How to Avoid, Defer, and Reduce your Tax Bill

When you financially measure your life, you’re not going to measure it based on how much tax you saved, rather, how much wealth you’ve built.

Pre-tax (Traditional) or post-tax (Roth) contributions: Which is better?

Traditional contributions can be better than Roth contributions. Roth contributions can be better than Traditional contributions. What rate you end up paying in taxes matters the most.

Student Loans Set to Resume (here's what you need to know)

Student loans are set to resume August 30th, here’s what you need to know to be prepared.

U.S. Debt Ceiling: How much is too much?

Why does the debt ceiling exist? How much more debt can we continue to take on?

How to Stick to a Budget

Budgeting doesn’t upset us, rather, it’s our judgment of budgeting that upsets us.

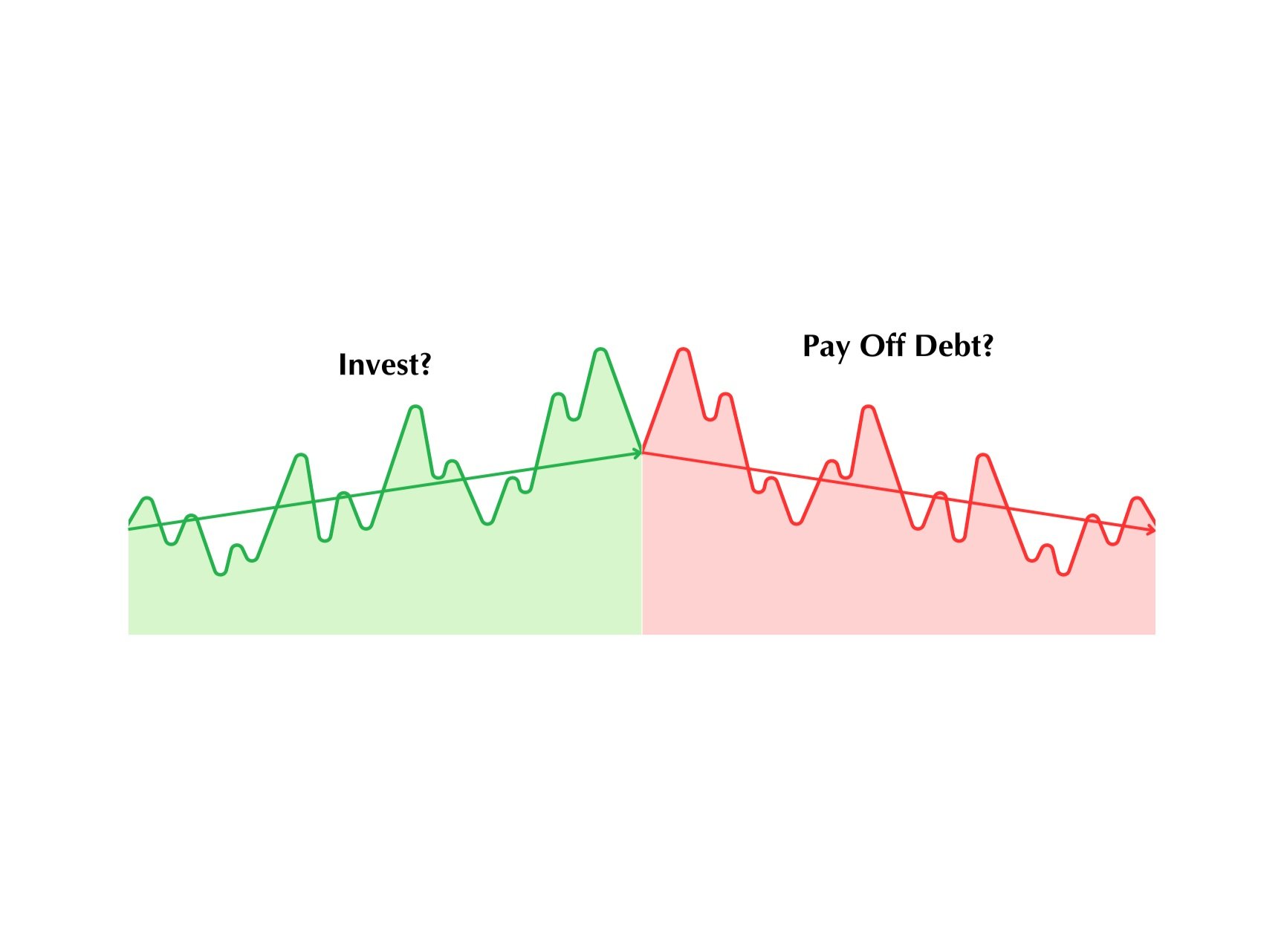

Should I Pay Debt Or Invest?

When you pay off debt, you guarantee yourself a fixed simple interest rate of return. When you invest, you guarantee yourself a compounded rate of return. How do you begin to choose?

Defining Success (outside of wealth)

How to view money’s role in determining success

How I manage my finances (from a financial planner)

My work centers around helping others make goal-aligned decisions with their money. But that begs the question: How well do I take that advice myself?

Is My Money Safe?

Silicon Valley Bank collapsed. Naturally, this has raised widespread concern as depositors and investors are questioning their confidence in banks.

How To Invest In Times Of Uncertainty

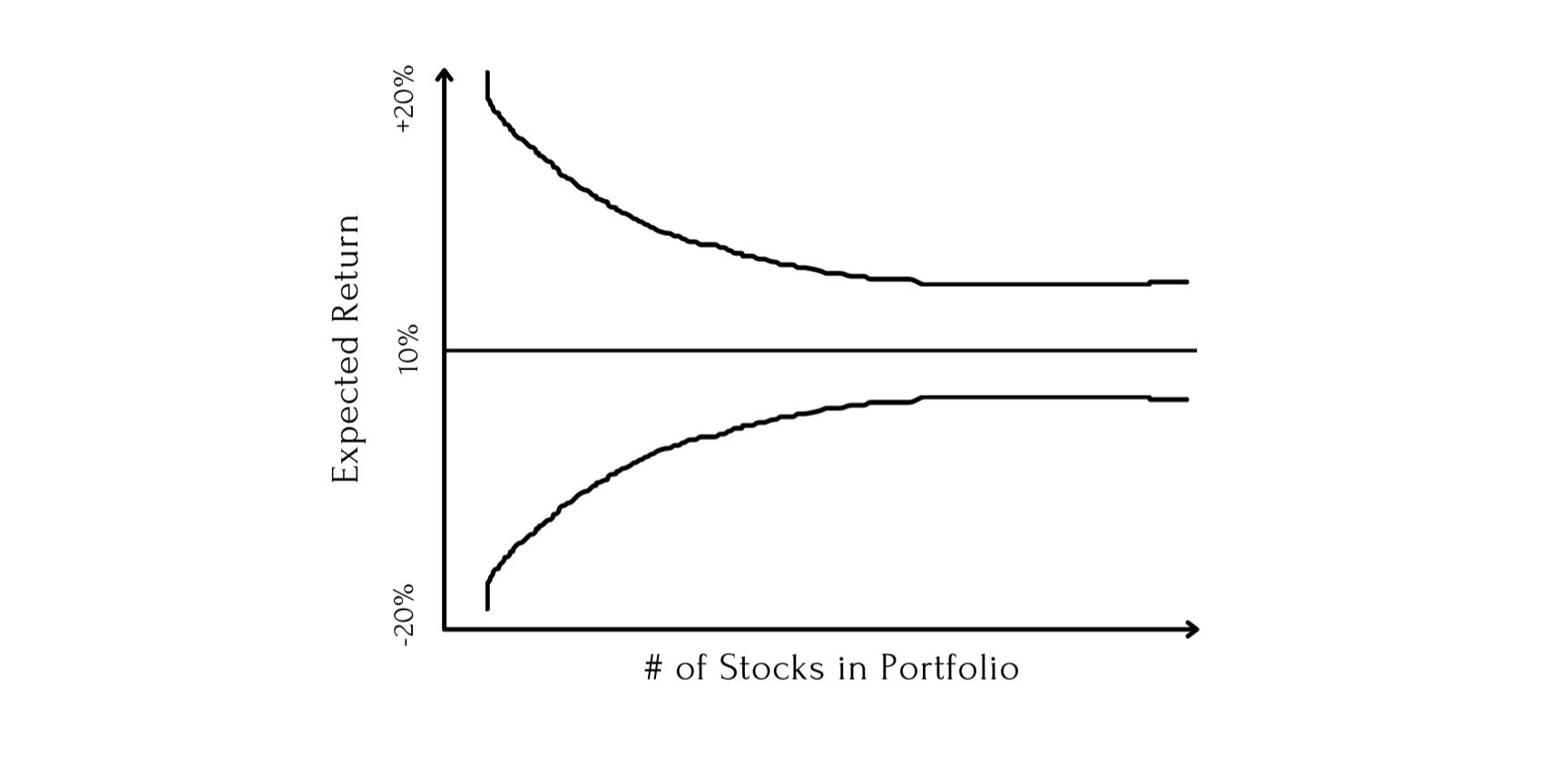

Construct a portfolio that gives you the highest return per unit of risk. Looking backwards, this is easy. Looking forward, this is hard. How do you manage this uncertainty?

Why don't we do, what we know we should do?

If you’ve ever found it easier to give advice than implement advice, you’re not alone. It’s more common to know what to do than to implement what’s common. If we know what to do, why don’t we do it?

Using Real Estate to Avoid Tax

Incentives drive outcomes. Today the government incentives real estate through multiple areas in the tax code.

How To Instantaneously Become More Wealthy

Your money stretches to the length of your desires. The shorter your desires, the longer your money stretches.

SECURE Act 2.0: What You Need To Know

While you cannot avoid Uncle Sam finding his way into your pocketbook, you can plan around minimizing how much he takes.

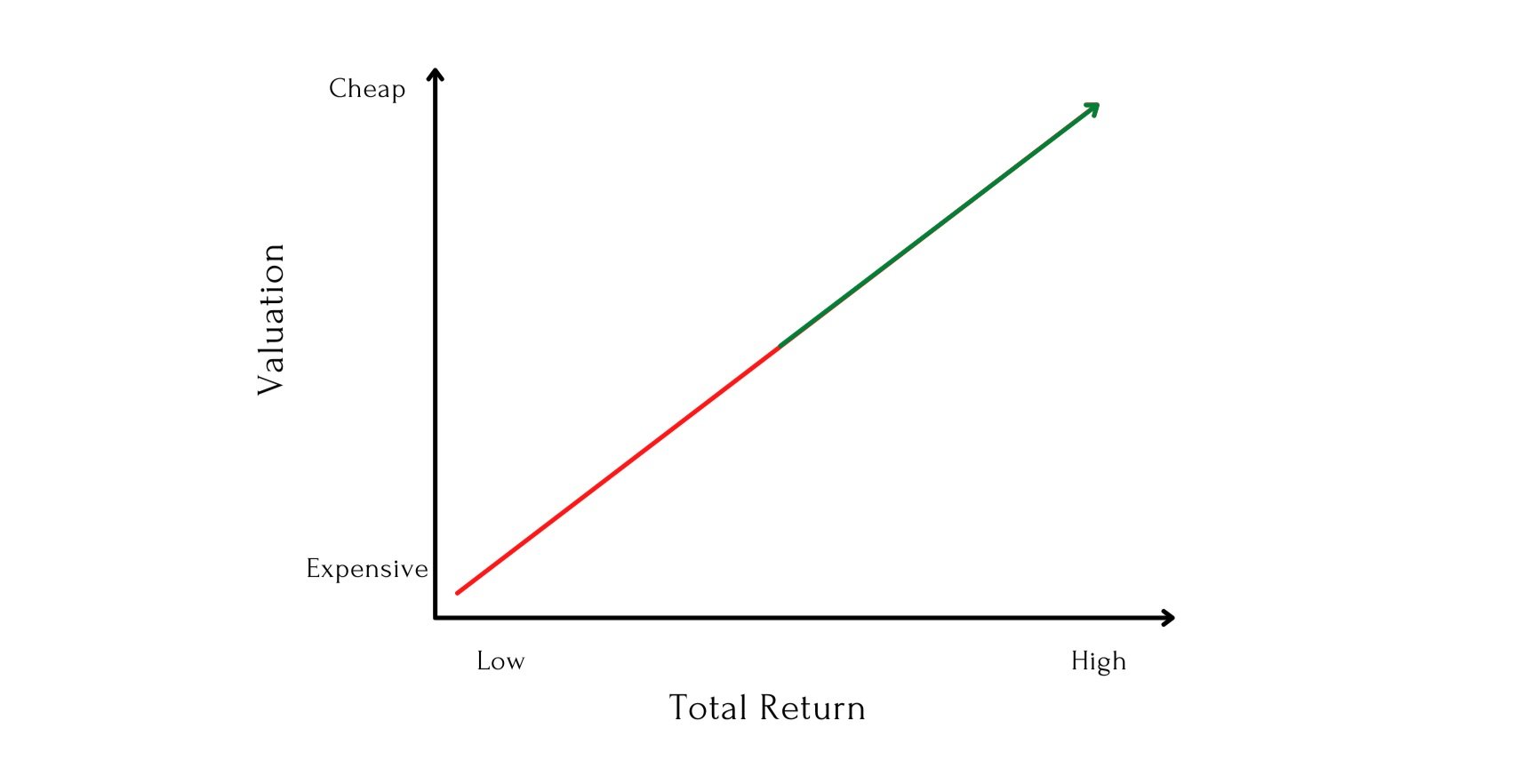

How Market Valuations Impact Future Market Returns

Expectations of future returns can be tied back to fundamentals of how cheap or expensive a company's cash flows are.

The Underlying Mechanics of Why ETFs are More Tax Efficient than Mutual Funds

ETFs rely on a creation/redemption mechanism that allows for the continuous creation or destruction of ETF shares which reduces, or in many cases, completely eliminating capital gain distributions.

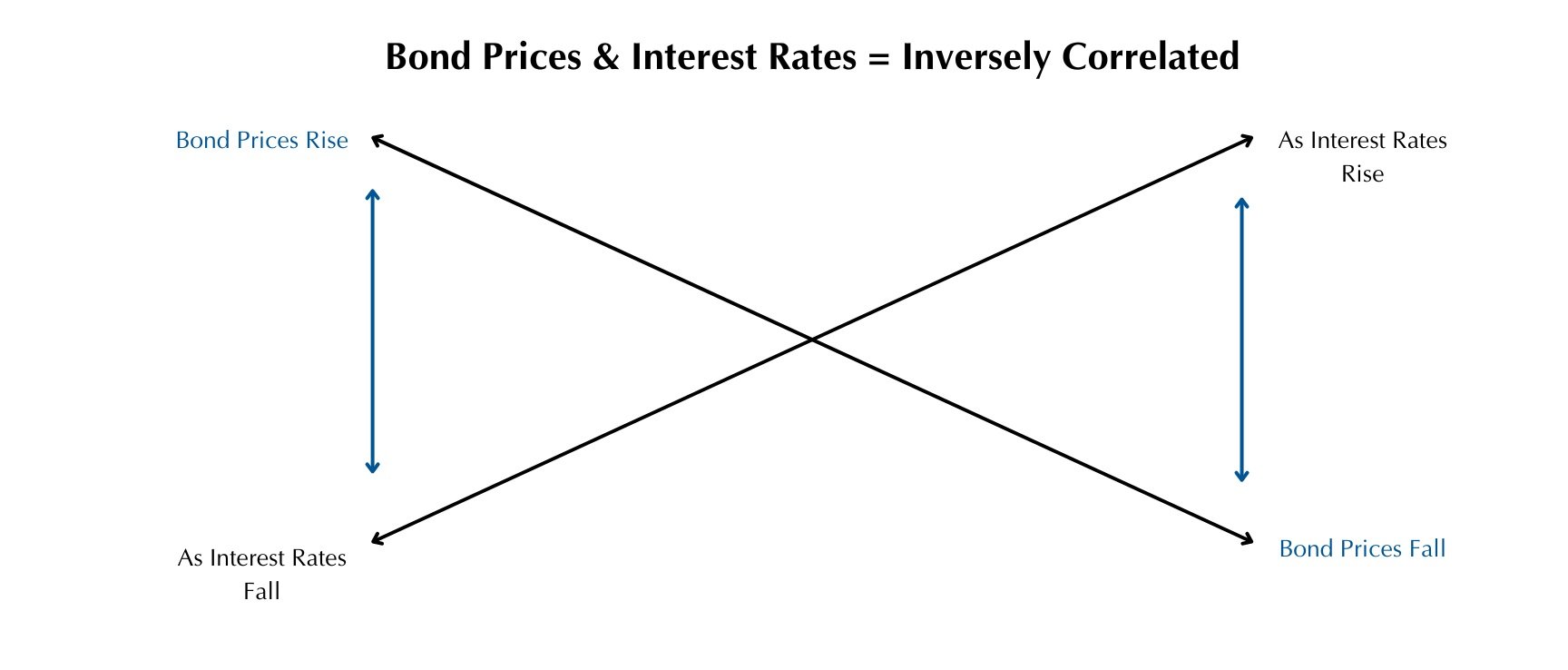

Why Bond Prices Fall When Interest Rates Rise

Equity markets have fallen 25% year to date and the bond market is down 17% - whatever happened to bonds acting as a ballast for market volatility?

Ultimate Quick Start Guide to Social Security

How is your benefit calculated? When do you start social security? How much of your social security is taxable?

Necessity of Discipline & Money

Success with your personal finances often hides behind boring solutions and underused basic insights. Being disciplined with the fundamentals is not cool or sexy - it just works.

Health Savings Account (what you don't know)

Your HSA is as valuable (or more) than your Roth IRA - here’s the tools on how to utilize it for your advantage.