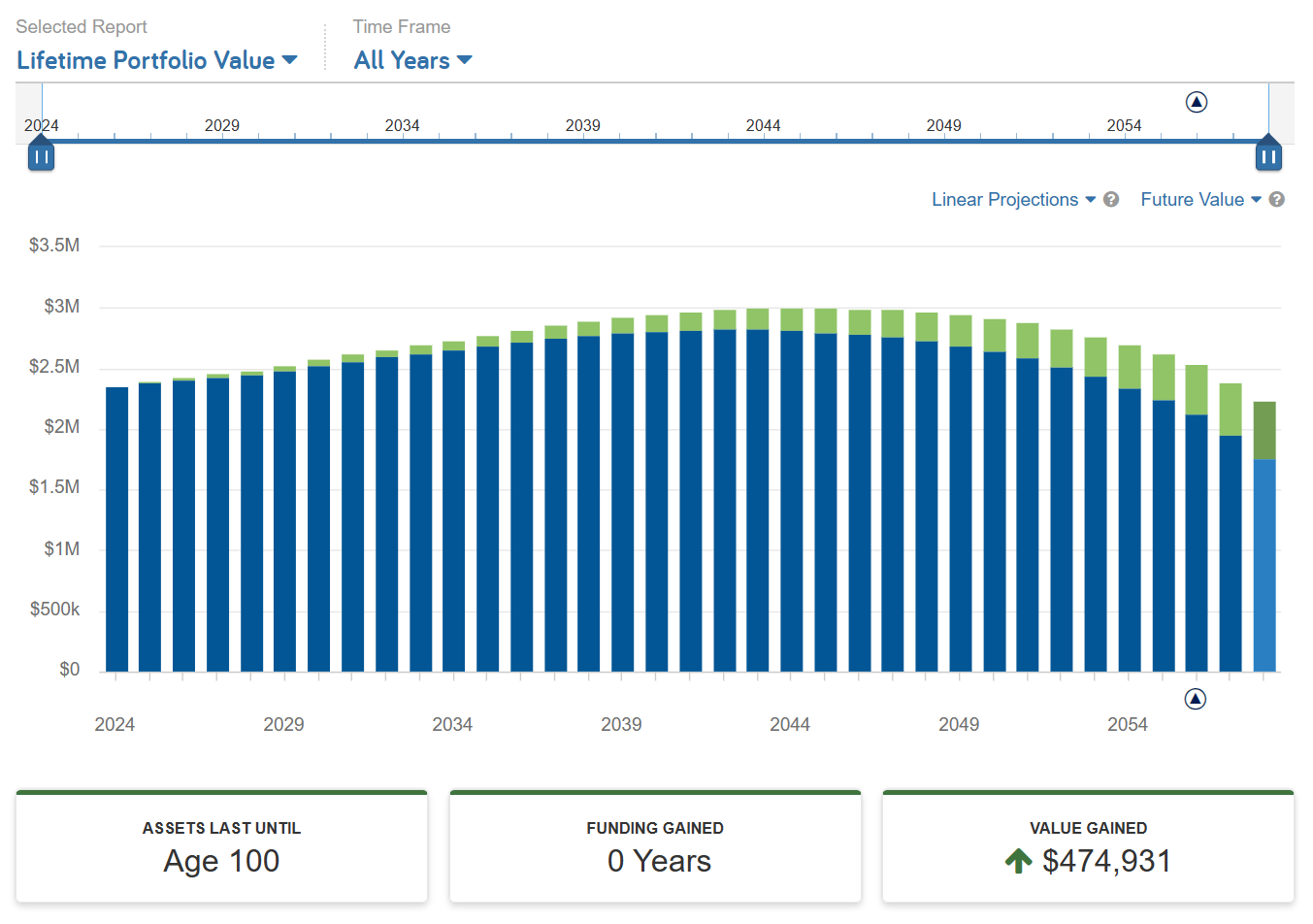

Enhancing Retirement Spending Rules (over & above the 4% rule)

If your retirement goal is to both maximize your net worth & your total lifetime spending, is the 4% rule the best way to attain both outcomes?

Maximizing Tax-Free Gain Exclusion in Qualified Small Business Stock (QSBS)

The biggest tax bill business owners face is when they sell their business - if you want to minimize that bill - qualified small business stock may be for you.

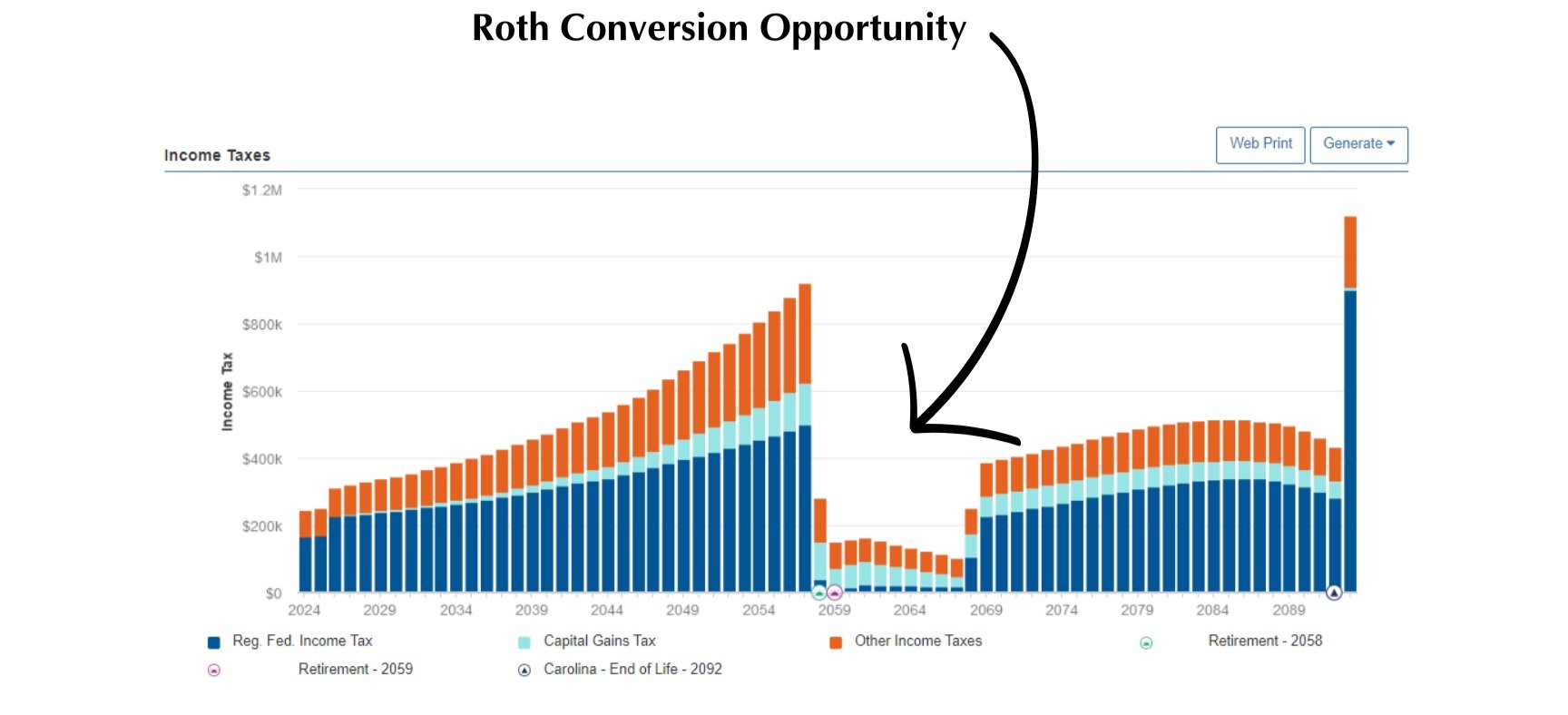

Using Roth Conversions to Reduce Lifetime Taxes Paid

How Roth conversions can reduce your lifetime tax liability.

Health Insurance: How to Navigate (& reduce costs)

Over the last 10 years, the average annual health insurance premium outpaced inflation by 56% & worker wage growth by 11.90% - how do you navigate these rising costs?

Why the economy is not the stock market (& what this means for you)

Do you ever wonder why markets can have positive returns yet the economy seems to be in the dumps? You’re not alone.

Finding Purpose in Retirement

Retirement offers 40+ hours per week to do something. So, what do you do?

Pros & Cons of Direct Indexing

Superior investment solution or unnecessarily messy portfolio?

Silent Wealth

How could your life improve if you stop fighting what you wish to happen and accept things to happen as they do?

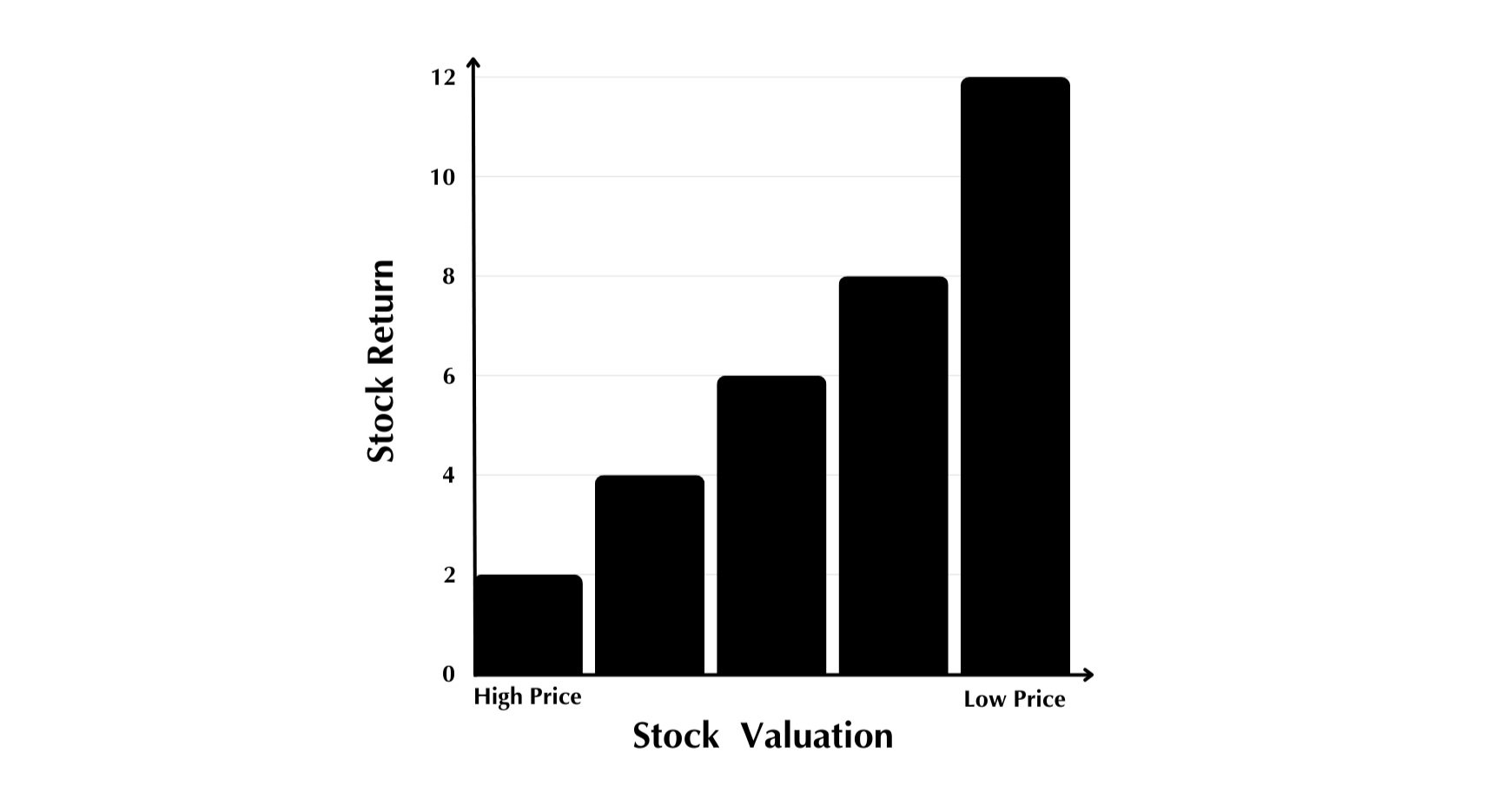

Nvidia Historical Return & Expectations of Future Return

Nvidia has returned 189% over the trailing one year & is up 1,069% over the last 5 years. Is now the time to buy or sell?

Estate Planning: Importance, Pitfalls, & Solutions

Estate planning is the ultimate form of having control from the grave. But few understand the importance of an estate plan (or the costs of not having one).

Fools React, Warriors Respond

To be financially free is to be void of any subconscious beliefs limiting your ability to fully feel what it is you already have.

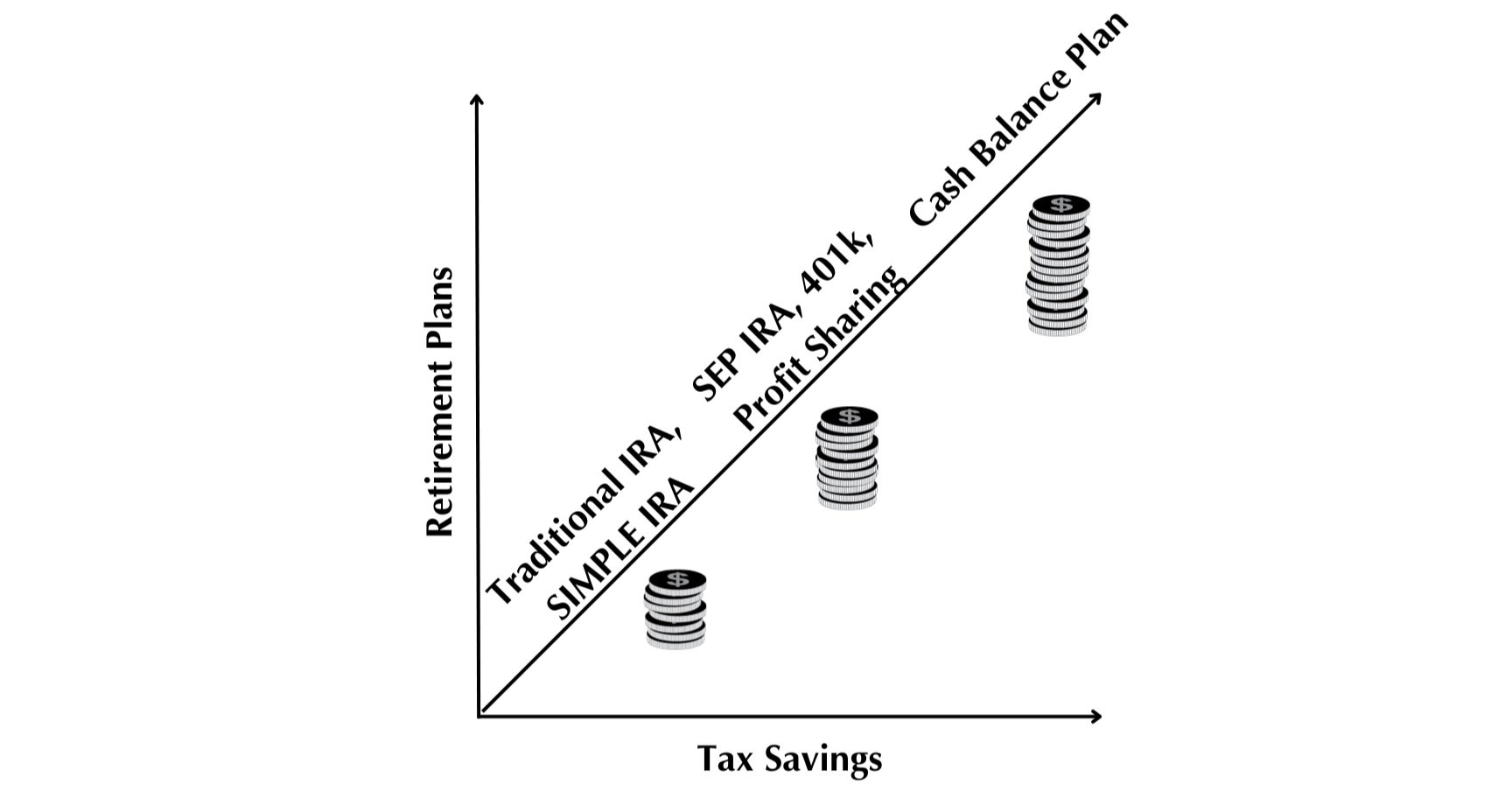

Choosing The Right Retirement Plan for Your Small Business

Is your current retirement plan allowing you to save the most amount of money in taxes annually?

Incentive Stock Options (ISOs) Taxes & Strategy

Stock options can make or break your total compensation. Not just for the potential future appreciation; but for the resulting tax consequence of not taking them seriously.

How to Identify & Avoid Common Financial Mistakes

When it comes to making decisions around money - knowing what NOT to do, can be just as impactful as knowing what TO do.

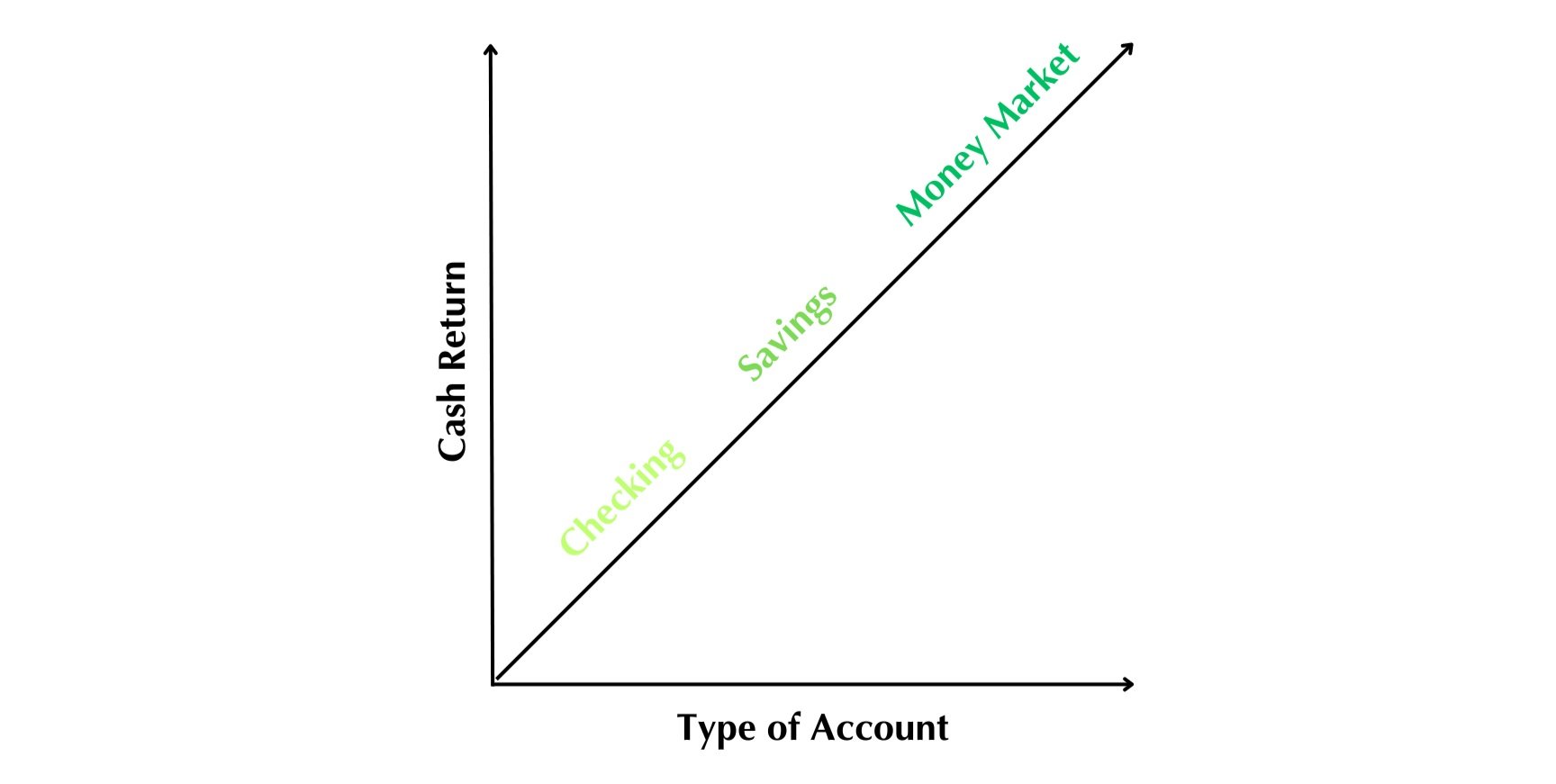

Emergency Fund: How to Systematically Increase your Cash Return

Planning isn’t always about maximizing return, rather, minimizing risk. So where can you invest your cash to maximize your expected return?

How to Retire With The Same Spending Power as Today

What needs to be done to retire with the same spending power that you have today?

Best Way to Buy a Car in Business Name

Should you buy a car in the name of your business? The question I would ask is, do you need a car?

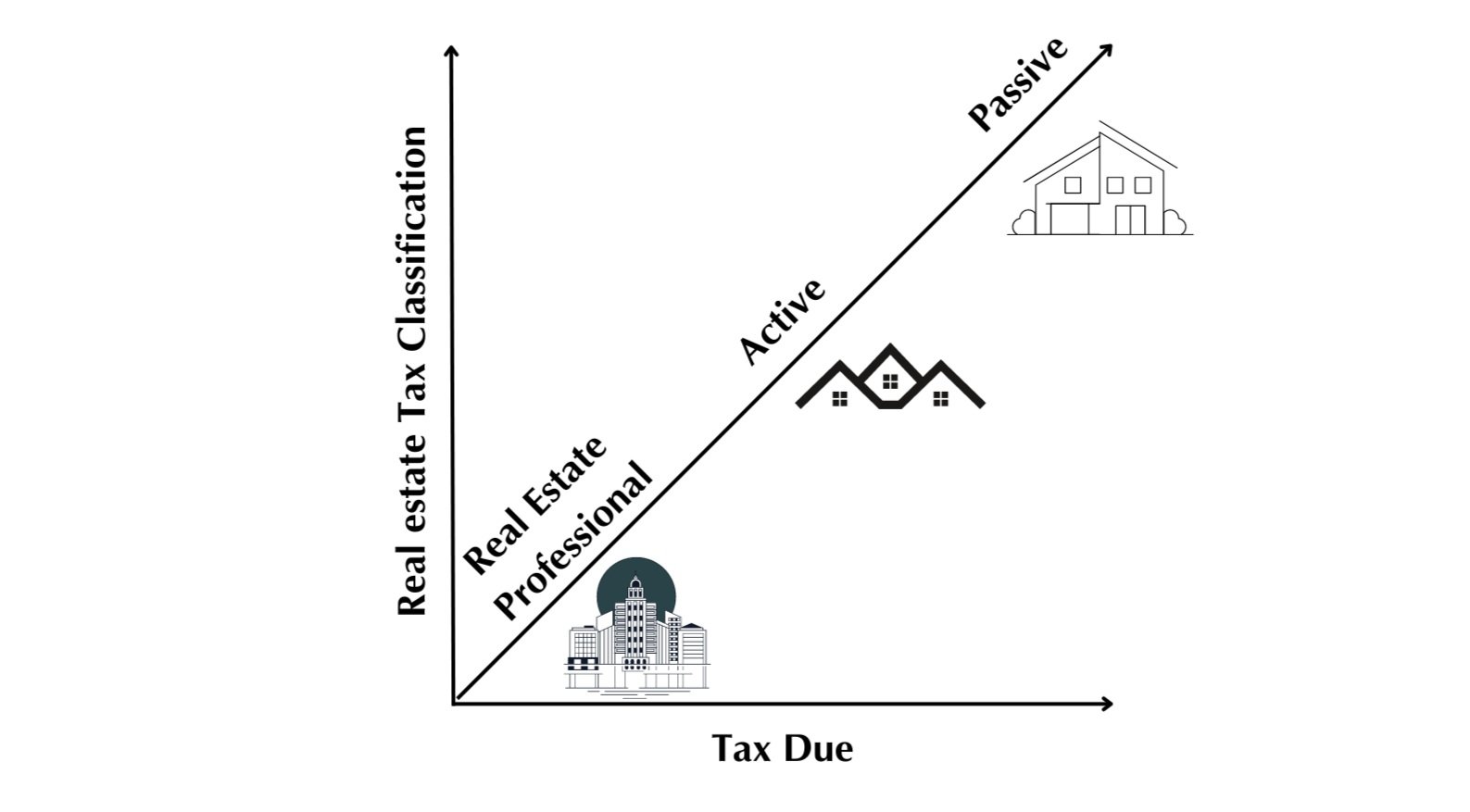

When Can You Use Real Estate Losses?

Rental activity by the IRS is deemed to be passive. This means if you’re not a real estate professional this makes your odds of being able to deduct losses slim.