Stoic Financial Planning

Wealth is not limited to those who have money. Rather, wealth is limited to those who ascend to an excellent moral character.

Origin of Stocks & Bonds (& Why Prices Behave The Way They Do)

Exploring — Where do stocks & bonds come from? How are they priced? Why do prices fluctuate the way they do?

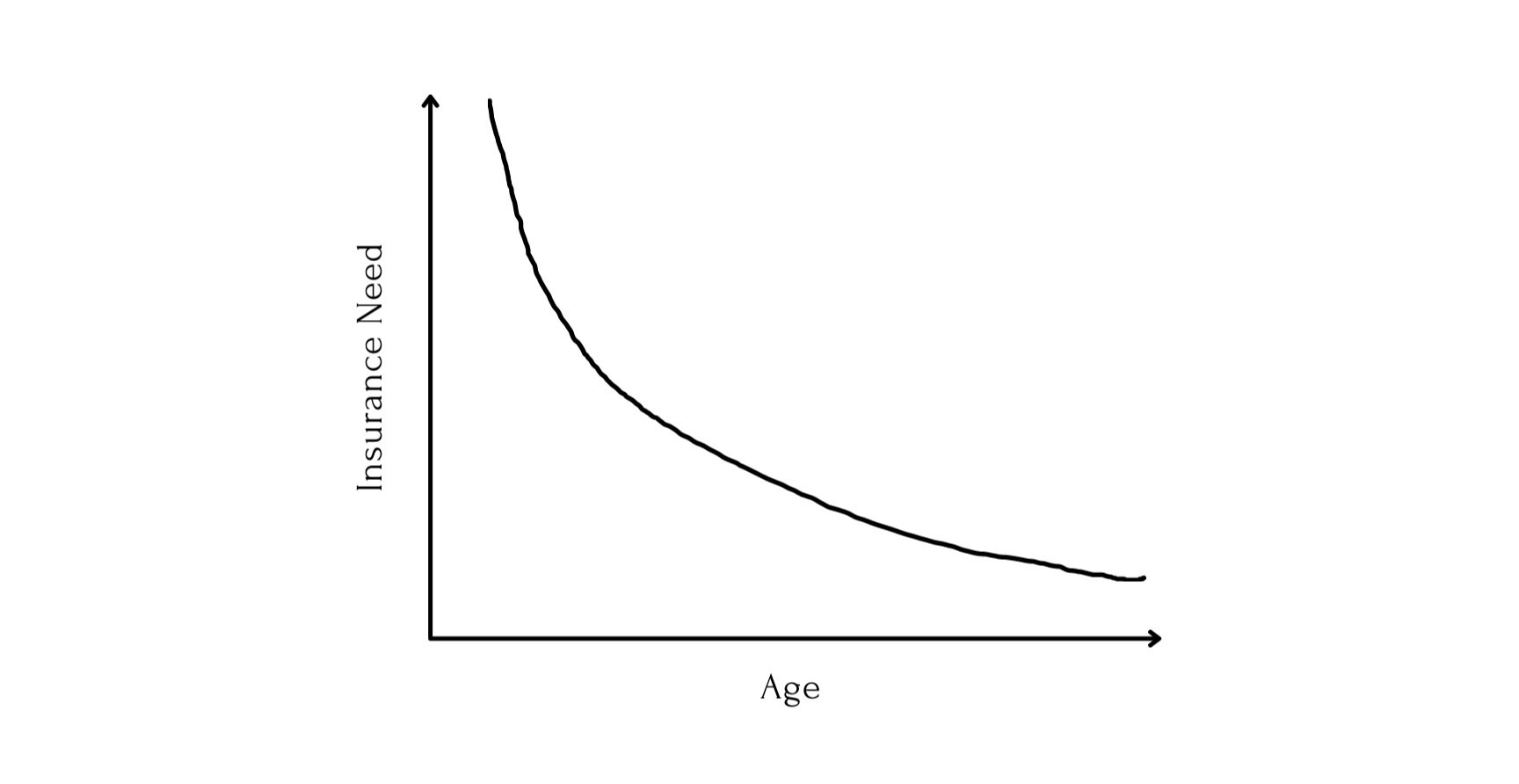

No, you don’t need permanent life insurance

For 99.99% of individuals looking to cover the risk of a premature death, term insurance makes the most sense. Here’s why -

The Power of Narratives During Market Volatility

Volatile markets do not mean the market is broken or the world is ending. Sharp price declines are a part of the markets (& should be expected).

The cost (& power) of leverage

Just as physical leverage allows you to lift an object with less effort, financial leverage allows you to increase return with less capital. Is this finally the cheat code we’ve been waiting for?

Should you invest in dividend stocks?

Are owning dividend stocks a superior way to invest in the stock market?

What Do Rising Interest Rates Mean for the Economic Machine?

An overview of how the Economy works & the role the Federal Reserve plays in it.

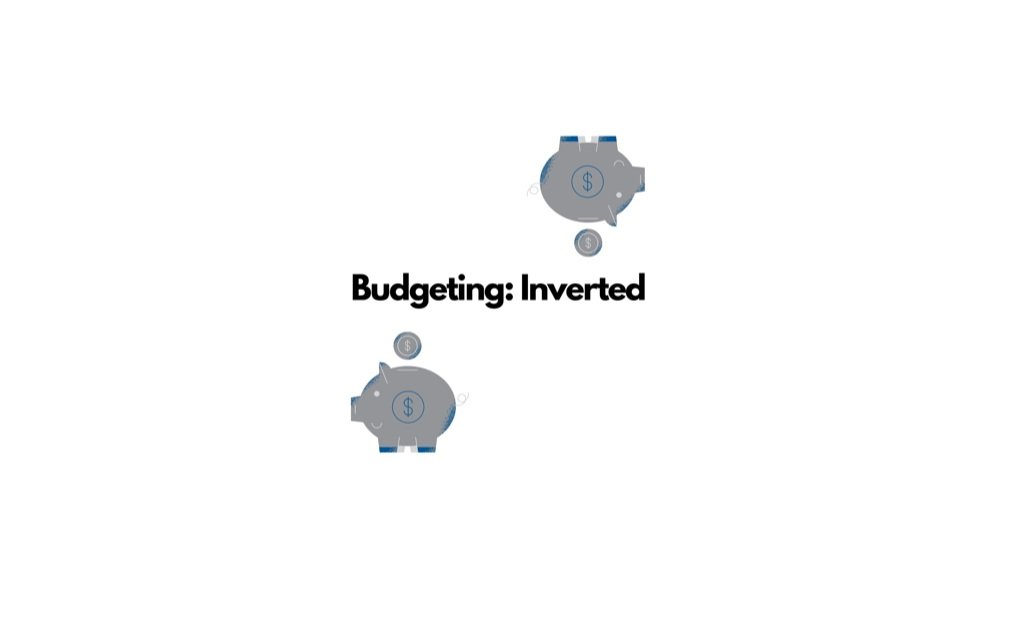

Budgeting: Inverted

What isn’t measured doesn’t progress. Budgeting is the key, but how can you create a budget that actually works?

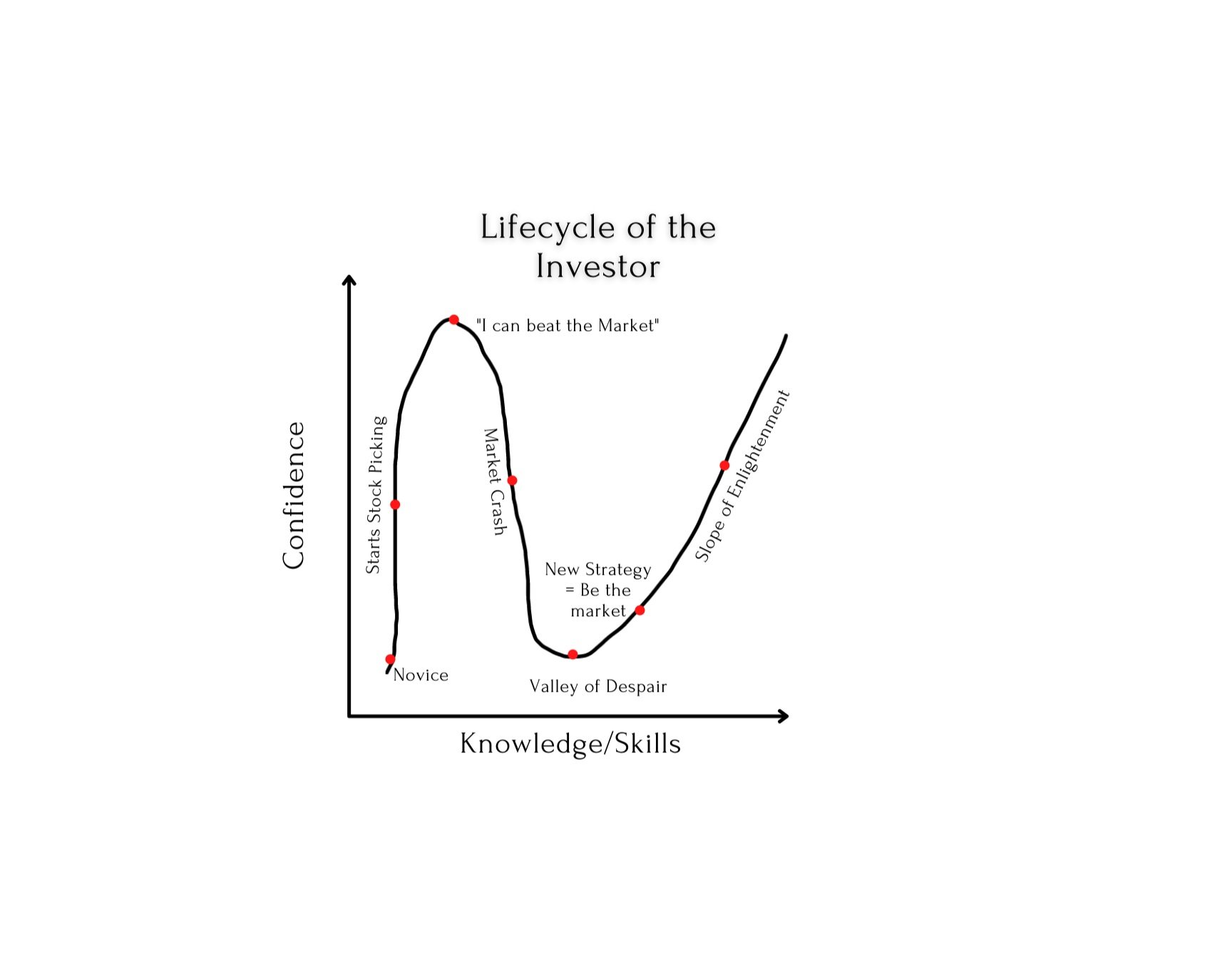

Stock Picking: Luck or Skill?

We’re overweight our belief in skill and underweight our belief in consistency. What odds for a successful financial independence are you will to accept?

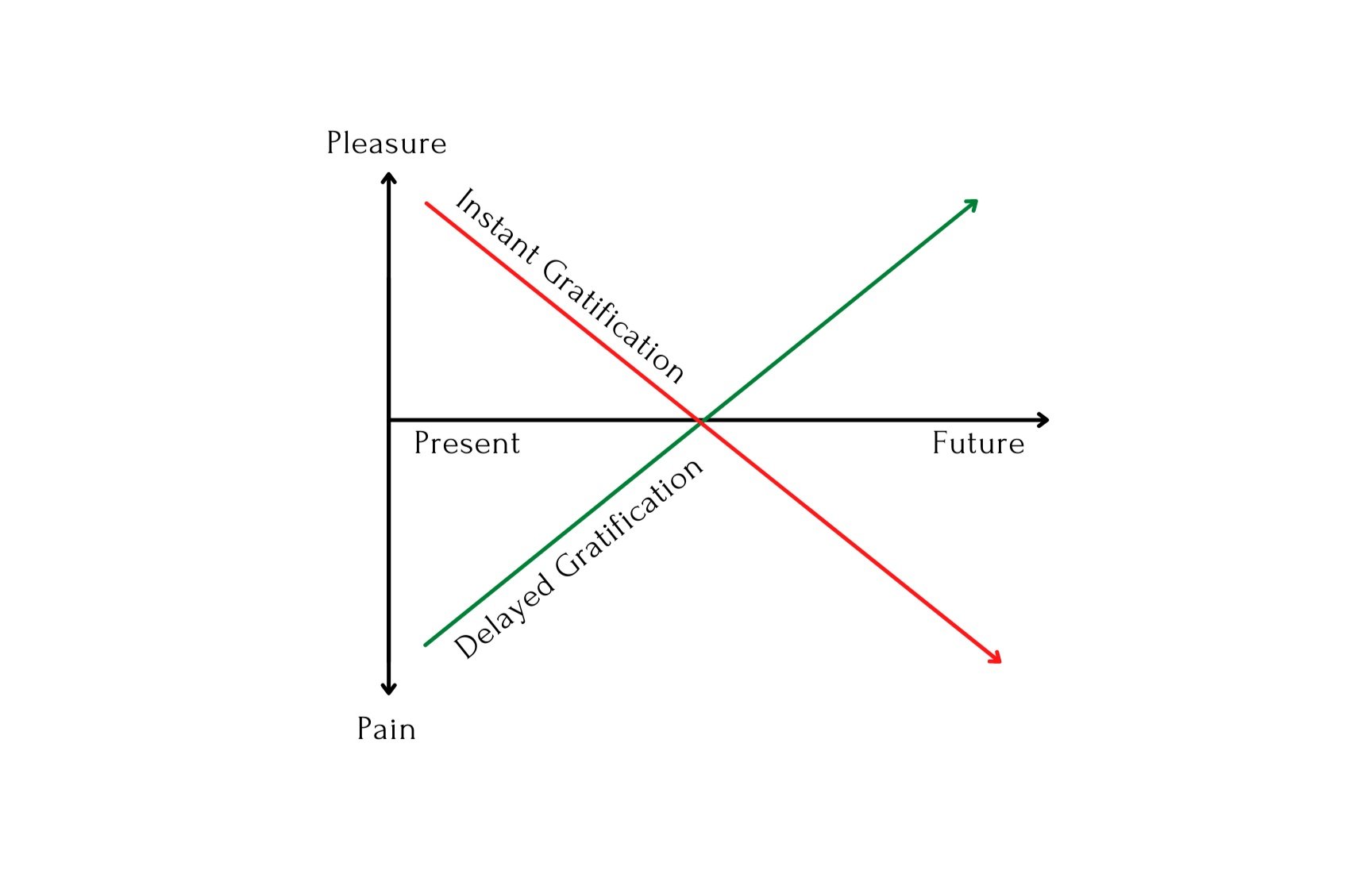

The Art of Delayed Gratification

A healthy body, clear mind, loving relationship, & true wealth lies in your ability to delay gratification. Why are some better at delaying gratification than others?

The Problem with Public Service Loan Forgiveness (& the solution)

98% of applications for forgiveness through Public Service Loan Forgiveness (PSLF) were denied. To qualify, you need to be on the right plan, with the right kind of payments, and the right kind of job. Are you leaving loan forgiveness on the table?

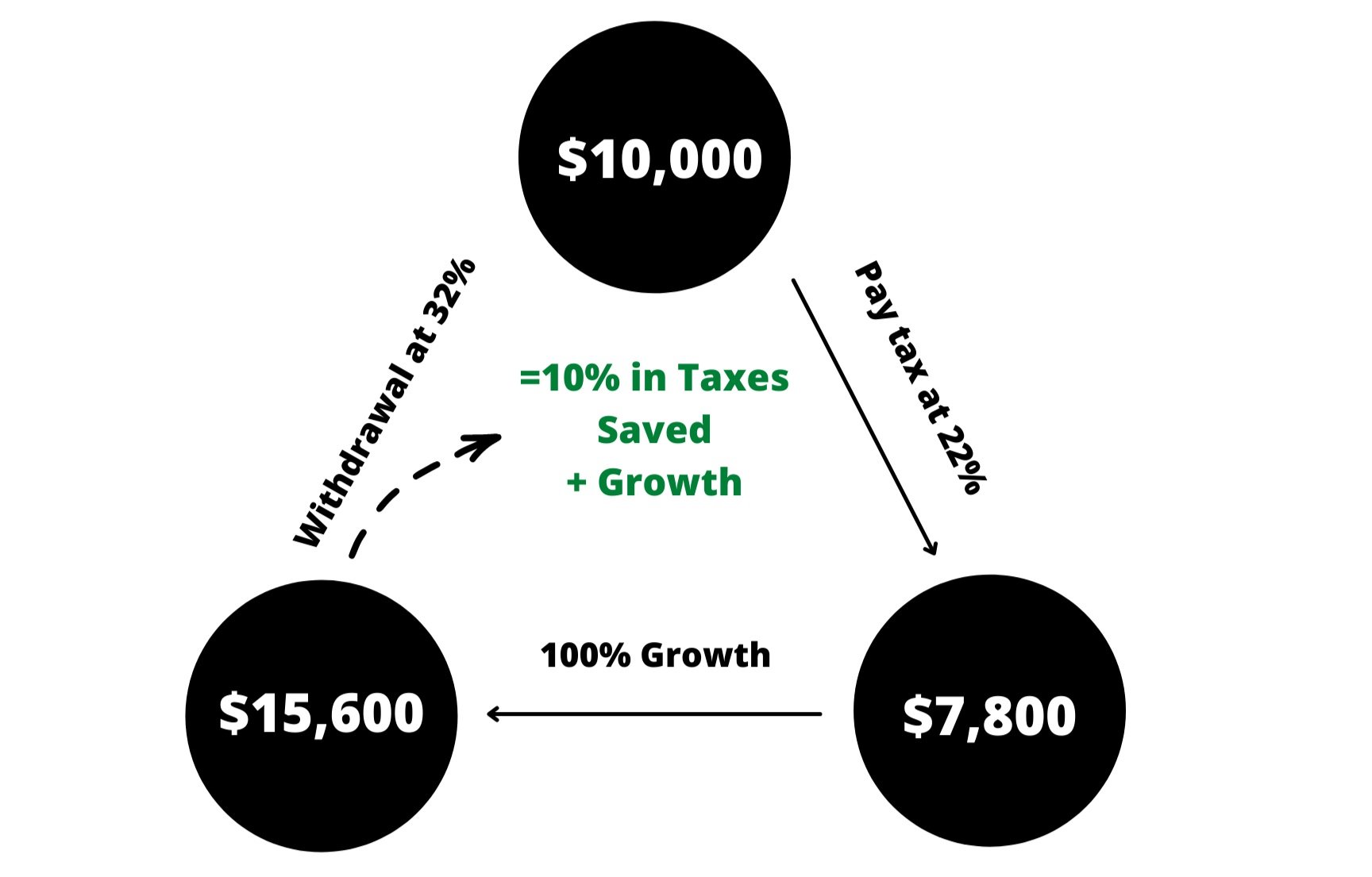

The Tax Arbitrage Game

With little effort you can enhance flexibility with your savings to reduce lifetime taxes paid and increase your net worth. Are you paying more tax than you should?

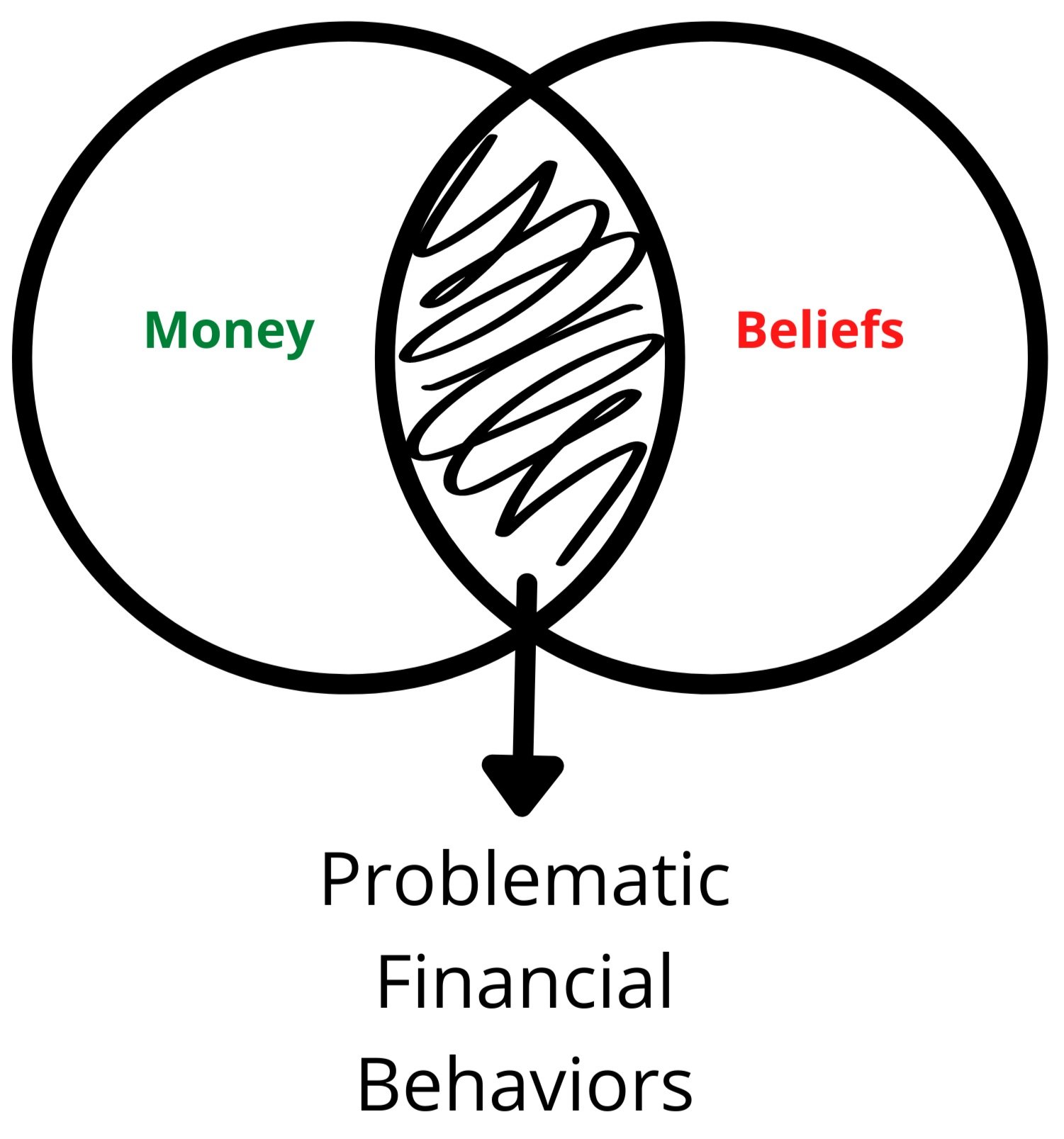

How your beliefs around money impact your net worth

Your beliefs around money could come at the cost of your net worth, or worse, your time. Could your beliefs around money be holding you back from financial independence?

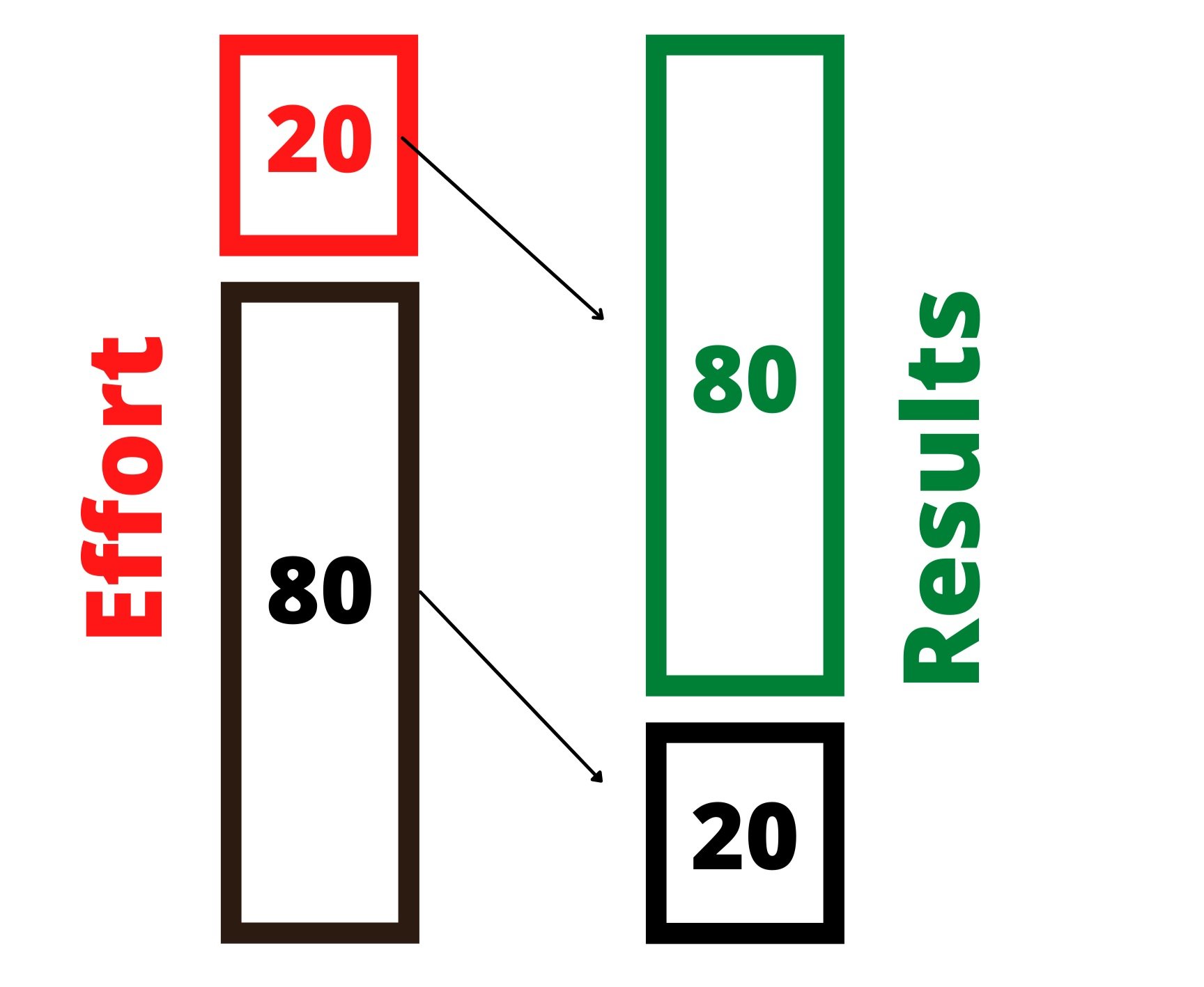

80/20 Rules of Financial Planning

All effort is not rewarded the same. You can receive massive returns by focusing on the key attributes responsible for growth in each discipline of financial planning.

Are you saving enough?

Saving is simple in theory but hard in practice. How can you build a sustainable savings habit?

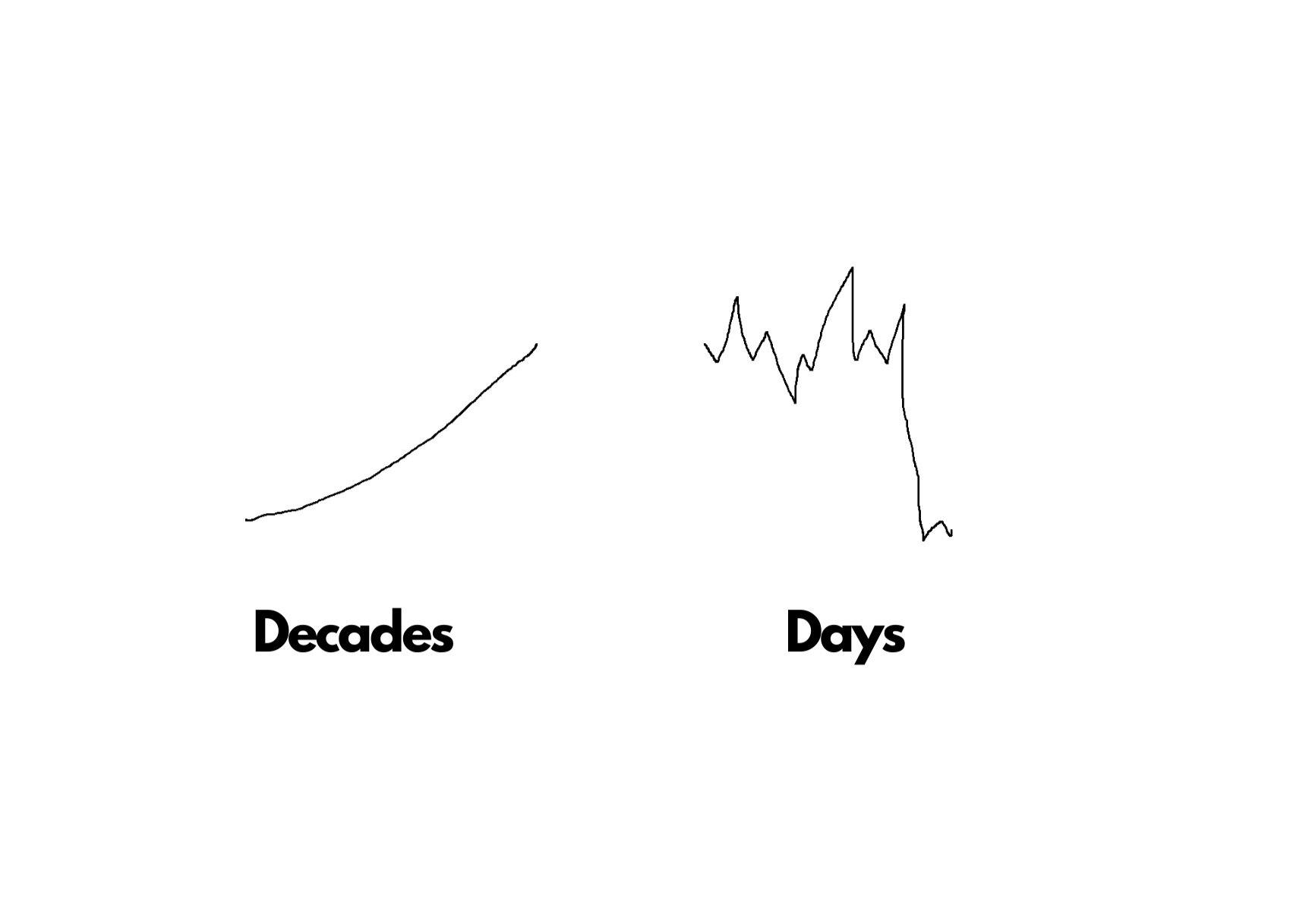

The Equity Premium

Historically, investors have been rewarded with excess return for owning stocks over bonds. As an investor, the question to ask yourself is how confident should you be over the long-term to expect a positive equity risk premium?

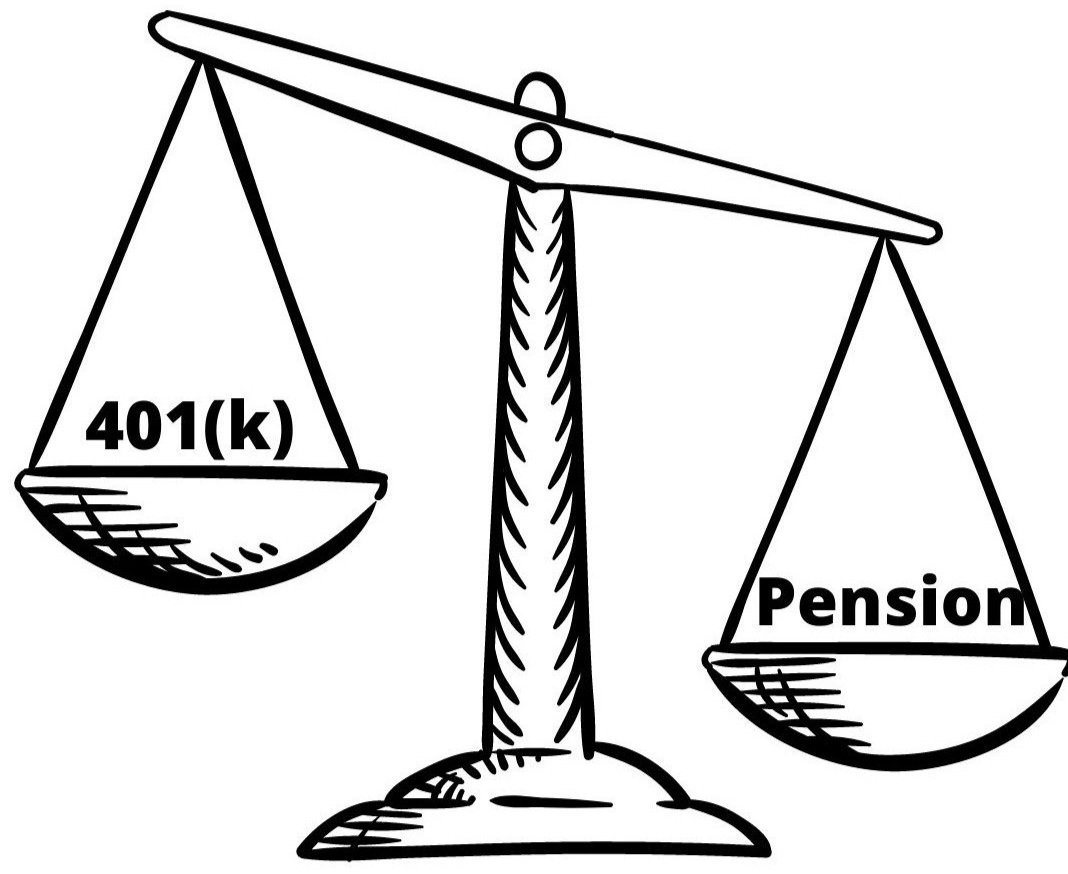

Are we better off with pensions or 401ks?

401ks compared to pensions are a superior retirement savings vehicle contingent on discipline and consistency. Yet, while many Americans have the opportunity to enter retirement with more monthly income - they end up with less.

What is Enough?

Enough is a sense of arrival.

A person can make himself happy, or miserable, regardless of what is actually happening externally by changing the contents of his mind.

How can you arrive sooner?

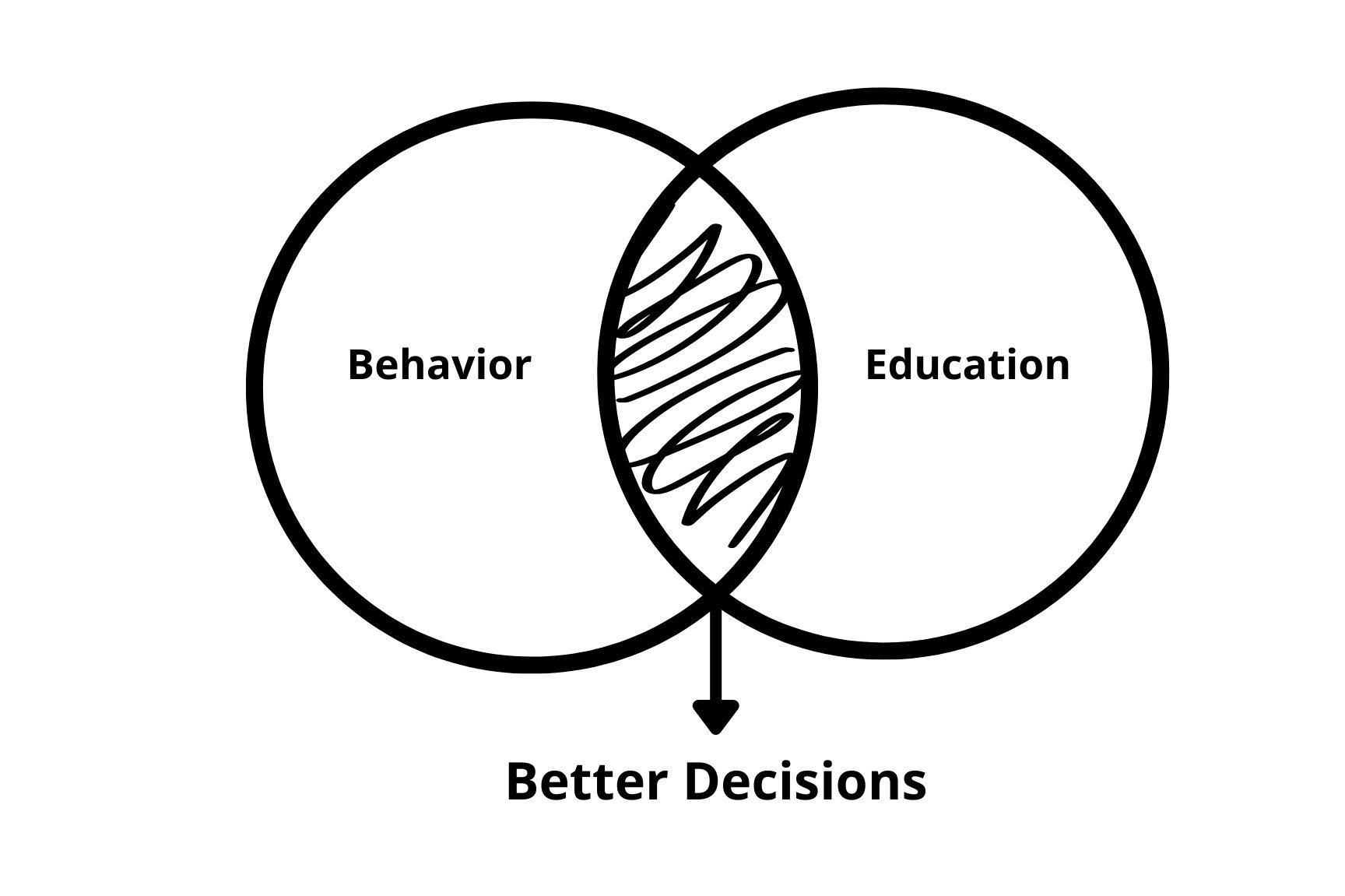

Invert To Financial Independence

Inversion considers a problem in reverse order. Use this mental model to improve your financial decision making.

An Outdated Money Script

Buying a home has been revered as the pinnacle of good financial decision making. Is it though?